TORONTO, March 06, 2024 (GLOBE NEWSWIRE) -- Galantas Gold Corporation (TSX-V & AIM: GAL; OTCQX: GALKF) ("Galantas" or the "Company") is pleased to announce the results of a recent gradient array induced polarization (IP) and resistivity geophysical survey five kilometres west of the Cavanacaw Gold Mine at the Omagh Project in County Tyrone, Northern Ireland.

The Company is also pleased to have recently received full planning permission to drill eight boreholes from three locations within the mine site. The holes will target a southern portion of the main Joshua Vein.

Mario Stifano, CEO of Galantas, commented: "It's exciting to note that a strong north-south trending resistor was identified at the Cornavarrow target, with a similar signal to that generated over a gold-bearing structure close to the mine in 2021. Cornavarrow represents an exciting target that has never previously been drilled, and would be key in helping us to glean the wider potential of the gold district.

"We're also keen to continue drilling at the main Joshua Vein which runs broadly parallel to and some 450 metres west of the other main Kearney Vein. Positive drilling results from the last few years have delineated trends of dilation zones, which have potential for higher widths of mineralization. Testing the down-dip potential of the dilation zones at Joshua could aid in resource expansion and ultimately add to the Omagh Mine's production capacity."

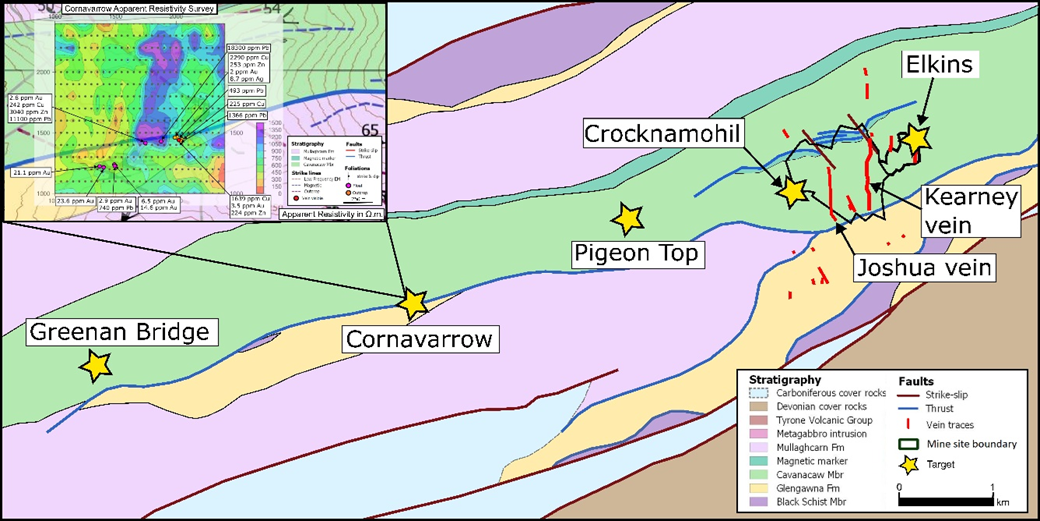

The effectiveness of the IP method for defining mineralization targets in this terrain was tested by the Company in 2021 when it ran a similar survey over the Elkins Vein. An apparent resistivity IP anomaly aligned north-south coinciding with known mineralization (see Galantas' news release dated December 1, 2021). Another IP survey was completed over the Pigeon Top target (1.5 kilometres west of the mine site) in 2021, and also identified a strong north-south trending resistor over 500 metres, coinciding with base-of-till gold anomalies. The Elkins, Pigeon Top and Cornavarrow targets are shown in Figure 1 and are situated along a six-kilometre strike. According to Consulting Geophysicist Graham Reid of BRG Ltd., the geophysical anomalies identified during those earlier surveys most likely represent fault structures in the bedrock. North trending faults are a prime exploration target as these are the structures that host mineralization on the mine site.

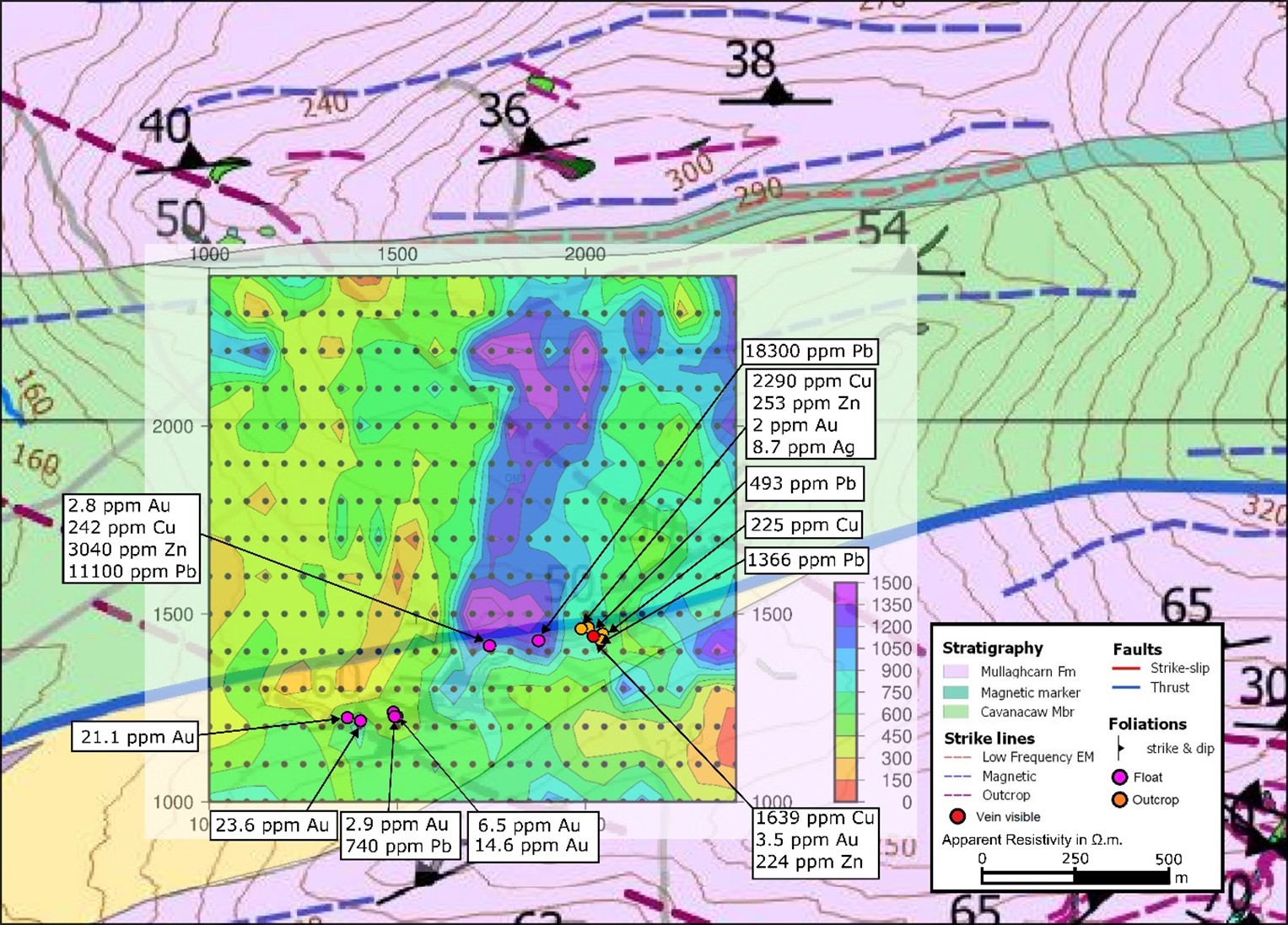

In January 2024, Galantas commissioned an IP survey grid over a 1.4-square-kilometre area at the Cornavarrow target (see Figure 2). Cornavarrow lies five kilometres west of the Cavanacaw Gold Mine. The area was explored by RioFinex in the late 1980s. Gold and base metal anomalies were recorded for float rock and stream sediments at that time; significantly, a small vein exposure was also identified 'Cornavarrow Burn East Showing' (see Figure 2). A 2003 technical report by ACA Howe contained an intersection grading 1.15 grams per tonne (g/t) gold, 4.2 g/t silver and 1,366 g/t lead over 1.5 metres in width across the portion of visible vein and stated that "what is visible at Cornavarrow Burn East Showing could be the edge of higher-grade mineralization which is not exposed." Subsequent exploration by Galantas geologists recorded 3.5 g/t gold for a chipped sample of outcrop.

Figure 1: Map showing the location of key exploration targets. New geophysical results over Cornavarrow shown in inset and Figure 2.

The eastern margin of the 900-metre northerly trending resistor lies 100 metres west of the in-situ vein mineralization. BRG Ltd. theorized that the Cornavarrow resistor may represent a zone of increased silicification within the mapped psammites. Galantas geologists have noted silicification associated with gold-bearing quartz veins at Cavanacaw.

The target area sits largely within the 'Cavanacaw Member', a competent lithology just north of a thrust fault. The structural setting is therefore similar to that at the mine site. No diamond drilling has been conducted in the area to date.

Figure 2: Contoured apparent resistivity data over Cornavarrow target. Black dots show grid measurement points. Key historical exploration data shown for reference.

Qualified Person

Scientific and technical disclosures in this press release have been reviewed and approved by Dr. Sarah Coulter, who is considered, by virtue of her education, experience and professional association, a Qualified Person under the terms of NI 43-101. Dr. Coulter is not considered independent under NI 43-101 as she is the Chief Geologist of Galantas Gold Corporation.

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

The information contained within this announcement is deemed to constitute inside information as stipulated under the retained EU law version of the Market Abuse Regulation (EU) No. 596/2014 (the "UK MAR") which is part of UK law by virtue of the European Union (Withdrawal) Act 2018. The information is disclosed in accordance with the Company's obligations under Article 17 of the UK MAR. Upon the publication of this announcement, this inside information is now considered to be in the public domain.

About Galantas Gold Corporation

Galantas Gold Corporation is a Canadian public company that trades on the TSX Venture Exchange and the London Stock Exchange AIM market, both under the symbol GAL. It also trades on the OTCQX Exchange under the symbol GALKF. The Company's strategy is to create shareholder value by operating and expanding gold production and resources at the Omagh Project in Northern Ireland, and exploring the Gairloch Project hosting the Kerry Road gold-bearing VMS deposit in Scotland.

Enquiries

Galantas Gold Corporation

Mario Stifano: Chief Executive Officer

Email: info@galantas.com

Website: www.galantas.com

Telephone: +44(0)28 8224 1100

Grant Thornton UK LLP (AIM Nomad)

Philip Secrett, Harrison Clarke, Enzo Aliaj

Telephone: +44(0)20 7383 5100

SP Angel Corporate Finance LLP (AIM Broker)

David Hignell, Charlie Bouverat (Corporate Finance)

Grant Barker (Sales & Broking)

Telephone: +44(0)20 3470 0470

Forward-Looking Statements

This news release contains forward-looking statements within the meaning of the United States Private Securities Litigation Reform Act of 1995 and applicable Canadian securities laws, including results of exploration and mine development programs at the Omagh Project and Gairloch Project. Forward-looking statements are based on estimates and assumptions made by Galantas in light of its experience and perception of historical trends, current conditions and expected future developments, as well as other factors that Galantas believes are appropriate in the circumstances. Many factors could cause Galantas' actual results, the performance or achievements to differ materially from those expressed or implied by the forward looking statements or strategy, including: gold price volatility; discrepancies between actual and estimated production, actual and estimated metallurgical recoveries and throughputs; mining operational risk, geological uncertainties; regulatory restrictions, including environmental regulatory restrictions and liability; risks of sovereign involvement; speculative nature of gold exploration; dilution; competition; loss of or availability of key employees; additional funding requirements; uncertainties regarding planning and other permitting issues; and defective title to mineral claims or property. These factors and others that could affect Galantas' forward-looking statements are discussed in greater detail in the section entitled "Risk Factors" in Galantas' Management Discussion & Analysis of the financial statements of Galantas and elsewhere in documents filed from time to time with the Canadian provincial securities regulators and other regulatory authorities. These factors should be considered carefully, and persons reviewing this news release should not place undue reliance on forward-looking statements. Galantas has no intention and undertakes no obligation to update or revise any forward-looking statements in this news release, except as required by law.

Photos accompanying this announcement are available at

https://www.globenewswire.com/NewsRoom/AttachmentNg/1d6aa691-5d8e-4b7e-a010-8ee6379c8bfb

https://www.globenewswire.com/NewsRoom/AttachmentNg/6cc91c1f-34b0-4c2e-b756-2fd744d13a12