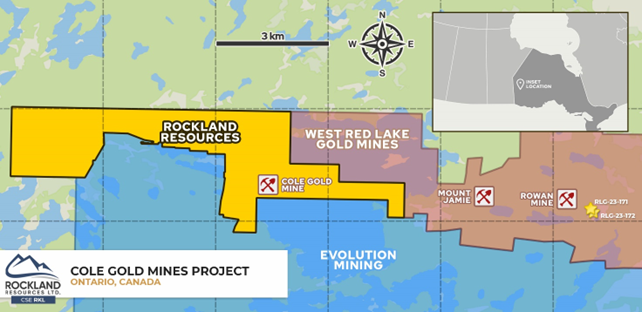

VANCOUVER, BC / ACCESSWIRE / April 18, 2024 / Rockland Resources Ltd. (the "Company" or "Rockland") (CSE:RKL) announces that, in anticipation of an upcoming diamond drill program this season, the permitting process is now underway. Work is also ongoing to prepare for a busy 2024 field season at the 100% owned Cole Gold Mines Property, located adjacent to West Red Lake Gold Mines Ltd. (WRLG) Rowan property in the western portion of the prolific Red Lake gold district of northwestern Ontario.

As soon as conditions permit, field crews will be prospecting the property to follow up historical results, mapping, and collar locations of old diamond drill holes (refer to RKL PR, March 27, 2024). Rockland is encouraged by the historical data and looking forward to confirming this in the field.

Rockland is also looking to secure a contractor to conduct a drone survey that would include both LiDAR (Light Detection and Ranging) and high-resolution magnetic data. LiDAR data has never been collected on this property and could aid in identifying structural features and provide a very accurate digital terrain model.

"This is an exciting time for shareholders as gold continues to set new record highs and we continue to find historical data on the Cole Gold Mines project indicating gold occurrences in numerous locations for us to now follow up on using modern mineral exploration technology," stated Mike England, CEO of Rockland Resources.

About Rockland Resources Ltd.

Rockland Resources is engaged in the business of mineral exploration and the acquisition of mineral property assets for the benefit of its shareholders. The Company also now owns 100-per-cent of the Cole Gold Mines property, located in Ball township, Red Lake mining division, Ontario. The Cole Property hosts high-grade gold mineralization in a classic Red Lake-type structurally controlled gold deposit environment.

On Behalf of the Board of Directors

Michael England, CEO & Director

For further information, please contact:

Mike England

Email: mike@engcom.ca

Neither the Canadian Stock Exchange nor its Regulation Services Provider accepts responsibility for the adequacy or accuracy of this release.

FORWARD-LOOKING STATEMENTS: This news release contains forward-looking statements, which relate to future events or future performance and reflect management's current expectations and assumptions. Such forward-looking statements reflect management's current beliefs and are based on assumptions made by and information currently available to the Company. Investors are cautioned that these forward-looking statements are neither promises nor guarantees and are subject to risks and uncertainties that may cause future results to differ materially from those expected. These forward-looking statements are made as of the date hereof and, except as required under applicable securities legislation, the Company does not assume any obligation to update or revise them to reflect new events or circumstances. All of the forward-looking statements made in this press release are qualified by these cautionary statements and by those made in our filings with SEDAR in Canada (available at WWW.SEDAR.COM).

SOURCE: Rockland Resources Ltd.

View the original press release on accesswire.com