Advisors and Their Clients Can View, Compare and Analyze Household Risk Scores Within RightCapital's Comprehensive Financial Planning Software

SHELTON, CT / ACCESSWIRE / May 7, 2024 / RightCapital, the fastest-growing financial planning software for financial advisors, today introduced RightRisk, a fully integrated risk assessment tool to simplify how financial advisors incorporate risk assessment as part of the financial planning process. RightRisk takes risk assessment beyond the traditional risk-return model by helping advisors balance each client's risk tolerance (risk score) with the level of risk needed to achieve their financial goals (probability of success).

"Moving from our manual, PowerPoint-based assessments to utilizing RightRisk within RightCapital is a game-changer for us in terms of saving time and costs," explained Matt Cook, CFP®, ChFC®, AAMS®, President, and CEO of Stoic Private Wealth. "The flexibility of RightRisk, allowing us to tailor risk assessments to our preferences and establish custom risk categories, has been particularly valuable."

"RightCapital is the only software tool that my clients have access to so it's nice to be able to offer risk assessment using the same client portal instead of having to jump into a separate risk tool," said Mike Bink, CCFS®, AAMS ®, founder and president of Equivest Financial Advisors. "I also like RightRisk's intuitive scoring methodology and the ability to incorporate the risk assessment PDF report into my investment policy statement. As an advisor, RightRisk allows me to streamline the tech stack I use when working with my clients as well as reduce my costs since it is included with my current RightCapital Premium subscription."

"With RightRisk, our goal was to make it as easy as possible for advisors to incorporate risk assessment into a financial plan," said Shuang Chen, co-founder and CEO of RightCapital. "Advisors and clients can quickly see the interplay across the risk score, current and target investment portfolios, and the probability of success-all from the same financial planning software."

Key RightRisk Features:

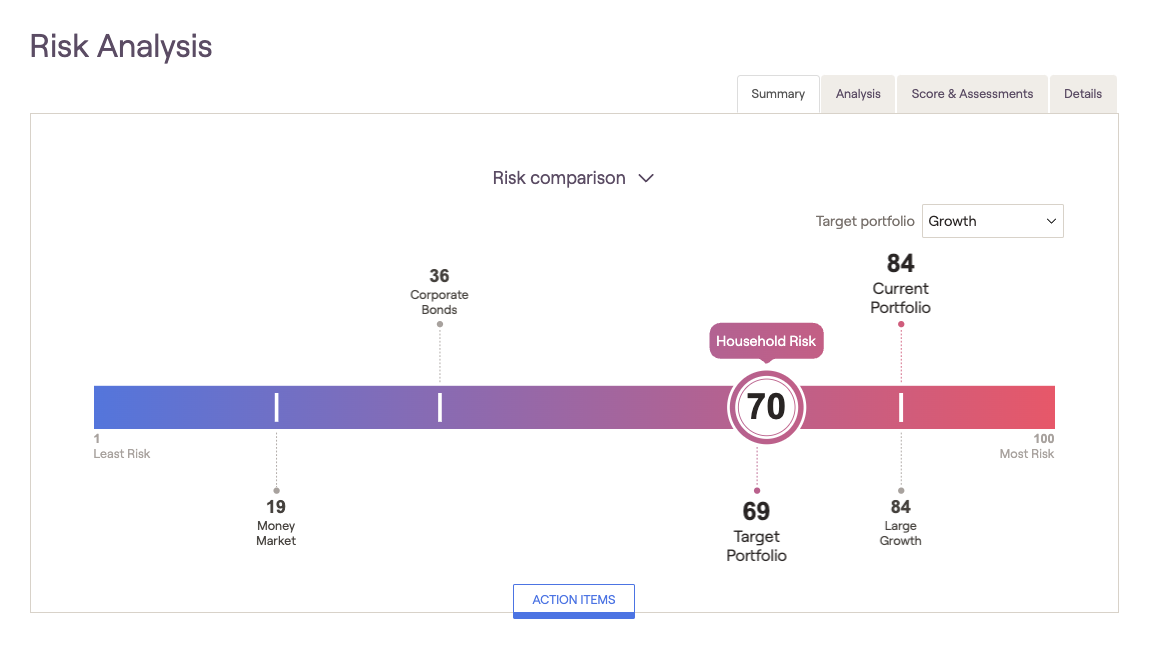

Household risk summary: See how a household risk score compares to the current portfolio, target portfolio as well as major asset classes. Advisors can also create custom risk categories to be included in the comparison.

Visual risk-return analysis: Help clients easily understand the potential upside and downside returns for their investment portfolios and major asset classes. Advisors can exclude specific investment accounts from the analysis as appropriate.

Customizable questionnaires: Use the default 13-item questionnaire based on the Grable and Lytton scale or create your own version. The assessment results are saved in one place for easy reference.

Flexible ways to engage clients: The questionnaire can be launched immediately during a live client discussion, shown to clients through a splash page when they log into the client portal or alerted via a task notification. Advisors can also include the risk score as part of the client's Snapshot Dashboard or PDF report.

RightRisk Availability and Pricing

RightRisk is available now and is included with the RightCapital Premium subscription or higher. To learn more, contact RightCapital Sales at rightcapital.com/book-demo, sales@rightcapital.com or (888) 982-9596 Opt 1.

About RightCapital

RightCapital's mission is to create Right Plans for Real People. RightCapital is used by thousands of financial advisors to grow their practices and set their clients on the path to financial success. Founded in 2015, RightCapital is the fastest-growing financial planning software with the highest user satisfaction among advisors (Source: The Kitces Report - 2023 AdvisorTech Study). For more information, visit https://www.rightcapital.com.

RightCapital media contact: marketing@rightcapital.com

SOURCE: RightCapital Inc.

View the original press release on accesswire.com