GRAND CAYMAN, Cayman Islands, Aug. 08, 2024 (GLOBE NEWSWIRE) -- Oxbridge Re Holdings Limited (NASDAQ: OXBR), (the "Company"), together with its subsidiaries which is engaged in the business of tokenized Real-World Assets ("RWAs") initially in the form of tokenized reinsurance securities, and reinsurance solutions to property and casualty insurers in the Gulf Coast region of the United States, reported its results for the three and six months ended June 30, 2024.

"Our stable performance persisted into the second quarter of 2024, with no losses incurred," stated Jay Madhu, Chairman and Chief Executive Officer of Oxbridge Re Holdings.

"Following Delta CatRe's targeted 42% payout last year, which was successfully exceeded at 49%, we are pleased to announce the completion of EpsilonCat Re private placement of approximately $2.8 million in tokenized securities within our RWA/Web3-focused subsidiary, SurancePlus Inc. This alternative investment leverages key aspects of blockchain technology to create a well-designed digital security, issued on the Avalanche blockchain," Mr. Madhu continued. "Provided there are no losses from our reinsurance contracts, investors in EpsilonCat Re tokenized securities can expect an estimated annual return of 42%.

We also recently announced a strategic partnership with Zoniqx, which has issued over $4 billion in assets on-chain to date. SurancePlus is now a well-capitalized business with substantial growth potential for our shareholders. We are proud of this accomplishment and look forward to this exciting new entity diversifying and accelerating our growth in the RWA space in the coming years."

"Looking ahead, with a strong balance sheet, no debt, and a well-diversified business from our recent transactions, we remain highly confident in our future ability to deliver shareholder value," concluded Jay Madhu.

Financial Performance

For the three months ended June 30, 2024, the Company generated a net loss of $821,000 or $(0.14) per basic and diluted common share compared to net loss of $85,000 or ($0.01) per basic and diluted common share in the second quarter of 2023. The decrease is due primarily negative change in the fair value of equity securities and other investments during the quarter. For the six months ended June 30, 2024, the Company generated a net loss of $1.73 million or ($0.29) per basic and diluted common share compared to a net profit of $57,000 or $0.01 basic and diluted common share for the six months ended June 30, 2023. The worsened results were primarily due to lower total revenues driven by the increase in unrealized losses on other investment and equity securities.

Net premiums earned for the three months ended June 30, 2024 were $564,000 compared to $183,000 in the same prior year period. For the six months ended June 30, 2024 net premiums earned were $1.1 million compared to $183,000 in the prior year. The increases are primarily due to the prior periods recognizing only one month of premiums because of premium acceleration on the reinsurance contracts in force. In contrast, the quarter and six months ended June 30, 2024, recognized a full three and six months of premiums, respectively.

There were no losses incurred for the three and six months ended June 30, 2024 or 2023.

Total expenses were $628,000 for the three months ended June 30, 2024 compared to $697,000 for the same period in the prior year. For the six months ended June 30, 2024 total expenses were $1.17 million compared to $1.1 million in the prior year. The increase was due to higher policy and acquisition costs when compared to the prior year.

At June 30, 2024, cash and cash equivalents, and restricted cash and cash equivalents were $3.98 million compared to $3.7 million at December 31, 2023.

Financial Ratios

Loss Ratio. The loss ratio, which measures underwriting profitability, is the ratio of losses and loss adjustment expenses incurred to net premiums earned. The loss ratio was 0% for the period ended June 30, 2024 and 2023 due to no loss or loss adjustment expenses in either period.

Acquisition Cost Ratio. The acquisition cost ratio, which measures operational efficiency and compares policy acquisition costs with net premiums earned, increased marginally to 11.0% for the three and six-month periods ended June 30, 2024 from 10.9% for the same period last year.

Expense Ratio. The expense ratio, which measures operating performance, compares policy acquisition costs and general and administrative expenses with net premiums earned. The expense ratio decreased to 105.7% for the six months ended June 30, 2024 from 601.6% in the prior year due to the higher levels of premium earned during the period.

Combined ratio. The combined ratio, which is used to measure underwriting performance, is the sum of the loss ratio and the expense ratio. The combined ratio decreased to 105.7% for the six months ended June 30, 2023 from 601.6% due to the higher levels of premium earned during the period.

SurancePlus Offering

On July 11, 2024, SurancePlus Inc. ("SurancePlus"), an indirect wholly owned subsidiary of Oxbridge Re Holdings Limited ("Oxbridge"), completed its private placement (the "Private Placement") of Participation Shares (the "Securities") represented by digital tokens issued under a 3-year Participation Share Investment Contract (the "PSIC"). On July 11, 2024, SurancePlus entered into subscription agreements with accredited investors and non-U.S. persons in the Private Placement with respect to 287,705 of the Participation Shares represented by the digital tokens, EpsilonCat Re at a purchase price of $10.00 per Participation Share for aggregate gross proceeds of $2,878,048. The Participation Shares are not shares in SurancePlus and shall have no preemptive right or conversion rights. The Participation Shares solely confer contractual rights against SurancePlus as contained in the PSIC. The aggregate amount raised in the Private Placement was $2,878,048 for the issuance of 287,804 Participation Shares represented by Digital Tokens of which approximately $1,469,000 was received from third-party investors and approximately $1,409,000 from Oxbridge Re Holdings Limited. Approximately $312,000 and $299,000 of management fees were deducted from the gross proceeds from the third-party investors and Oxbridge Re Holdings Limited, respectively. The tokens were issued on the Avalanche blockchain. Ownership of DeltaCat Re tokenized reinsurance securities indirectly confers fractionalized interests in reinsurance contracts underwritten by Oxbridge Re's reinsurance subsidiary, Oxbridge Re NS, for the 2024-2025 treaty year.

Conference Call

Management will host a conference call later today to discuss these financial results, followed by a question and-answer session. President and Chief Executive Officer Jay Madhu and Chief Financial Officer Wrendon Timothy will host the call starting at 4:30 p.m. Eastern time. The live presentation can be accessed by dialing the number below or by clicking the webcast link available on the Investor Information section of the company's website at www.oxbridgere.com.

Date: August 8, 2024

Time: 4.30 p.m. Eastern time

Toll-free number: 877 524-8416

International number: +1 412 902-1028

Passcode (required): 13746518

Please call the conference telephone number 10 minutes before the start time. An operator will register your name and organization. If you have any difficulty connecting with the conference call, please contact InComm Conferencing at 201 493-6280 or 877 804-2066

A replay of the call will be available by telephone after 4:30 p.m. Eastern time on the same day of the call and via the Investor Information section of Oxbridge's website at www.oxbridgere.com until August 22nd, 2024.

Toll-free replay number: 877-660-6853

International replay number: +1-201-612-7415

Conference ID: 13746518

About Oxbridge Re Holdings Limited

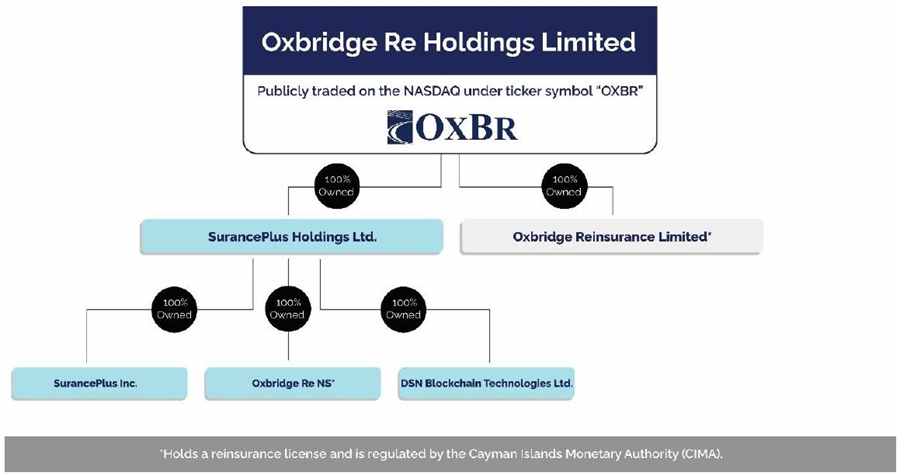

Oxbridge Re Holdings Limited (NASDAQ: OXBR, OXBRW) ("Oxbridge Re") is headquartered in the Cayman Islands. The company offers tokenized Real-World Assets ("RWAs") as tokenized reinsurance securities and reinsurance business solutions to property and casualty insurers, through its wholly owned subsidiaries SurancePlus Inc, Oxbridge Re NS, and Oxbridge Reinsurance Limited.

Insurance businesses in the Gulf Coast region of the United States purchase property and casualty reinsurance through our licensed reinsurers Oxbridge Reinsurance Limited and Oxbridge Re NS.

Our new Web3-focused subsidiary, SurancePlus Inc. ("SurancePlus"), has developed the first "on-chain" reinsurance RWA of its kind to be sponsored by a subsidiary of a publicly traded company. By digitizing interests in reinsurance contracts as on-chain RWAs, SurancePlus has democratized the availability of reinsurance as an alternative investment to both U.S. and non-U.S. investors.

Forward-Looking Statements

This press release may contain forward-looking statements made pursuant to the Private Securities Litigation Reform Act of 1995. Words such as "anticipate," "estimate," "expect," "intend," "plan," "project" and other similar words and expressions are intended to signify forward-looking statements. Forward-looking statements are not guarantees of future results and conditions but rather are subject to various risks and uncertainties. A detailed discussion of risks and uncertainties that could cause actual results and events to differ materially from such forward-looking statements is included in the section entitled "Risk Factors" contained in our Form 10-K filed with the Securities and Exchange Commission ("SEC") on 26th March 2024. The occurrence of any of these risks and uncertainties could have a material adverse effect on the Company's business, financial condition and results of operations. Any forward-looking statements made in this press release speak only as of the date of this press release and, except as required by law, the Company undertakes no obligation to update any forward-looking statement contained in this press release, even if the Company's expectations or any related events, conditions or circumstances change.

Company Contact:

Oxbridge Re Holdings Limited

Jay Madhu, CEO

345-749-7570

jmadhu@oxbridgere.com

OXBRIDGE RE HOLDINGS LIMITED AND SUBSIDIARIES

Consolidated Balance Sheets

(expressed in thousands of U.S. Dollars, except per share and share amounts)

| At June 30, 2024 | At December 31, 2023 | |||||||

| (Unaudited) | ||||||||

| Assets | ||||||||

| Investments: | ||||||||

| Equity securities, at fair value (cost: $1,563 and $1,926) | $ | 213 | 680 | |||||

| Cash and cash equivalents | 3,594 | 495 | ||||||

| Restricted cash and cash equivalents | 391 | 3,250 | ||||||

| Premiums receivable | 2,118 | 977 | ||||||

| Other Investments | 965 | 2,478 | ||||||

| Loan Receivable | - | 100 | ||||||

| Due from Related Party | 63 | 63 | ||||||

| Deferred policy acquisition costs | 240 | 101 | ||||||

| Operating lease right-of-use assets | 124 | 9 | ||||||

| Prepayment and other assets | 113 | 96 | ||||||

| Property and equipment, net | 2 | 4 | ||||||

| Total assets | $ | 7,823 | 8,253 | |||||

| Liabilities and Shareholders' Equity | ||||||||

| Notes payable to noteholders | 118 | 118 | ||||||

| Notes payable to Epsilon DeltaCat Re Tokenholders | 1,239 | 1,523 | ||||||

| Unearned Premium Reserve | 2,181 | 915 | ||||||

| Operating lease liabilities | 124 | 9 | ||||||

| Accounts payable and other liabilities | 374 | 356 | ||||||

| Total liabilities | 4,036 | 2,921 | ||||||

| Shareholders' equity: | ||||||||

| Ordinary share capital, (par value $0.001, 50,000,000 shares authorized; 6,036,579 and 5,870,234 shares issued and outstanding) | 6 | 6 | ||||||

| Additional paid-in capital | 32,921 | 32,740 | ||||||

| Accumulated Deficit | (29,140 | ) | (27,414 | ) | ||||

| Total shareholders' equity | 3,787 | 5,332 | ||||||

| Total liabilities and shareholders' equity | $ | 7,823 | 8,253 | |||||

OXBRIDGE RE HOLDINGS LIMITED AND SUBSIDIARIES

Consolidated Statements of Operations

(Unaudited)

(expressed in thousands of U.S. Dollars, except per share amounts)

| Three Months Ended | Six Months Ended | |||||||||||||||

| June 30, | June 30, | |||||||||||||||

| 2024 | 2023 | 2024 | 2023 | |||||||||||||

| Revenue | ||||||||||||||||

| Assumed premiums | $ | 2,379 | 2,196 | 2,379 | 2,196 | |||||||||||

| Change in unearned premiums reserve | (1,815 | ) | (2,013 | ) | (1,266 | ) | (2,013 | ) | ||||||||

| Net premiums earned | 564 | 183 | 1,113 | 183 | ||||||||||||

| SurancePlus management fee income | 312 | 300 | 312 | 300 | ||||||||||||

| Net investment and other income | 65 | 79 | 126 | 168 | ||||||||||||

| Interest and gain on redemption of loan receivable | - | - | 41 | - | ||||||||||||

| Unrealized (loss) gain on other investments | (825 | ) | 124 | (1,513 | ) | 505 | ||||||||||

| Change in fair value of equity securities | (72 | ) | 5 | (160 | ) | 81 | ||||||||||

| Total revenue | 44 | 691 | (81 | ) | 1,237 | |||||||||||

| Expenses | ||||||||||||||||

| Policy acquisition costs and underwriting expenses | 62 | 20 | 122 | 20 | ||||||||||||

| General and administrative expenses | 566 | 677 | 1,054 | 1,081 | ||||||||||||

| Total expenses | 628 | 697 | 1,176 | 1,101 | ||||||||||||

| Income (Loss) before income attributable to noteholders and tokenholders | (584 | ) | (6 | ) | (1,257 | ) | 136 | |||||||||

| Income attributable to noteholders and tokenholders | (237 | ) | (79 | ) | (469 | ) | (79 | ) | ||||||||

| Net (loss) income | $ | (821 | ) | (85 | ) | (1,726 | ) | 57 | ||||||||

| (Loss) earnings per share | ||||||||||||||||

| Basic and Diluted | $ | (0.14 | ) | (0.01 | ) | (0.29 | ) | 0.01 | ||||||||

| Weighted-average shares outstanding | ||||||||||||||||

| Basic and Diluted | 6,010,561 | 5,870,234 | 6,007,868 | 5,863,973 | ||||||||||||

| Performance ratios to net premiums earned: | ||||||||||||||||

| Loss ratio | 0.0 | % | 0.0 | % | 0.0 | % | 0.0 | % | ||||||||

| Acquisition cost ratio | 11.0 | % | 10.9 | % | 11.0 | % | 10.9 | % | ||||||||

| Expense ratio | 111.3 | % | 380.9 | % | 105.7 | % | 601.6 | % | ||||||||

| Combined ratio | 111.3 | % | 380.9 | % | 105.7 | % | 601.6 | % | ||||||||