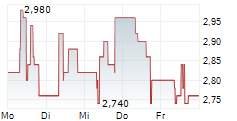

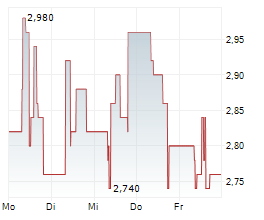

Die Ringmetall SE (DE000A3E5E55) kann für das Geschäftsjahr 2024 einen deutlichen Gewinnsprung vermelden, obwohl der Umsatz leicht rückläufig war. Der Münchner Spezialist für Industrieverpackungen blickt auf ein erfolgreiches Jahr zurück - muss aber gleichzeitig feststellen, dass das Marktumfeld zunehmend herausfordernder wird.

Ringmetall steigert EBITDA um fast ein Viertel

Der Konzernumsatz lag mit 174,9 Millionen Euro zwar um 3,7 Prozent unter dem Vorjahreswert von 181,6 Millionen Euro, aber das Ergebnis vor Zinsen, Steuern und Abschreibungen (EBITDA) konnte um beeindruckende 23,9 Prozent auf 23,7 Millionen Euro gesteigert werden. Die EBITDA-Marge verbesserte sich dadurch deutlich von 10,6 auf 13,6 Prozent. […] Wo es dennoch hakt, lesen Sie auf www.nebenwertewelt.de

Der Beitrag Ringmetall trotzt Gegenwind - Ertragskraft steigt deutlich trotz sinkender Umsätze erschien zuerst auf Nebenwertewelt.