Rankings validate Bottomline partnership excellence across critical areas including implementation, client satisfaction, and client success

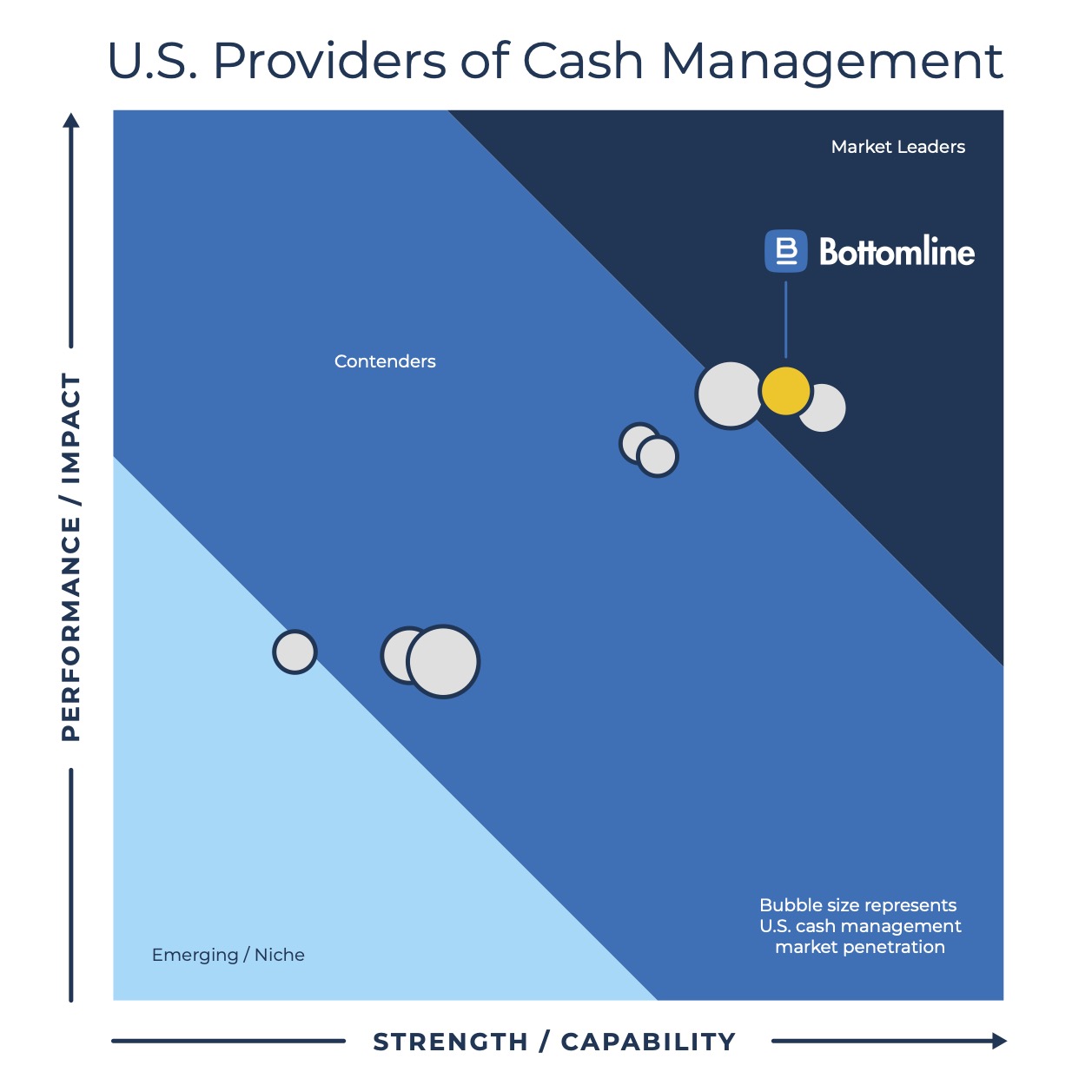

PORTSMOUTH, N.H., Oct. 21, 2024 (GLOBE NEWSWIRE) -- Datos Insights announced Bottomline as a "market-leading' US-based cash management provider in its new 2024 Datos Matrix: US Cash Management Technology Providers report. This is Bottomline's 6th consecutive "market-leader' recognition by the Datos Matrix (formerly the Aite Matrix), a trusted evaluation of best-in-class cash management technology providers. Bottomline achieved the highest overall position in the quadrant, highlighted by its leadership ranking across the majority of evaluation categories. This recognition underscores its core strengths in strategic consulting, best-in-class implementations, product innovation, seamless customer migrations, and outstanding post-production support.

"Bottomline scores very high in both the quality of its management team and its commitment to innovation. Its robust and scalable product features meet the needs of businesses of all sizes. Just as noteworthy, Bottomline's diverse client base and very high retention rates reflect the stability and lasting value it provides. Clients consistently praise the company for its ability to deliver on promises and recognize it as a trusted partner," said Christine Barry, Strategic Initiatives Leader, Research, Datos Insights.

The 2024 Datos Matrix: US Cash Management Technology Providers report measures the performance of a competitive set of cash management providers in the U.S. As the report states, "This research evaluates key market dynamics, as well as the technology vendor landscape, to differentiate the market leaders from the contenders and emerging/niche options" and examines specific areas, including payment and data capabilities, ease of integration with fintechs and ERPs, and platform extensibility/configurability.

"Our banking customers understand that we act as a partner and not just a vendor. Through the power of Bottomline's extensive suite of digital banking, cash management, payments hubs and connectivity services, and B2B payments network, we uniquely empower banks to create new revenue streams and secure primary customer relationships," said Kevin Pettet, Chief Revenue Officer, Banking, Bottomline.

"It's an honor to be recognized as the leading provider in Commercial Digital Banking," Pettet said, adding that Bottomline works as a strategic partner throughout the entire customer journey - from strategic consulting to proactive product innovation, to best-in-class implementations, customer migration, and strong post-launch support. "It all comes together seamlessly to spur digital transformation for Bottomline banking customers," he said.

Additional Resources:

- For more information about Bottomline, visit us by clicking here (https://www.bottomline.com/).

- For a complementary report download, click here (https://datos-insights.com/reports/datos-matrix-u-s-cash-management-technology-providers/).

About Bottomline

Bottomline helps businesses transform the way they pay and get paid. A global leader in business payments and cash management, Bottomline's secure, comprehensive solutions modernize payments for businesses and financial institutions globally. With over 35 years of experience, moving more than $10 trillion in payments annually, Bottomline is committed to driving impactful results for customers by reimagining business payments and delivering solutions that add to the bottom line. Bottomline is a portfolio company of Thoma Bravo, one of the largest software private equity firms in the world, with more than $160 billion in assets under management. For more information visit www.bottomline.com.

Bottomline and the Bottomline logo are trademarks or registered trademarks of Bottomline Technologies, Inc.

About Datos Insights

Datos Insights delivers the most comprehensive and industry-specific data and advice to the companies trusted to protect and grow the world's assets, and to the technology and service providers who support them. Staffed by experienced industry executives, researchers, and consultants, we support the world's most progressive banks, insurers, investment firms, and technology companies through a mix of insights and advisory subscriptions, data services, custom projects and consulting, conferences, and executive councils.

| Media Contacts: | |

| Christine Barry | Heather Pavliga |

| Datos Insights | Bottomline |

| Email: pr@datos-insights.com (mailto:pr@datos-insights.com) | Global Head, Brand & Communications |

| Email: pr@bottomline.com (mailto:pr@bottomline.com) | |

A photo accompanying this announcement is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/bc65c1ad-adda-45cb-966b-a8aec9d00587