NORTHAMPTON, MA / ACCESSWIRE / October 22, 2024 / Bloomberg

Originally published on bloomberg.com

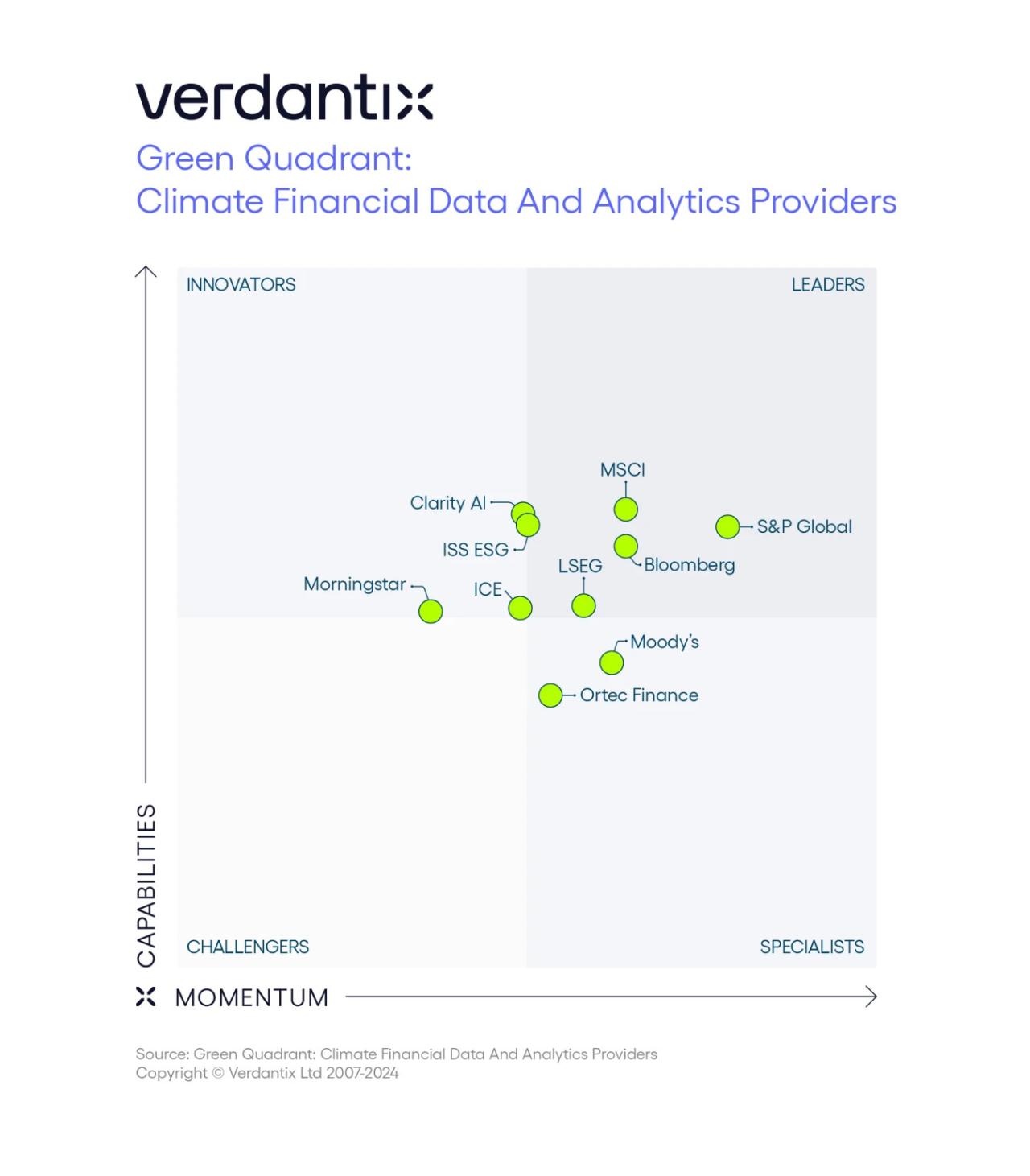

Bloomberg has been recognized as a Leader in The Verdantix Green Quadrant: Climate Financial Data And Analytics Providers 2024.

This report evaluates vendors across 11 capability categories and 11 measures of market momentum, and positions Bloomberg as a Leader offering comprehensive transition risk analytics at the asset and portfolio levels, and strong carbon emission and energy transition solutions.

The criteria for which Bloomberg received its highest scores include: net zero targets, tracking and alignment; transition plans; alignment with regulations and frameworks; climate financial data and analytics partners; and system integration.

Patricia Torres, Global Head of Sustainable Finance Solutions at Bloomberg, said: "Bloomberg's goal is to be at the forefront of the development of sustainable finance solutions, and we are therefore proud to be recognized as a Leader in Climate Financial Data and Analytics. We are committed to leading the way in developing sustainable finance solutions that drive real-world progress. As the world increasingly focuses on financing reduced emissions, we provide decision-useful climate and nature data and analytics that enable firms to make more informed, impactful investment decisions. By integrating high-quality climate and nature insights with comprehensive financial tools, we help our clients stay ahead in an evolving regulatory landscape, drive sustainable change, manage risk and offer differentiated products to their customers."

In the report, Verdantix noted:

"Bloomberg offers unique, comprehensive transition risk analytics at the asset and portfolio levels" with the Transition Risk Assessment Company Tool developed by BloombergNEF.

"Bloomberg's carbon emission and energy transition solutions are also strong. For example, its net zero forecasts incorporate credibility analysis of transition pathways. For investors that engage in decarbonization, there are automated tools to track these engagements for sustainability report. Bloomberg also offers solutions to identify and evaluate investment opportunities that support the climate transition."

The Bloomberg Terminal brings together business insights - for example asset-level data, such as location and activities, and supplier networks - with climate analytics and traditional financial data."

For complimentary access to the full report, click here.

Bloomberg's sustainable finance solutions span data and analytics, indices, scores, regulatory solutions, sustainable debt and climate risk. In addition, Bloomberg Terminal users also have access to ESG research from Bloomberg Intelligence and BloombergNEF. Clients can readily access ESG data on the Bloomberg Terminal via {ESGD } or across their enterprise via Data License at data.Bloomberg.com for use in proprietary or third-party applications in their cloud environment of choice. Through Data License Plus (DL+) ESG Manager, Bloomberg connects customers' ESG data workflows to the full power of Bloomberg's datasets as well as data from vendor partners, so clients can unlock maximum value with ease. For more information, visit Bloomberg Sustainable Finance Solutions.

About Bloomberg

Bloomberg is a global leader in business and financial information, delivering trusted data, news, and insights that bring transparency, efficiency, and fairness to markets. The company helps connect influential communities across the global financial ecosystem via reliable technology solutions that enable our customers to make more informed decisions and foster better collaboration. For more information, visit Bloomberg.com/company or request a demo.

Bloomberg Press Contacts

Alyssa Gilmore - agilmore7@bloomberg.net

View additional multimedia and more ESG storytelling from Bloomberg on 3blmedia.com.

Contact Info:

Spokesperson: Bloomberg

Website: https://www.3blmedia.com/profiles/bloomberg

Email: info@3blmedia.com

SOURCE: Bloomberg

View the original press release on accesswire.com