SUNNY ISLES BEACH, FL / ACCESSWIRE / December 17, 2024 / Elektros (OTC PINK:ELEK), a leader in electric mobility and lithium mining, announced its strategic initiative to revolutionize grid-scale battery storage through advanced AI-driven predictive algorithms, and lithium supply management.

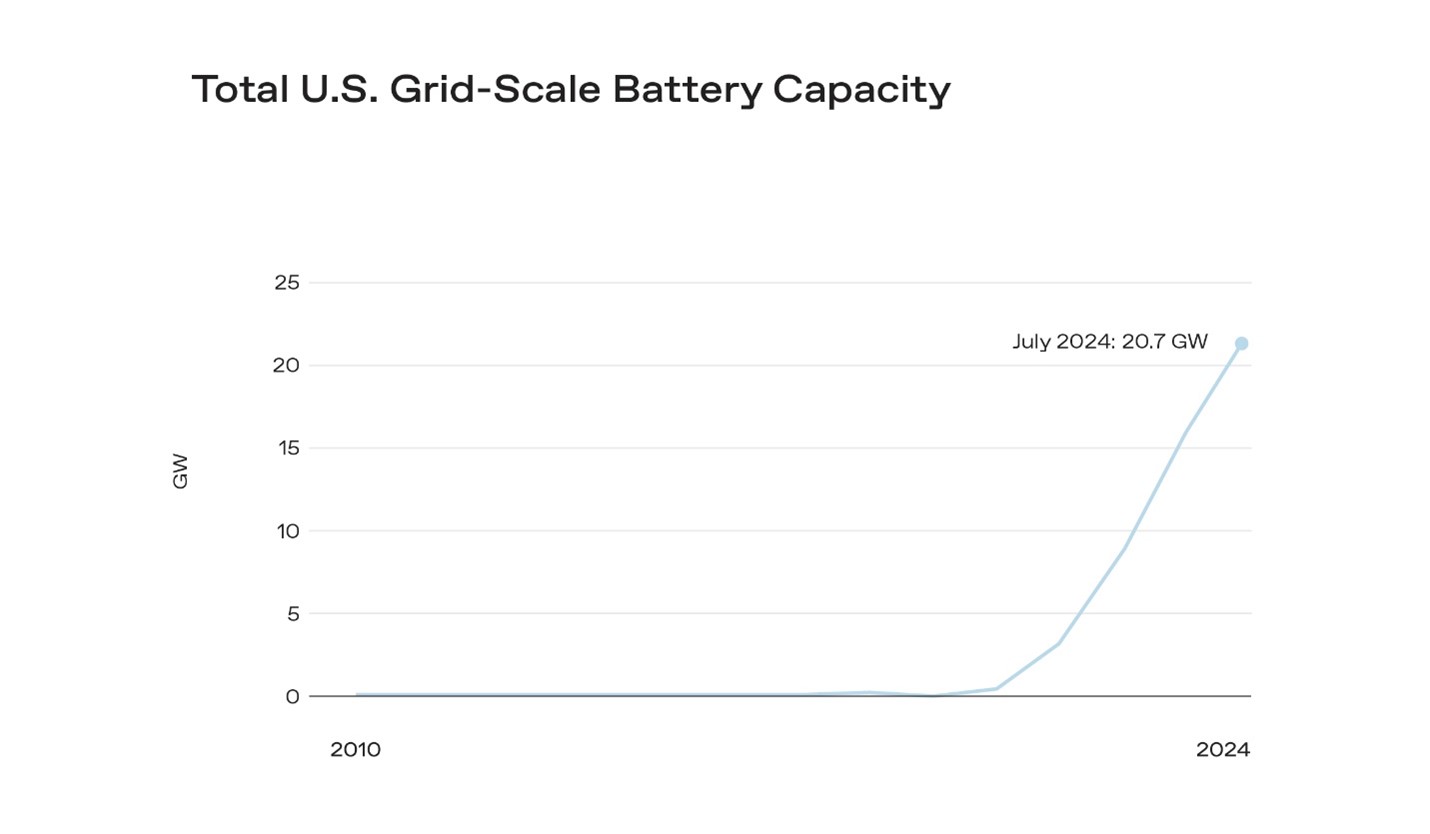

The United States currently maintains 20.7 gigawatts of battery energy storage capacity as of July 2024. The Company looks to position itself as a vertically integrated solution provider by leveraging its own lithium mining capabilities to directly support grid-scale battery storage ecosystems. The company, in partnership with Next Realm AI, plans to develop sophisticated AI algorithms designed to optimize battery charging and discharging processes, while simultaneously ensuring a robust, domestically sourced lithium supply chain.

"Elektros could integrate intelligent decision-making systems that analyze complex datasets, including weather patterns, historical consumption data, and market prices," said Tom Bustamante, Founder & CEO of Next Realm AI.

"By leveraging AI technologies, and their lithium assets, the company could help grid operators maintain reliable electricity supply while significantly reducing fossil fuel dependency, with an initial focus on Florida's unique energy infrastructure needs."

The Florida-centric strategy positions Elektros to capitalize on the state's aggressive renewable energy targets and increasing vulnerability to climate-related energy challenges. By developing predictive models that determine optimal times for battery charging when renewable sources generate excess energy and discharging when grid demand peaks, Elektros aims to enhance grid reliability, reduce operational costs, and accelerate the transition to sustainable energy infrastructure.

Uniquely positioned through its integrated lithium mining operations, Elektros can provide a competitive advantage by controlling key components of the battery storage supply chain. The company's lithium mining assets will directly support battery storage technology, ensuring a streamlined and secure source of critical battery materials.

South Florida Events

To stay informed about these exclusive networking events, interested parties are invited to join our Elektros Investor Network at https://elektros.energy/investors/

About Elektros, Inc.

Elektros (OTC PINK:ELEK) is a vertically integrated sustainable energy company focused on lithium mining, electric vehicle charging, solar energy storage, and power supply for AI data centers. We are at the forefront of the clean energy transition, driving innovation in mobility and energy technologies to combat the global climate crisis and deliver transformative user experiences. www.elektros.energy

Follow of Facebook: https://www.facebook.com/Elektrosenergy

Cautionary Language Concerning Forward-Looking Statements

This release contains "forward-looking statements" that include information relating to future events and future financial and operating performance. The words "may," "would," "will," "expect," "estimate," "can," "believe," "potential," and similar expressions and variations thereof are intended to identify forward-looking statements. Forward-looking statements should not be read as a guarantee of future performance or results and will not necessarily be accurate indications of the times at, or by, which that performance or those results will be achieved. Forward-looking statements are based on information available at the time they are made and/or management's good faith belief as of that time with respect to future events and are subject to risks and uncertainties that could cause actual performance or results to differ materially from those expressed in or suggested by the forward-looking statements. Important factors that could cause these differences include, but are not limited to: fluctuations in demand for Elektros, Inc.'s products, the introduction of new products, the Company's ability to maintain customer and strategic business relationships, the impact of competitive products and pricing, growth in targeted markets, the adequacy of the Company's liquidity and financial strength to support its growth, and other information that may be detailed from time to time in Elektros Inc.'s filings with the United States Securities and Exchange Commission. Examples of such forward-looking statements in this release include statements regarding future sales, costs, and market acceptance of products as well as regulatory actions at the State or Federal level. For a more detailed description of the risk factors and uncertainties affecting Elektros Inc., please refer to the Company's Securities and Exchange Commission filings, which are available at www.sec.gov. Elektros, Inc. undertakes no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise.

CONTACT:

Elektros, Inc. IR and Media Inquiries

Email: ElektrosInc@gmail.com

SOURCE: Elektros, Inc.

View the original press release on accesswire.com