SEATTLE, WASHINGTON / ACCESS Newswire / January 28, 2025 / NLM Photonics announces investment by Emerald Technology Ventures and Oregon Venture Fund to help bring energy-efficient, high performance electro-optic modulation technology to AI, data centers, quantum computing, and more. The two firms join Tokyo Ohka Kogyo Co., Ltd., Pack Ventures, StoryHouse Ventures, and other existing NLM investors to support NLM's vision and focus.

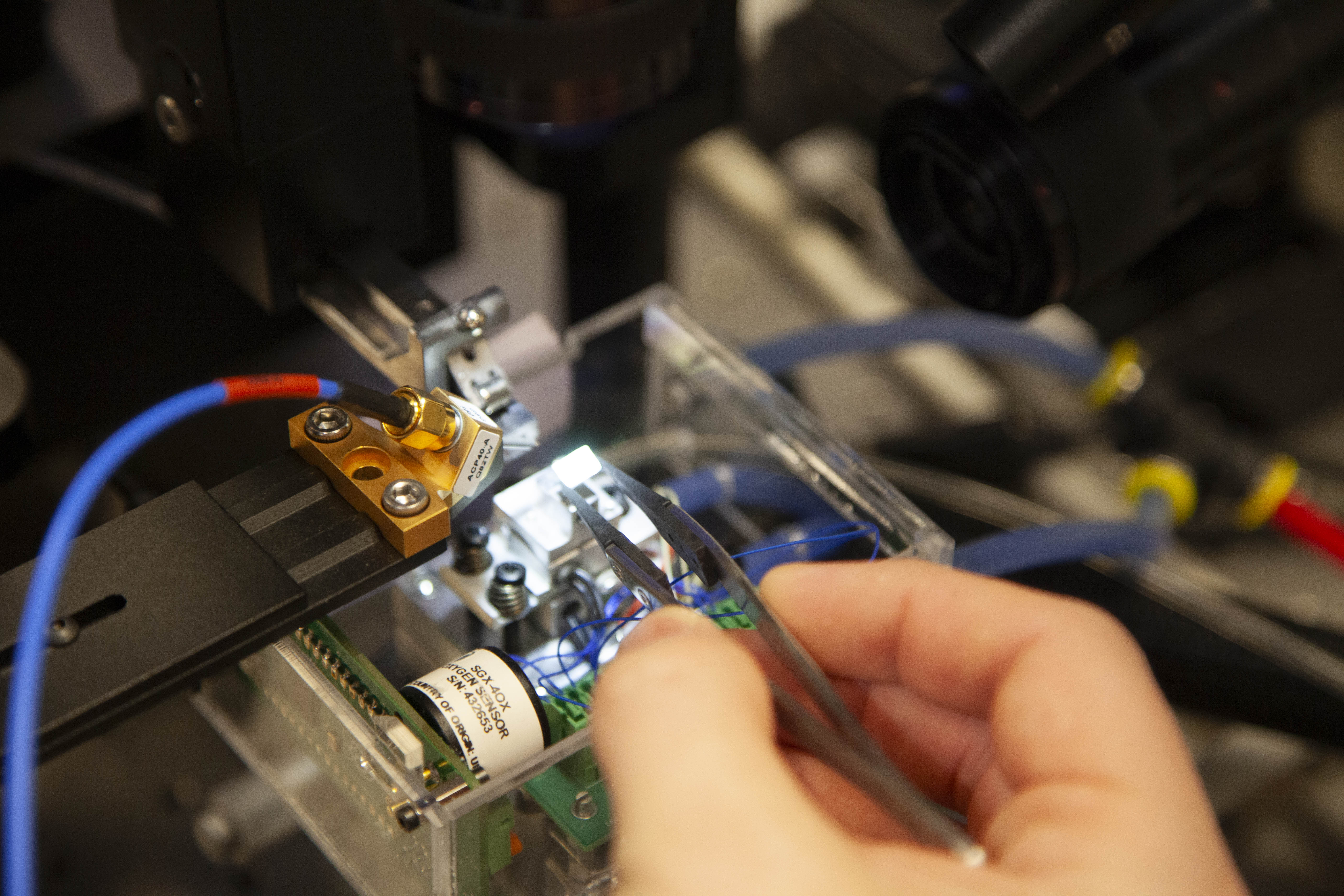

NLM is a semiconductor technology company whose breakthrough hybrid organic electro-optic photonic modulators can enable up to a 30 percent reduction in data center network power consumption. Their cutting-edge solutions enable high-bandwidth, low-voltage, low-power data transfer between electronics and photonics.

"With the expansion of cloud computing and AI, communication within the data center is quickly becoming the bottleneck to continued growth in the sector," says Frank Balas, the Emerald Investment Director. "NLM tackles the issue by offering photonic technology that is not only faster and more energy efficient but can be manufactured in standard CMOS fabs. We are thrilled to be working with the team as they bring their modulators to the market."

"NLM's proven innovation and strong early market interest make them uniquely positioned to shape the future of data center communications and deliver transformative growth opportunities. We are excited to support the world-class team at NLM," says Deepthi Madhava, Partner at Oregon Venture Fund.

"NLM is excited to have new and returning investors that believe in our team and the technology we're bringing to the communications industry," stated Brad Booth, NLM's CEO. "Their support will help NLM transition its technology into broad market availability."

This investment is part of NLM's next phase of development to scale and commercialize their technology. Given the market's current high demand for data center enhancement, NLM remains in discussions with further investors to expand the current investment round.

About NLM Photonics

NLM Photonics develops cutting-edge organic electro-optic modulation technology transforming data centers, AI, communications, and quantum computing. We build on photonic platforms to enable higher bandwidth, lower power, and minimal process disruption. Follow us at nlmphotonics.com and on LinkedIn @nlm-photonics.

About Emerald Technology Ventures

Emerald is a globally recognized venture capital firm, founded in 2000, that manages and advises assets of over €1 billion from its offices in Zurich, Toronto, and Singapore. The firm invests in start-ups that tackle big challenges in climate change and sustainability, with four current funds, hundreds of venture transactions, and five third-party investment mandates, including loan guarantees to over 100 start-ups. Bold Ideas. Bright Future. www.emerald.vc

About Oregon Venture Fund

The Oregon Venture Fund (OVF), based in Portland, Oregon, is the most active venture capital firm between Seattle and the Bay Area. Backed by business and technology leaders and dozens of institutional investors, the fund provides capital and support to locally based teams building world-class growth companies regardless of stage or sector. With over $200M in assets under management, OVF invests locally to scale globally. OVF's performance is consistently in the top 25% of all venture funds (2024, Pitchbook).

Contact Information

Theo McGillivray

Communications Director

press-relations@nlmphotonics.com

SOURCE: NLM Photonics