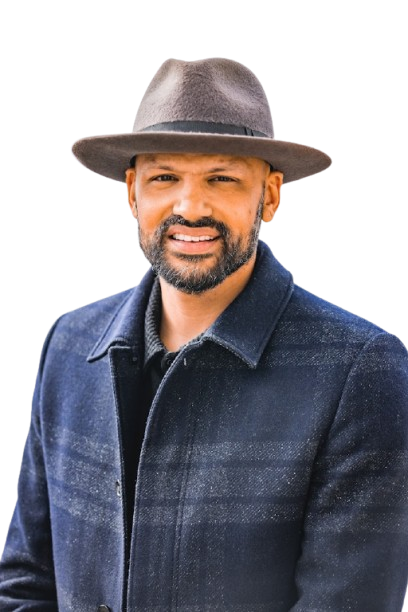

OAKLAND, CALIFORNIA / ACCESS Newswire / January 30, 2025 / CMG Home Loans, the retail division of well-capitalized privately held mortgage lender, CMG Financial, announced today the hire of Area Sales Manager, Brady Thomas (NMLS# 396946). With nearly two decades of experience leading high-performing teams, Thomas has earned a reputation for significantly growing purchase market share in the Oakland, California region.

Thomas launched his career in property management and industrial real estate at Colliers International in 2006. With this initial experience, he made his mark at LaSalle Mortgage Services from 2011-2024, rising through the ranks to become one of LaSalle's top producing loan officers. Thomas then took his loan origination skills to the next level and was promoted to Originating Branch Manager at LaSalle. Throughout his career, Thomas has excelled at helping buyers succeed in competitive markets, guiding them through every detail and providing ongoing support every step of the way. His hands-on approach and customer-first mindset align seamlessly with CMG Home Loans' mission to deliver innovative solutions and an unparalleled client experience.

"I am beyond excited to be joining CMG," said Thomas. "I was blown away by their commitment to making it easier for loan originators to succeed in a crowded and competitive marketplace. This was clear when we looked at their commitment to technology, operational workflows, pricing, and marketing. I also loved that [CMG] is the only lender offering revolutionary products like the All In One Loan and the HomeFundIt program. I know that these will be a huge help to our clients and referral partners."

"Brady will be an incredible asset to our team," added Natalie Overturf, Divisional Vice President. "He's bringing nearly 20 years of experience in the real estate and mortgage industry, a proven track record of ranking in the top 100 nationally in loan volume since 2015, and a passion for helping real estate agents close more deals and grow their businesses. His strategic support, focus on client success, and commitment to giving back to the community make him not only a highly skilled professional but also a dedicated and inspiring teammate."

About CMG

CMG Mortgage, Inc. (NMLS #1820) is a well-capitalized mortgage lender founded in 1993. Founder and CEO, Christopher M. George, was Chairman of the Mortgage Bankers Association in 2019. CMG makes its products and services available to the market through three distinct origination channels including retail lending, wholesale lending, and correspondent lending. CMG currently operates in all states, including District of Columbia, and holds approvals with FNMA, FHLMC, and GNMA. CMG is widely known through the mortgage lender and housing markets for responsible lending practices, industry and consumer advocacy, product innovation, and operational efficiency.

Contact Information

Annaugh Madsen

Senior Copywriter

amadsen@cmgfi.com

(667) 260-6360

SOURCE: CMG Financial