DIEPPE, New Brunswick, March 25, 2025 (GLOBE NEWSWIRE) -- Canadian Gold Resources Ltd. ("Canadian Gold" or the "Company") (TSX.V: CAN), a Canadian exploration company focused on high-grade gold projects in Quebec's Gaspé Gold Belt, is pleased to announce the preliminary interpretation of data from the recently completed airborne magnetic survey at its wholly owned Lac Arsenault Property, located on the Gaspé Peninsula.

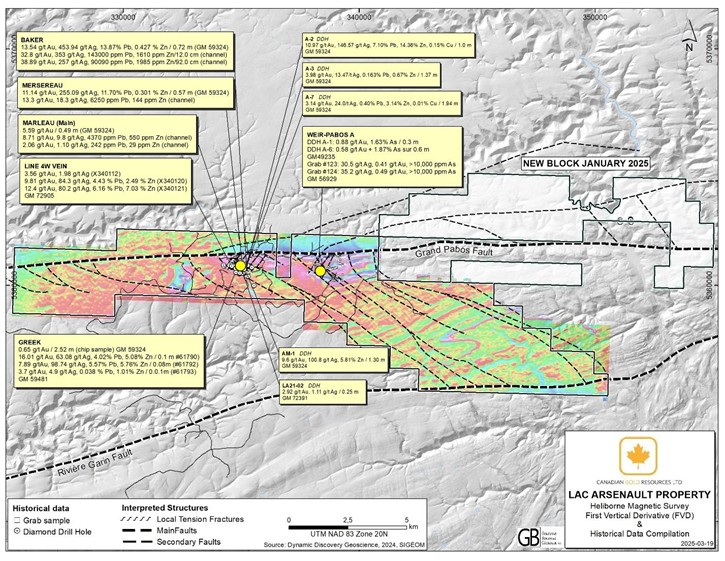

The survey results represent a significant exploration milestone, delivering critical structural insights and advancing the Company's understanding of the mineralized systems along its 34-kilometre land position on the highly prospective Grand Pabos Fault.

"The promising data from Lac Arsenault reinforces the exploration potential along the Grand Pabos Fault system," said Ronald Goguen, Chairman, President & CEO of Canadian Gold. "The identification of clear structural continuity enhances our confidence in the potential for new gold and silver discoveries across our holdings and marks a key advancement in our strategy to unlock value within the Gaspé Gold Belt."

Highlights of the Magnetic Survey:

- Multiple major fault structures identified, including precise delineation of the Grand Pabos Fault and newly recognized splay and secondary structures interpreted to be critical for gold-silver mineralization emplacement.

- Key structures correlate with known historical mineral showings, including the Baker Vein (Au-Ag-Pb) and the Mersereau Vein (Au-Ag-Pb), significantly enhancing the prioritization of future drill targets.

- Improved structural understanding supports regional continuity of mineralized systems across the Company's land holdings, including the Robidoux and VG Boulder properties.

Figure 1. First Vertical Derivative data (FVD) magnetic data with interpreted structures.

"The structural patterns emerging from the Lac Arsenault survey closely mirror those observed at Robidoux, suggesting repeating orientations of mineralized features," said Mark Smethurst, P.Geo., Director and Geologist at Canadian Gold. "We've identified multiple through-going fault corridors between the Grand Pabos and Rivière faults, with associated secondary structures similar to those hosting the Baker and Mersereau veins. These findings greatly expand our exploration footprint and guide our next phases of drilling."

The Baker and Mersereau showings are based on historical data filed with Ressources naturelles et Forêts (e.g., report GM59324). While Canadian Gold has not verified these historical results and does not rely on them, the interpreted structural continuity and historical indicators together support the region's high mineral potential. Historical grades are not necessarily indicative of current or future mineral resources.

The Company will continue integrating this geophysical data with field mapping, sampling, and historical datasets to further refine drill targets at Lac Arsenault and adjacent projects.

Qualified Person

Mark T. Smethurst, P.Geo., a Director of Canadian Gold Resources and a Qualified Person as defined by National Instrument 43-101, has reviewed and approved the technical content of this news release.

About Canadian Gold Resource Ltd.

Canadian Gold Resources Ltd. (TSXV: CAN) is a Canadian exploration company focused on developing high-grade gold projects in the Gaspé Gold Belt of Quebec. The Company targets under-explored, past-producing properties with significant growth potential, leveraging modern exploration techniques to unlock value. With a team of experienced professionals and a commitment to sustainability and community engagement, Canadian Gold Resources is well-positioned to capitalize on opportunities within this historic and promising gold region. For more information, visit www.cdngold.com.

For further information, please contact:

Ronald Goguen

Chairman, President & CEO

Canadian Gold Resources Ltd.

rongoguen@cdngold.com

506-383-4274

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) has reviewed or accepts responsibility for the adequacy or accuracy of this release.

This news release may contain forward-looking statements including but not limited to comments regarding the timing and content of upcoming work programs, geological interpretations, receipt of property titles, potential mineral recovery processes, etc. Forward-looking statements address future events and conditions and therefore, involve inherent risks and uncertainties. Actual results may differ materially from those currently anticipated in such statements.

A photo accompanying this announcement is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/529d33bd-0a82-4d87-9fb3-99eb4c13eed2