CARMEL, Ind., April 1, 2025 /PRNewswire/ -- Syra Health Corp. (NASDAQ: SYRA) ("Syra Health" or the "Company"), a healthcare technology company dedicated to powering better health through innovative technology products and services, announced today that it has given formal notice to the Nasdaq Stock Market of its intention to voluntarily delist its common stock from the Nasdaq Capital Market.

The Company currently anticipates that it will file with the Securities and Exchange Commission (the "SEC") a Form 25, Notification of Removal of Listing and/or Registration Under Section 12(b) the Exchange Act, relating to the delisting on or about April 11, 2025, with the delisting of its common stock taking effect no earlier than ten days thereafter. As a result, the Company expects that the last trading day of its common stock on the Nasdaq Capital Market will be on or about April 21, 2025.

Following a thorough and extensive evaluation, the Executive Management team and Board of Directors have decided that a delisting is warranted, and a strategic pause will allow for improved focus on strengthening the Company's core fundamentals while reducing the Company's costs associated with a Nasdaq listing. This is a proactive measure in which management believes the Company will be better enabled to enhance operational efficiencies, optimize its financial health, and generate sustainable long-term growth.

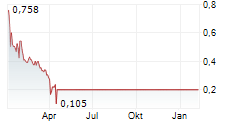

As previously reported, on October 18, 2024, the Company received written notice from the Nasdaq Stock Market, LLC indicating that the bid price for the Company's common stock, for the last 30 consecutive business days, had closed below the minimum $1.00 per share and, as a result, the Company was not in compliance with the $1.00 minimum bid price requirement for the continued listing on the Nasdaq Capital Market, as set forth in Nasdaq Listing Rule 5550(a)(2). In accordance with the Nasdaq Listing Rule 5810(c)(3)(A), the Company had a period of 180 calendar days, or until April 16, 2025, to regain compliance with the minimum bid price requirement.

The Company expects that its common stock will be listed on the OTC market until such time it decides to reapply and receives approval to relist on a national securities exchange. The Company intends to continue providing information to its shareholders and taking actions within its control to facilitate the quoting of its common stock on the OTC market, so that a trading market may continue to exist for its common stock. However, there is no guarantee that a broker will continue to make a market in the common stock or that trading of the common stock will continue on the OTC market or elsewhere.

About Syra Health

Syra Health is a healthcare technology company powering better health in critical areas such as mental health, population health, and the healthcare workforce. The company's leading-edge technology products and innovative services focus on prevention, access, and affordability. With a commitment to improving health, Syra Health is advancing healthcare solutions nationwide and around the world.

Forward-Looking Statements

Statements in this press release about future expectations, plans, and prospects, as well as any other statements regarding matters that are not historical facts, may constitute "forward-looking statements." These statements include but are not limited to, statements relating to the expected use of proceeds, the Company's operations and business strategy, and the Company's expected financial results. The words "anticipate," "believe," "continue," "could," "estimate," "expect," "intend," "may," "plan," "potential," "predict," "project," "should," "target," "will," "would" and similar expressions are intended to identify forward-looking statements, although not all forward-looking statements contain these identifying words. The forward-looking statements contained in this press release are based on management's current expectations and are subject to substantial risks, uncertainty, and changes in circumstances. Investors should read the risk factors set forth in our Form 10-K for the year ended December 31, 2024, and other periodic reports filed with the Securities and Exchange Commission. Any forward-looking statements contained in this press release speak only as of the date hereof, and, except as required by federal securities laws, the Company specifically disclaims any obligation to update any forward-looking statements, whether as a result of new information, future events, or otherwise.

Contacts

For Media Inquiries:

Christine Drury

Director of Corporate Communications

Syra Health

463-345-5180

[email protected]

For Investor Inquiries:

Corbin Woodhull

Managing Director, Global Advisory

Hayden IR

602-476-1821

[email protected]

SOURCE Syra Health