Richmond Hill Resources Plc - Proposed Reverse Takeover and Suspension of Share Trading

PR Newswire

LONDON, United Kingdom, April 10

Richmond Hill Resources Plc

("Richmond Hill " or the "Company")

Proposed Reverse Takeover and Suspension of Share Trading

Richmond Hill (AQSE: SHNJ) is pleased to announce that further to the announcement on 12 March 2025, it has signed a binding term sheet with Three Mile Beach Ltd ("Three Mile") for the Company to acquire the legal and beneficial interest of certain mineral exploration licences in Quebec ("Proposed Transaction").

Proposed Transaction

On or before the completion date of the Proposed Transaction, Bulawayo CC Ventures Ltd ("Bulawayo") (which itself is owned by Three Mile) will be the 100% legal and beneficial owner of the exploration licences, detailed in the announcement of 12 March 2025. Richmond Hill proposes to acquire the entire issued share capital of Bulawayo from Three Mile.

The consideration payable by Richmond Hill for Bulawayo is expected to be £3,300,000 in aggregate, that will be satisfied in a combination of new ordinary shares in Richmond Hill (Consideration Shares) and cash. The number of Consideration Shares, the price per Consideration Share and the cash amount will be agreed in the Share Purchase Agreement ("SPA").

The Proposed Transaction is conditional on a number of conditions being satisfied or waived on or before 30 June 2025 (the Long Stop Date) including, inter alia:

- Richmond Hill having conducted and being satisfied with legal, technical and financial due diligence on the Exploration Licences, Three Mile and Bulawayo;

- Richmond Hill, Three Mile and Bulawayo entering into the SPA, in an agreed form;

- Bulawayo being the 100% registered holder of the exploration licences; and

- Shareholder approval.

It will also be a condition precedent to completion of the Proposed Transaction that Richmond Hill's entire issued share capital will be admitted to trading on AIM and that an AIM admission document will be published in respect of AIM admission.

Share Trading Suspension

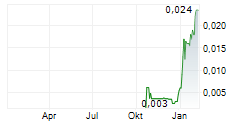

The acquisition is expected to constitute a reverse takeover in accordance with the Aquis Growth Market Access Rulebook. Accordingly, pursuantto Rule 3.6 of the Aquis Growth Market Access Rulebook, trading in the Company's ordinary shares will be suspended from 8.00 a.m. on 10 April 2025. The Company's ordinary shares will remain suspended until such time as either an admission document is published, or an announcement is released confirming that the Proposed Transaction is not proceeding.

This announcement contains inside information for the purposes of the UK Market Abuse Regulation and the Directors of the Company are responsible for the release of this announcement.

The directors of the Company accept responsibility for the contents of this announcement,

For further information, please contact:

The Company

Hamish Harris

hharris@roguebaron.com

AQSE Corporate Adviser and Broker:

Peterhouse Capital Limited

+44 (0) 20 7469 0936

Joint Broker:

Clear Capital Limited

Bob Roberts +44 (0) 20 3869 6080

Forward Looking Statements

This announcement contains forward-looking statements relating to expected or anticipated future events and anticipated results that are forward-looking in nature and, as a result, are subject to certain risks and uncertainties, such as general economic, market and business conditions, competition for qualified staff, the regulatory process and actions, technical issues, new legislation, uncertainties resulting from potential delays or changes in plans, uncertainties resulting from working in a new political jurisdiction, uncertainties regarding the results of exploration, uncertainties regarding the timing and granting of prospecting rights, uncertainties regarding the Company's ability to execute and implement future plans, and the occurrence of unexpected events. Actual results achieved may vary from the information provided herein as a result of numerous known and unknown risks and uncertainties and other factors.