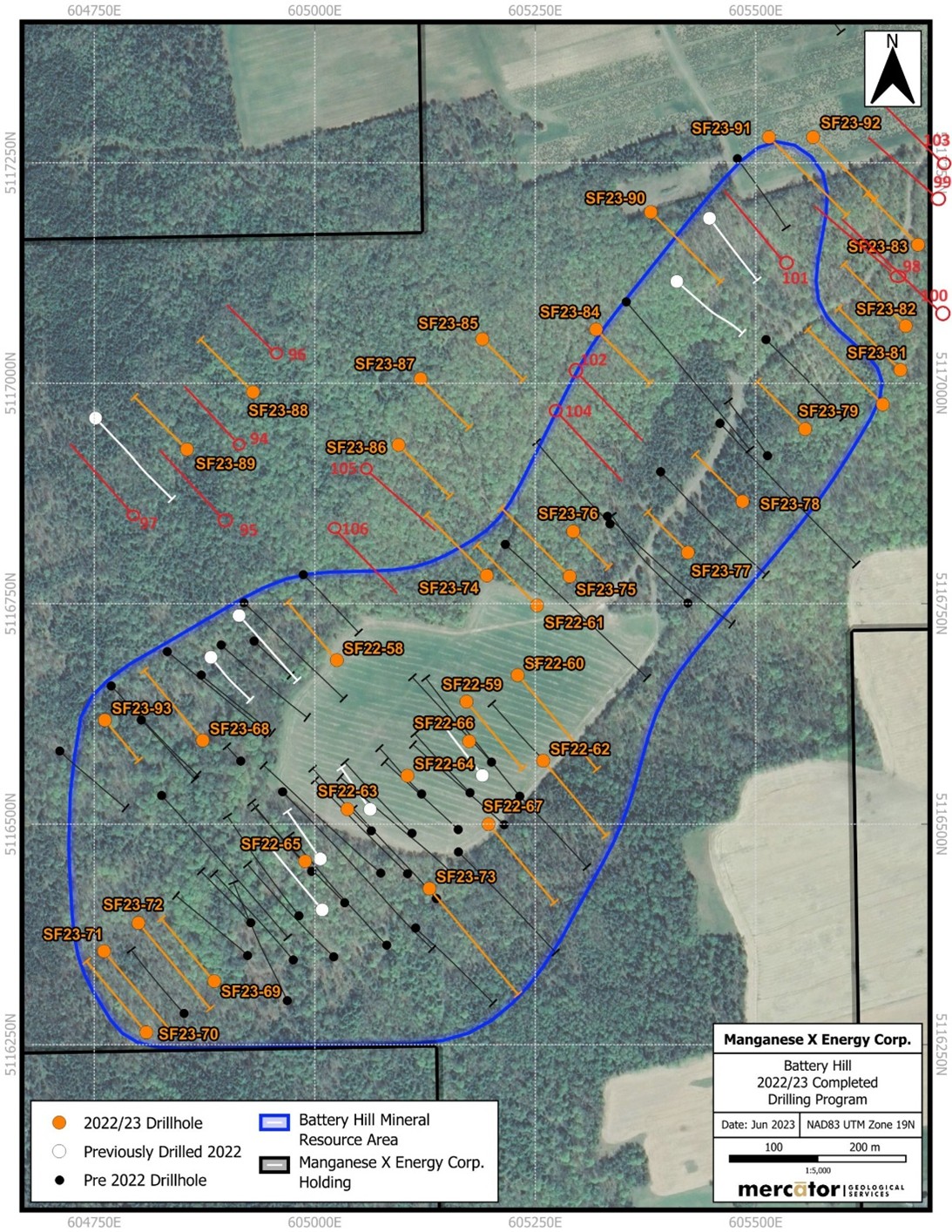

ROUYN-NORANDA, Quebec, April 10, 2025 (GLOBE NEWSWIRE) -- GLOBEX MINING ENTERPRISES INC. (GMX - Toronto Stock Exchange, G1MN - Frankfurt, Stuttgart, Berlin, Munich, Tradegate, Lang & Schwarz, LS Exchange, TTMzero, Düsseldorf and Quotrix Düsseldorf Stock Exchanges and GLBXF - OTCQX International in the US) is pleased to update shareholders as regards drill results reported by Manganese X Energy Corp. (MN-TSXV, 9SC-FSE, MNXXF-OTCQB) on Globex's 1% Gross Metal Royalty, Battery Hill manganese property in New Brunswick. Globex also is a very large shareholder in Electric Royalties (ELEC-TSXV) that holds a 2% Gross Metal Royalty as the property. Manganese X has reported 12 new drill holes totalling 1,393 metres in the Moody Hill and Sharpe Farm sectors of the property which are in addition to the 93 previous drill holes. Intersections up to 72.6 metres (238 feet) are reported.

Key Highlights

- SF24-96: 12.5m @ 13.62% MnO from 41.5m and 13.3m @ 14.9% MnO

- SF24-98: 72.6m @ 11.29% MnO from 11m, including 42.1m @ 13.3% MnO

- SF24-99: 32m @ 15.7% MnO from 5m

- SF24-101: 16m @ 13% MnO from 8m, and 51.5m @ 12.57% MnO from 136m

- SF24-102: 24.2m @ 9.3% MnO from 6.8m, 16.8m @ 10.89% MnO from 53.4m, and 35.6m @ 14.6% MnO from 87.2m

- SF24-103: 32m @ 11.6% MnO from 27m

- SF24-105: 20.2m @ 11.2% MnO from 81m

All drill holes were inclined at -45 degrees, with true thickness estimated at 65-80% of the reported core lengths. Core logging and sampling followed industry-standard protocols, including a QA/QC program with Certified Standards, blanks, and duplicates, comprising 5% of total samples. Sample intervals averaged 2 metres.

Initial half-core samples were collected by Company personnel and sent to the Actlabs prep lab in Fredericton, New Brunswick, before being forwarded to Actlabs in Ancaster, Ontario, for XRF-Fusion Whole Rock Analysis (Code 4C). Actlabs is an accredited laboratory.

Manganese X's news release was reviewed and approved by Perry MacKinnon, P. Geo., Vice President of Exploration for Manganese X, and a Qualified Person under NI 43-101 guidelines for mineral project disclosure.

The holes were focused on infill and expansion drilling to upgrade Inferred resources to Measured and Indicated categories supporting an upcoming NI 43-101 compliant Pre-Feasibility Study currently underway by Mercator Geosciences. The Manganese X Energy Corp. press release is available on the Manganese X website.

Considering the current worldwide economic situation and the need for Canada to source its own critical minerals both for domestic use and export, the Battery Hill manganese deposit is well positioned for the future.

The Manganese X mission as stated "is to advance its Battery Hill project into production, thereby becoming the first public actively traded manganese mining company in Canada and the US to commercialize EV Compliant High Purity Manganese, potentially supplying the North American supply chain. The Company intends on supplying value-added materials to the lithium-ion battery and other alternative energy industries, as well as striving to achieve new carbon-friendly more efficient methodologies, while processing manganese at a lower competitive cost."

Completed Drilling Program - Manganese X Energy Corp.

This press release was written by Jack Stoch, P. Geo., President and CEO of Globex in his capacity as a Qualified Person (Q.P.) under NI 43-101.

| We Seek Safe Harbour. | Foreign Private Issuer 12g3 - 2(b) |

| CUSIP Number 379900 50 9 LEI 529900XYUKGG3LF9PY95 | |

| For further information, contact: | |

| Jack Stoch, P.Geo., Acc.Dir. President & CEO Globex Mining Enterprises Inc. 86, 14th Street Rouyn-Noranda, Quebec Canada J9X 2J1 | Tel.: 819.797.5242 Fax: 819.797.1470 info@globexmining.com www.globexmining.com |

Forward-Looking Statements: Except for historical information, this news release may contain certain "forward-looking statements". These statements may involve a number of known and unknown risks and uncertainties and other factors that may cause the actual results, level of activity and performance to be materially different from the expectations and projections of Globex Mining Enterprises Inc. ("Globex"). No assurance can be given that any events anticipated by the forward-looking information will transpire or occur, or if any of them do so, what benefits Globex will derive therefrom. A more detailed discussion of the risks is available in the "Annual Information Form" filed by Globex on SEDARplus.ca

A photo accompanying this announcement is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/150e1250-2996-4d1c-80ee-18c346772b7c