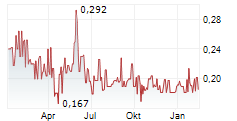

JAKARTA, Indonesia, April 14, 2025 /PRNewswire/ -- PT Bank Rakyat Indonesia (Persero) Tbk. (BRI) (IDX: BBRI) is carrying out a share buyback as a strategic step to support the employee and corporate share ownership program in relation to the sustainability of BRI's long-term performance.

Corporate Secretary of BRI, Agustya Hendy Bernadi, stated that the BRI buyback had received approval from the Annual General Meeting of Shareholders (AGMS) held on March 24, 2025, with a maximum amount of Rp3 trillion.

"The buyback will be done through or outside the Stock Exchange, either in stages or all at once, and must be completed no later than 12 (twelve) months after the date of the AGMS," explained Hendy.

As an initial stage, BRI will conduct the first period of buyback in April 2025 as part of the company's strategy to enhance investor confidence. The step taken by BRI also considers global and domestic macroeconomic conditions, including the effects of new tariff policies announced by the US President's administration and uncertainty over the direction of the benchmark rate policy, namely the Federal Funds Rate (FFR).

Hendy added that the decision for the buyback during this period reflects BRI's strong commitment to safeguarding shareholder interests amid market fluctuations. Furthermore, BBRI's buyback is also carried out in accordance with applicable regulations, including Article 43 of the Financial Services Authority Regulation (POJK) No. 29 of 2023.

"Through this corporate action, the company has carefully considered current liquidity conditions and financial position, ensuring that the buyback implementation will not disrupt BRI's financial health," he stated.

BRI has been conducting buybacks as part of the Employee, and/or Board of Directors and Board of Commissioners Share Ownership Program since 2015. This program is part of the company's efforts to encourage employee engagement toward the sustainability of the company's long-term performance improvement.

"BBRI's buyback is projected to increase the motivation and performance of BRILiaN personnel, enabling optimal achievement of targets and ultimately leading to improved company performance. On the other hand, the implementation of this policy continues to refer to applicable regulations and good corporate governance (GCG) principles," said Hendy.

For more information about BANK BRI, visit www.bri.co.id

Photo - https://mma.prnewswire.com/media/2664126/PT_Bank_Rakyat_Indonesia_Tbk_BRImo.jpg

![]() View original content:https://www.prnewswire.co.uk/news-releases/bri-prepares-rp3-trillion-for-share-buyback-to-sustain-long-term-performance-302427791.html

View original content:https://www.prnewswire.co.uk/news-releases/bri-prepares-rp3-trillion-for-share-buyback-to-sustain-long-term-performance-302427791.html