Yesterday, FWAG released Mar'25 traffic figures marked by mid-single-digit growth, rounding up a sound Q1. In detail:

In March, group passenger numbers rose by 4.1% yoy to 2.99m (eNuW: 2.99m). At VIE, passengers grew only by 0.9% yoy, mainly due the later Easter holiday in April 2025 (vs. end of March in 2024). Consequently, we expect a disproportionately stronger Apr'25, due to the Easter holiday catch up effect. MLA and KSC continued its strong development with 14% yoy and 18% yoy respectively. This amounts to again expanded Q1 group passenger numbers of 7.93m (+4.6% yoy), despite geopolitical uncertainties and higher ticket prices, showing resilient demand for air travel.

VIE passenger mix reverted back to a higher transfer share. The trend of passenger mix moving towards a higher local passenger share in expense of a lower transfer passenger share has reverted back, as expected (see update from 14.02.2025). In Jan'25 (Feb'25), the share of VIE's local passengers has risen by 1.9pp yoy to 85.7% (2.5pp yoy to 86.6%). In Mar'25 this has fallen to 84.8% in Mar'25 (flat yoy), showing that the seasonal switch ahead of summer has reverted towards a higher transfer passenger share. Mind you, transfer passengers are important for connecting hubs like VIE, as they usually spend more on retail and restaurants than local passengers and contribute twice in terms of passenger fees.

Limited impacts from new US presidency. Following Trump's remarks about a more restrictive visa policy and entry controls, travel to the US from Europe could be burdened. However, North America's market share at VIE stood at only 3%, thus limiting a potential impact on the group. On the other hand, the ongoing uncertainty regarding tariffs and potential trade wars could further burden the economic situation and thus the consumer sentiment. However, as visible in yesterday's traffic figures, air travel remains a high priority of consumers and thus sees robust demand.

Sound Q1 ahead. Following the statutory price increase for airport charges (+4.6% as of Jan'25; c. 40% of sales) coupled with the 4.6% yoy Q1 passenger growth, we expect Q1 sales to expand by 7% yoy to € 224m with a proportionate rise in EBITDA by +7% yoy to € 85m.

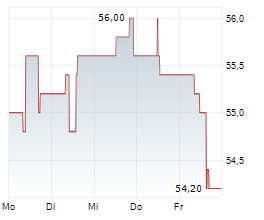

All in all, FWAG remains fairly priced at the moment. Therefore, we reiterate our HOLD recommendation with an unchanged PT of € 60.00, based on DCF.

ISIN: AT00000VIE62