AUSTIN, TX / ACCESS Newswire / April 23, 2025 / In honor of Financial Literacy Month, Dealing With Debt is thrilled to launch its pioneering social platform, built to help individuals reduce financial stress, build confidence, and achieve lasting financial stability. This unique space merges expert guidance, practical tools, and a judgement-free supportive community for users wherever they are on their financial path.

With nearly 70% of Americans experiencing financial anxiety and over one-third facing challenges with debt repayment, this platform emerges as a timely solution in the national dialogue on financial well-being.

"We believe financial literacy is not a transactional experience-it's a lifelong quest," said Addison Wiggin, Board Member. "We've built a platform that not only meets people where they are but evolves with them. Being part of our community means getting the encouragement, clarity, and connection needed to build confidence and achieve lasting stability."

Designed for Everyday Needs

The Dealing With Debt platform features:

Expert-driven financial education, spanning budgeting essentials, employment success, and personal wellness.

Engaging, gamified learning where users earn points, unlock milestones, and redeem rewards like coffee, transit passes, or other essentials.

A judgment-free, anonymous community to safely share experiences, ask questions, and learn from peers.

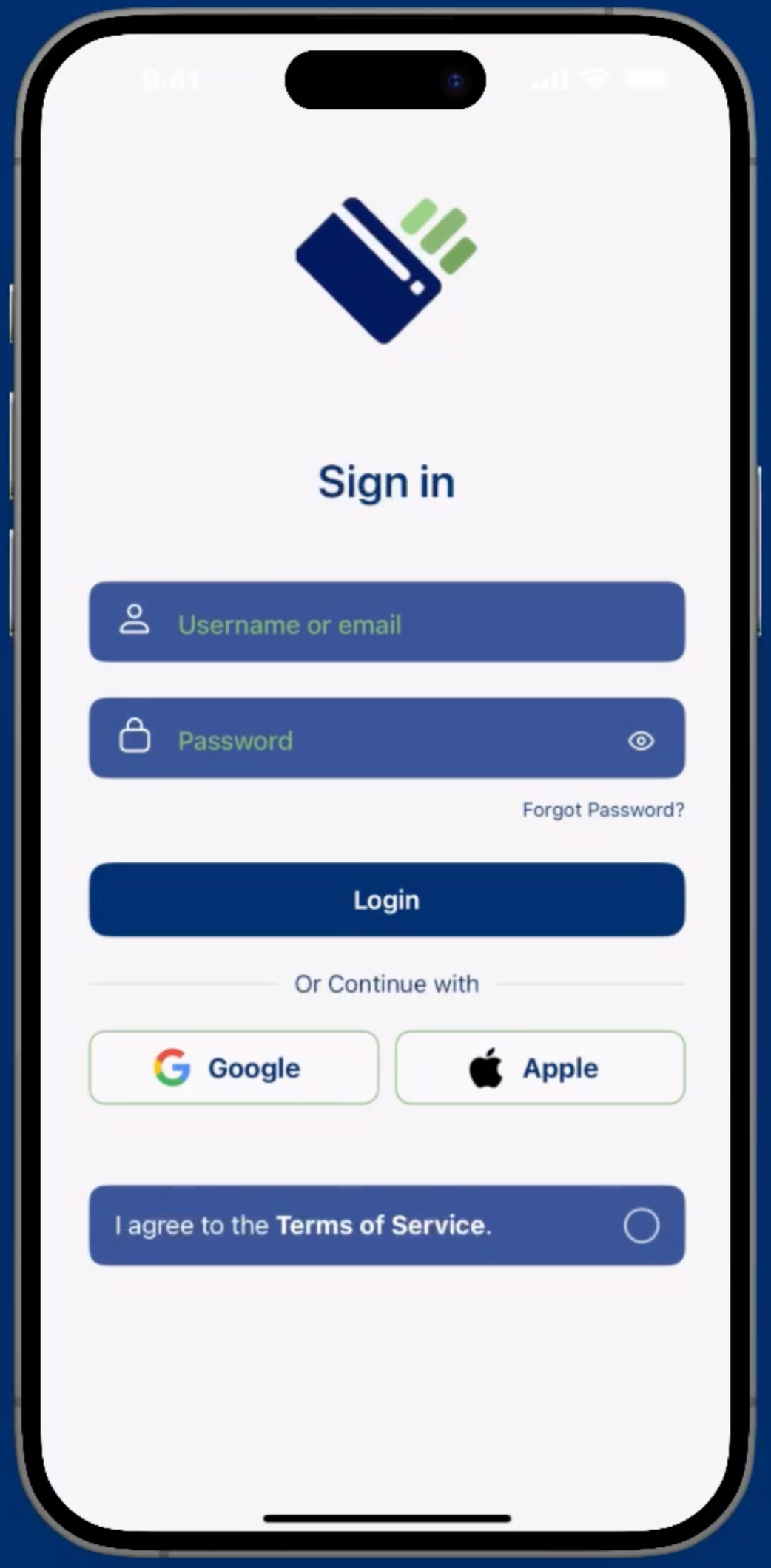

Mobile-optimized access, ensuring anyone can work toward a brighter financial future on their terms.

Beyond financial strain, debt often impacts emotional and physical health. By integrating education, community, and positive incentives, this platform is poised to drive meaningful, lasting changes in financial behaviour at scale.

Early Success Signals Strong Demand

Weeks before its official launch, Dealing With Debt welcomed its first partner and began onboarding community members on March 25, 2025, highlighting the urgent need for accessible, community-focused financial tools.

"The demand for measurable financial wellness solutions is undeniable," said Desmond Stinnie, Chief Innovation Officer. "Our first partnership affirms the value of what we've created, and this is just the beginning."

The organization plans to expand partnerships with educational institutions, businesses, and member-based groups nationwide. The services are free to "literacy students"

Redefining Debt as a Shared Challenge

Financial stress is often endured in isolation, unlike other public health issues. Dealing With Debt repositions debt as a collective, systemic issue that can be tackled through continuous learning, connection, and empathetic support.

"Debt is personal, but it's also a shared experience," Stinnie noted. "Our platform provides the vehicle for sharing and makes financial education approachable and emotionally supportive-qualities that have been largely absent."

Join the Community

The platform is now live at www.dealingwithdebt.org, with fresh content, podcast episodes, and discussion forums added weekly. Whether you're navigating a financial setback or starting to build better money habits, Dealing With Debt provides a welcoming space to learn and grow alongside others.

Media Contact:

Barbara Sanchez

info@dealingwithdebt.org

512-807-0696

SOURCE: Dealing With Debt