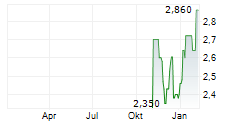

SHANGHAI, April 29, 2025 /PRNewswire/ -- SANY Heavy Industry (SANY) announced its 2024 results on April 19, reporting $10.88 billion in full-year sales and revenue, up 6.22% year-on-year. Net profit attributed to shareholders surged by 31.98% to $0.84 billion. As international revenue accounting for 64% of its core business revenue, the company continues to show its strong overseas growth.

The company reported a core business gross margin of 26.63% in 2024, marking a 0.47pp year-on-year increase. Among which, the hoisting machinery contributed the most to the growth, showing a 4.23pp increase compared to 2023. In 2024, the company's operating cash flow was $2.07 billion, a whopping 159.53% increase, compared with $0.80 billion in 2023.

Solid Core Business and Green Innovation

The earthmoving machinery, concrete machinery, and hoisting machinery contributed 76% of the full-year revenue, reporting $4.25 billion, $2.01 billion, and $1.83 billion accordingly. The road machinery performed strongly, posting a 20.8% year-on-year growth.

Staying committed to decarbonization, SANY continues to promote the development of clean technology. In 2024, the company applied 275 low-carbon patents and the low-carbon products generated $0.56 billion in revenue. In addition, SANY is driving forward the electrification of main machines, core spare parts, and power supply units. In 2024, the company launched over 40 electric products, with the sales exceeding 6,200 units.

International Revenue Hits New High

Prioritizing globalization efforts, SANY established production bases, R&D centers, marketing and service networks, and localized teams, enabling coordinated and efficient operations across all regions.

During 2024, the international core business revenue set a new high of $6.78 billion, an increase of 12.15% compared with $6.06 billion for 2023, and accounting for 64% of the total core business revenue. The company reported the international gross margin of 29.7%. The growth of international markets was primarily driven by the Asia and Australia regions, whose reported revenue was $2.88 billion, a 15.47% year-on-year increase. The African market boasted strong growth with the revenue surging by 44% to $0.75 billion. The Europe and America regions also showed stable growth of 1.86% and 6.64%, contributing $1.72 billion to $1.44 billion respectively.

"I'm proud of our achievements in the challenging yet opportunity-filled 2024. In 2025 we will deepen technological innovation, strengthen risk management, and enhance governance efficiency, contributing our corporate strength to global sustainable development," stated Xiang Wenbo, Chairman of SANY Heavy Industry.

Photo - https://mma.prnewswire.com/media/2675631/20250429153216.jpg

Logo - https://mma.prnewswire.com/media/1518641/logo_Logo.jpg

![]() View original content:https://www.prnewswire.co.uk/news-releases/sany-2024-annual-report-net-profit-up-31-98-international-revenue-accounts-for-64-302441061.html

View original content:https://www.prnewswire.co.uk/news-releases/sany-2024-annual-report-net-profit-up-31-98-international-revenue-accounts-for-64-302441061.html