Facephi Ends 2024 Strong with Double-Digit Growth Across Key Metrics: TCV, ARR, Turnover and Ebitda

- Turnover reached €28.9mm, setting a new high with a 14.8% YoY growth, driven by the launch of new products and services, as well as ongoing diversification into new countries and business verticals.

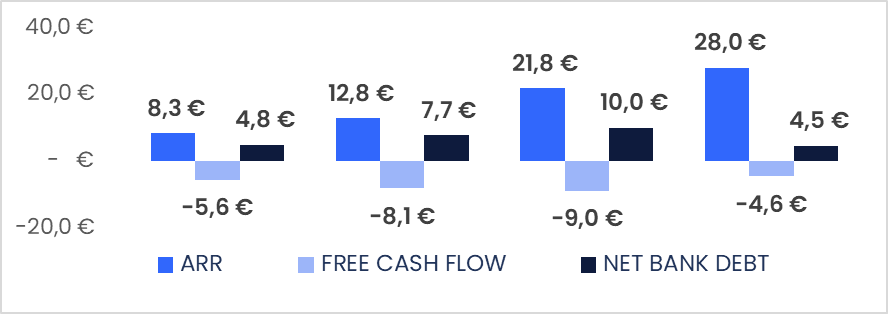

- TCV1 and ARR2 also set new highs, reaching €57.8mm and €28.0mm, respectively, reflecting 49.5% and 28.5% growth compared to 2023; underscoring the Company's positive outlook for 2025 and beyond.

- Normalized Ebitda reached €1.0mm; a favorable increase of 10.4% compared to €0.9mm in 2023.

- Both Cash Flow & Net Financial Debt saw significant improvements versus 2023

- Facephi will host a webcast to discuss earnings on Wednesday, May 7, 2025, at 10:00 CT.

Alicante, April 29th , 2025 - Facephi Biometría, SA (BME Growth: FACE; Euronext Growth Paris: ALPHI) ("Facephi" or the "Company"), a Spanish tech leader in global digital identity protection and verification, announced its audited financial results for fiscal year 2024.

| € million | 2023 | 2024 | Change |

| TCV | 38.6 € | 57.8 € | +49.5% |

| ARR | 21.8 € | 28.0 € | +28.5% |

| NET TURNOVER | 25.1 € | 28.9 € | +14.8% |

| EBITDA NORMALIZED | 0.9 € | 1.0€ | +10.4% |

| CASH FLOW | -9.0 € | -4.6 € | +48.3% |

| NET BANK DEBT3 | 10.0 € | 4.5 € | -55.0% |

| NBD/TURNOVER | 40.0% | 15.6% | -2440 bps |

Javier Mira, CEO of Facephi, commented: "We are incredibly proud of our 2024 performance, which showcases the success of over 12 years of strategic investment in infrastructure, global expansion, and diversification into new services and sectors. These efforts have strengthened our operational and technological foundation, positioning us for accelerated growth and stronger cash flow in 2025 and beyond.

Our confidence in the future is underscored by the impressive evolution in Total Contract Value (TCV) and Annual Recurring Revenue (ARR); which continue to gain momentum and lay a strong foundation for sustained growth.

Key 2024 achievements include the launch of Behavioral Biometrics, Mule Account Detection, and the IDV Suite for identity verification. In addition to strengthening our presence across APAC, EMEA, and LATAM, we also expanded into Iraq, Jordan, Pakistan, Poland, Saudi Arabia, South Africa, and Uganda, while expanding in Canada and the U.S. through strategic partnerships with DIACC4 and STA5.

Furthermore, we increased our reach into key sectors such as gaming, cryptocurrency, hospitality and travel - as highlighted through our partnership with IATA6 to enable fully digital air travel7, and other projects.

With a solid foundation now in place, we remain committed to continuous innovation, sustained growth, and creating long-term value for our stakeholders."

To access the full earnings release, please click here for the English version: Facephi's 2024 FY Earnings, and here for the Spanish version: Facephi - Cuentas Anuales 2024.

The Company will host a webcast to discuss the results on Wednesday, May 7, 2025, at 10:00 a.m. CT. The live webcast will be accessible via Webcast | Facephi's 2024 Full-Year Audited Earnings | Facephi. A replay of the webcast will be made available on the same website shortly after its conclusion.

About Facephi

Facephi is a technology company specializing in the protection and verification of digital identity, renowned for its focus on security and data integrity. Its solutions are designed to create safer, more accessible, and fraud-free processes, prevent identity theft, and ensure the ethical treatment of personal data.

With over a decade of experience in developing technologies aimed at safeguarding digital identity, Facephi is headquartered in Spain, with subsidiaries in APAC, EMEA, and LATAM. The company serves the needs of clients across 25+ countries, delivering innovative solutions that address security challenges in an ever-evolving digital landscape.

1 TCV

5 STA: Home - Secure Technology Alliance

6 International Air Transport Association

7 Fully Digital Travel Experience Closer to Reality - IATA