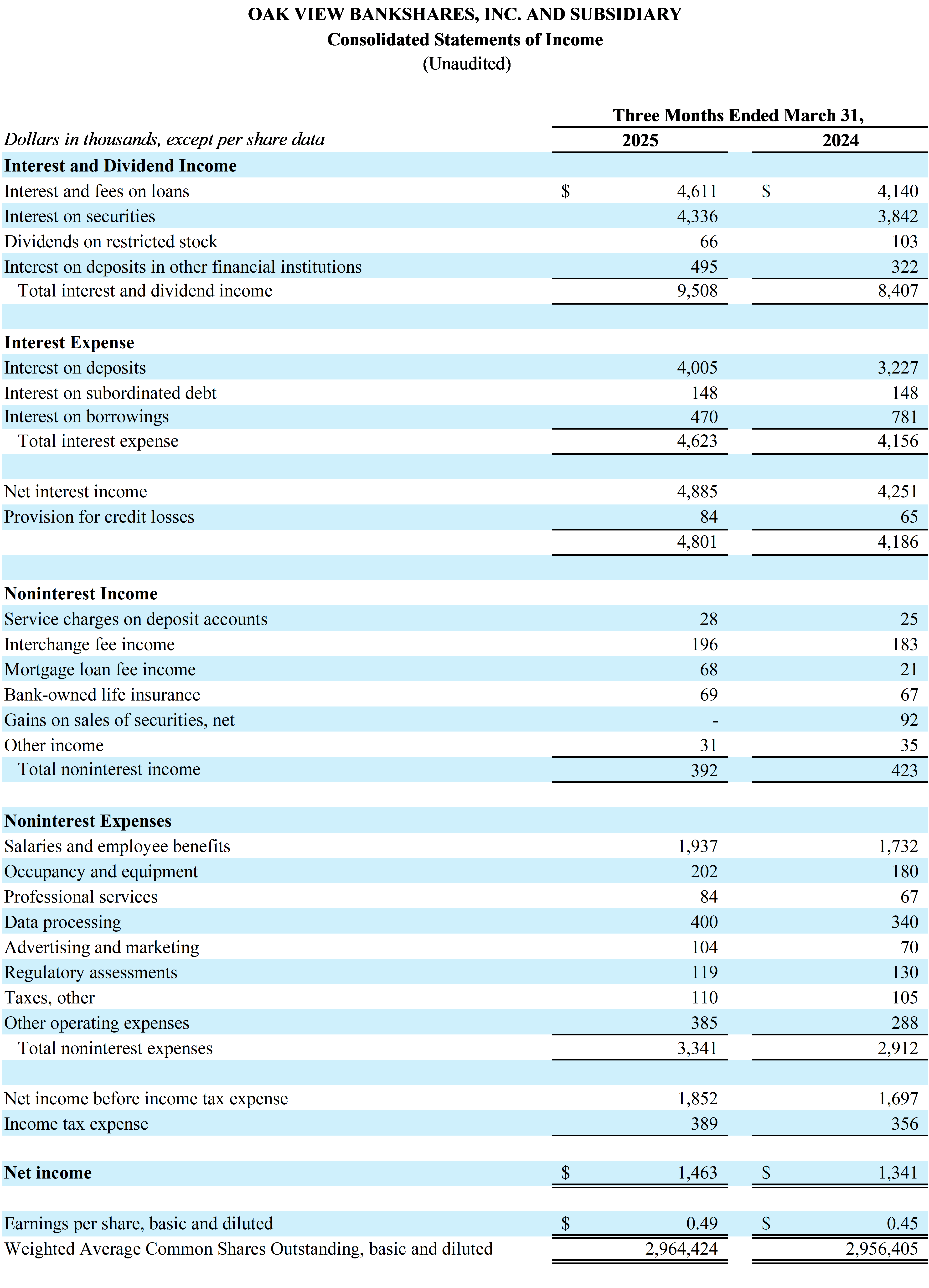

WARRENTON, VA / ACCESS Newswire / May 1, 2025 / Oak View Bankshares, Inc. (the "Company") (OTC PINK:OAKV), parent company of Oak View National Bank (the "Bank"), reported net income of $1.46 million for the quarter ended March 31, 2025, compared to net income of $1.34 million for the quarter ended March 31, 2024, an increase of 9.10%.

Basic and diluted earnings per share for the quarter ended March 31, 2025, were $0.49 compared to $0.45 for the quarter ended March 31, 2024.

"Despite persistent market volatility, our exceptional team continues to win market share, produce compelling returns, and create durable franchise value. Your Company's strong financial performance reflects our unwavering commitment to striking the optimal balance among safety and soundness, profitability, and growth," said Michael Ewing, CEO and Chairman of the Board. Mr. Ewing continued, "In April, we achieved two milestones. First, we opportunistically raised $7.82 million of common equity in a private placement. Second, we relocated our Warrenton offices to a newly constructed state-of-the-art financial services center. Together, the offensive capital issuance and the newly constructed financial services center fortify our foundation for organic growth within the markets we are so privileged to serve. These accomplishments are massive votes of confidence in our future."

Selected Highlights:

On April 2, 2025, the Company announced the completion of a private placement of 558,227 shares of common stock at a price of $14.00 per share. Gross proceeds from the private placement totaled $7.82 million, which will be used for general corporate purposes.

Return on average assets was 0.84% and return on average equity was 15.30% for the quarter ended March 31, 2025, compared to 0.89% and 16.51%, respectively, for the quarter ended March 31, 2024.

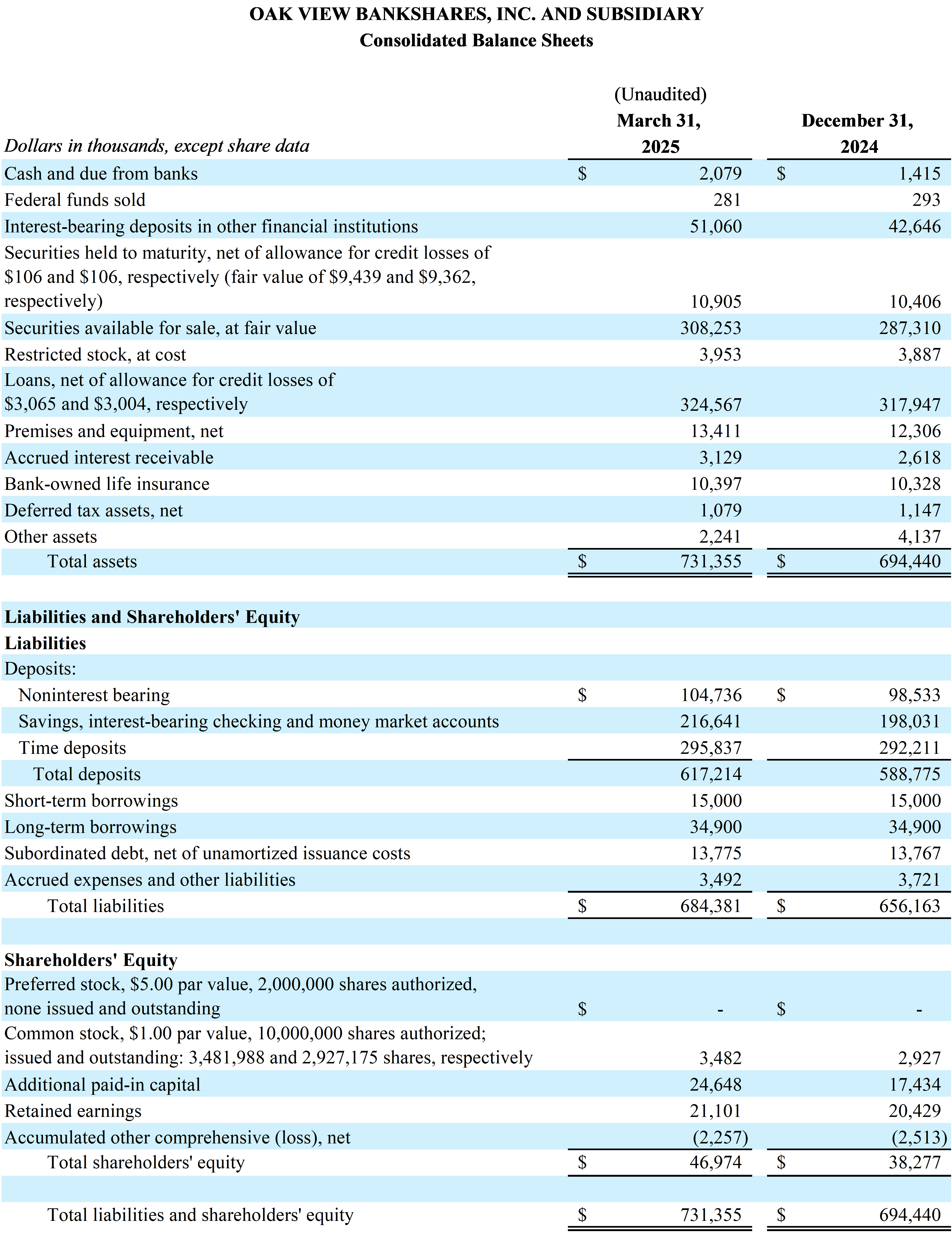

Total assets were $731.36 million on March 31, 2025, compared to $694.44 million on December 31, 2024, an increase of $36.92 million.

Total loans were $327.63 million on March 31, 2025, compared to $320.95 million on December 31, 2024, an increase of $6.68 million. Much of this increase was within the residential real estate portfolio.

The total amortized cost of debt securities was $319.26 million on March 31, 2025, compared to $297.82 million on December 31, 2024, an increase of $21.44 million.

Total deposits were $617.21 million on March 31, 2025, compared to $588.78 million on December 31, 2024, an increase of $28.44 million. Savings, interest-bearing checking and money market accounts represent much of this growth.

As of March 31, 2025, asset quality continues to be outstanding. Net charged-off loans were 0.004% of total loans, there were no nonaccrual loans, and no loans past due 90 days or more. There were three accruing loans past due 30-89 days and represented 0.01% of total loans. As of December 31, 2024, net charged-off loans were 0.004% of total loans, there were no nonaccrual loans, accruing loans past due 30-89 days were 0.015% of total loans, and there was one accruing loan past due 90 days or more was 0.005% of total loans.

Liquidity remains strong with cash, unencumbered securities available for sale, and available secured and unsecured borrowing capacity totaling $414.82 million as of March 31, 2025, compared to $384.81 million as of December 31, 2024.

Regulatory capital remains strong with the Bank's ratios exceeding the "well capitalized" thresholds in all categories, with total capital ratio at 16.54%, common equity tier 1 capital ratio at 15.60%, tier 1 capital ratio at 15.60% and leverage ratio at 7.75%.

Net Interest Income

The net interest margin was 2.91% for the quarter ended March 31, 2025, compared to 2.90% for the quarter ended March 31, 2024. Net interest income was $4.89 million for the quarter ended March 31, 2025, compared to $4.25 million for the quarter ended March 31, 2024. Average earning assets and the related yield were $682.02 million and 5.66%, respectively, for the quarter ended March 31, 2025, compared to $592.01 million and 5.72%, respectively, for the quarter ended March 31, 2024. Average interest-bearing liabilities, and the related cost of funds, which includes average noninterest bearing deposits, were $662.76 million and 2.82%, respectively, for the quarter ended March 31, 2025, compared to $571.94 million and 2.92%, respectively, for the quarter ended March 31, 2024.

Noninterest Income

Noninterest income was $392 thousand and $423 thousand for the quarters ended March 31, 2025, and 2024, respectively, a decrease of 7.33%. The decline is primarily attributed to no net gains from the sales of available for sale securities for the quarter ended March 31, 2025, compared to $92 thousand for the quarter ended March 31, 2024.

Noninterest Expense

Noninterest expenses were $3.34 million and $2.91 million for the quarters ended March 31, 2025, and 2024, respectively, an increase of 14.73%. Net noninterest margin, which is defined as noninterest income less noninterest expense to average assets, was 1.70% and 1.64% for the quarters ended March 31, 2025, and 2024, respectively. This increase is primarily the result of the increase in full-time equivalent employees as well as the increased level of salaries and employee benefits. Management has consistently exercised robust expense control oversight, even with the Company's growth.

Liquidity

Liquidity remains exceptionally strong with $414.82 million of liquid assets available which included cash, unencumbered securities available for sale, and secured and unsecured borrowing capacity as of March 31, 2025, compared to $384.81 million as of March 31, 2024.

The Company's deposits proved to be stable with core deposits, which are defined as total deposits excluding brokered deposits, of $528.95 million as of March 31, 2025, compared to $505.70 million as of December 31, 2024. Uninsured deposits, those deposits that exceed FDIC insurance limits, were $122.31 million as of March 31, 2025, or 19.82% of total deposits, which management believes is within industry averages.

Asset Quality

The allowance for credit losses related to the loan portfolio was $3.07 million as of March 31, 2025, compared to $3.00 million as of December 31, 2024, or 0.94% and 0.94% of total loans outstanding, net of unearned income, respectively.

The provision for credit losses was $84 thousand as of March 31, 2025, compared to $65 thousand as of March 31, 2024. The increase in the provision for credit losses was primarily attributable to the $6.68 million increase in the loan portfolio.

Shareholders' Equity

Shareholders' equity was $46.97 million as of March 31, 2025, compared to $38.28 million as of December 31, 2024. Accumulated other comprehensive loss was $2.26 million as of March 31, 2025, compared to $2.51 million as of December 31, 2024. The unrealized losses reflected therein are primarily related to mark-to-market adjustments on U.S. Treasury bonds within the available for sale securities portfolio, which are the result of changes in market interest rates since they were acquired.

As of March 31, 2025, dividends paid to common shareholders were $0.27 per share compared to $0.20 per share as of March 31, 2024.

About Oak View Bankshares, Inc. and Oak View National Bank

Oak View Bankshares, Inc. is the parent bank holding company for Oak View National Bank, a locally owned and managed community bank serving Fauquier, Culpeper, Rappahannock, and surrounding Counties. For more information about Oak View Bankshares, Inc. and Oak View National Bank, please visit our website at www.oakviewbank.com. Member FDIC.

For additional information, contact Tammy Frazier, Executive Vice President & Chief Financial Officer, Oak View Bankshares, Inc., at 540-359-7155.

Cautionary Note Regarding Forward-Looking Statements

Any statements in this release about expectations, beliefs, plans, objectives, assumptions or future events or performance are not historical facts and are forward-looking statements. These statements are often, but not always, made through the use of words or phrases such as "may," "should," "could," "would," "predict," "potential," "believe," "likely," "expect," "anticipate," "seek," "estimate," "intend," "plan," "project" and similar expressions. Accordingly, these statements involve estimates, assumptions, and uncertainties, and actual results may differ materially from those expressed in such statements. The following factors could cause the Company's actual results to differ materially from those projected in the forward-looking statements made in this document: changes in assumptions underlying the establishment of allowances for credit losses, and other estimates; the risks of changes in interest rates on levels, composition and costs of deposits, loan demand, and the values and liquidity of loan collateral, securities, and interest sensitive assets and liabilities; the effects of future economic, business and market conditions; legislative and regulatory changes, including changes in banking, securities, and tax laws and regulations and their application by our regulators; the Company's ability to maintain adequate liquidity by retaining deposit customers and secondary funding sources, especially if the Company's or banking industry's reputation becomes damaged; computer systems and infrastructure may be vulnerable to attacks by hackers or breached due to employee error, malfeasance, or other disruptions despite security measures implemented by the Company; risks inherent in making loans, such as repayment risks and fluctuating collateral values; governmental monetary and fiscal policies; changes in accounting policies, rules and practices; competition with other banks and financial institutions, and companies outside of the banking industry, including companies that have substantially greater access to capital and other resources; demand, development and acceptance of new products and services; problems with technology utilized by the Company; changing trends in customer profiles and behavior; success of acquisitions and operating initiatives, changes in business strategy or development of plans, and management of growth; reliance on senior management, including the ability to attract and retain key personnel; and inadequate design or circumvention of disclosure controls and procedures or internal controls. These factors could cause actual results or outcomes to differ materially from those expressed in any forward-looking statements made by the Company, and you should not place undue reliance on any such forward-looking statements. Any forward-looking statement speaks only as of the date on which it is made and the Company does not undertake any obligation to update any forward-looking statement or statements to reflect events or circumstances after the date on which such statement is made or to reflect the occurrence of unanticipated events. New factors emerge from time to time, and it is not possible for the Company to predict which will arise. In addition, the Company cannot assess the impact of each factor on the Company's business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statements.

SOURCE: Oak View Bankshares, Inc.

View the original press release on ACCESS Newswire:

https://www.accessnewswire.com/newsroom/en/banking-and-financial-services/oak-view-bankshares-inc.-announces-first-quarter-earnings-1022574