All amounts in Canadian dollars unless otherwise stated

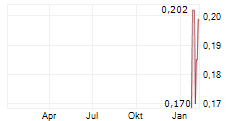

VANCOUVER, BC / ACCESS Newswire / May 2, 2025 / RE Royalties Ltd. (TSXV:RE)(OTCQX:RROYF) (" RE Royalties " or the " Company "), a global leader in renewable energy royalty-based financing, is pleased to announce the financial results for the year ended December 31, 2024 (" FY2024 "). For further information on these results please see the Company's Consolidated Financial Statements (the "Financial Statements") and Management's Discussion and Analysis for FY2024, filed on SEDAR+ at www.sedarplus.com .

"FY2024 was a transitionary year for the Company, as we added new operating battery and solar assets in Ontario to the Company's portfolio, along with new loan and royalty investments from returning clients" said Bernard Tan, CEO. "These new assets provide a strong, stable and recurring cash flow stream to support our objective of creating long term cash flows for our investors. While certain clients encountered delays in their refinancing plans, we also had a number of clients who successfully refinanced our loans early, which allowed us to reinvest into new opportunities. We continue to actively work with those clients' encountering delays and are optimistic in their ability to complete their financing plans."

"For the current fiscal year, we have entered into a letter of intent with an existing client for an acquisition loan which will allow us to be substantially fully invested. This investment is expected to further increase our revenues, income and cash flow for the current fiscal year and is anticipated to close sometime in the second quarter of this year."

Key business highlights for FY2024 include:

In January 2024, the Company entered into an agreement with Clean Communities Corporation, an Alberta-based Indigenous-led clean energy company, to provide a $1.7 Million secured loan (the "CCC Loan") to support the construction of a 4MW solar project ("Sunrise Solar") in Cardston, Alberta. The CCC Loan has a 60-month term and an interest rate of 13% per annum, compounded monthly. The Company will receive a gross revenue royalty of 5.0% on Sunrise Solar for 20 years after reaching commercial operations.

In February 2024, the Company closed a $4.0 Million loan and royalty agreement with Revolve Renewable Power Corp. ("Revolve") to support Revolve's acquisition of a portfolio of two operational run-of-river hydro projects in British Columbia, and one operational wind project in Alberta with a combined gross capacity of 23 MW (the "Operational Projects").The Operational Projects receive revenue from Power Purchase Agreements ("PPAs") with BC Hydro and the City of Medicine Hat, for the hydro projects and the wind project, respectively. The Operational Projects have PPAs with remaining terms ranging from 32-35 years for the hydro projects and 11 years for the wind project. The loan had a term of 36 months and bears interest at the rate of 12% per annum, compounded monthly, and payable semi-annually. The loan was repaid early by Revolve in February 2025. The Company holds a gross revenue royalty of 1.0% on the Operating Projects for the remaining life of the PPAs.

In November 2024, the Company entered into an agreement with a wholly-owned subsidiary of Abraxas Power Corp., an Ontario-based energy transition developer, to provide up to a $10 Million secured loan (the "Abraxas Loan") to support the construction of solar projects in the Maldives. The first tranche of $1.1 Million was advanced for the construction of two rooftop solar projects (the "Projects") with a combined generation capacity of 0.77 MWDC. The Projects are located at a hospital in Malé, the capital of the Maldives, and an island resort, approximately 50km north of Malé. They will generate revenue from PPAs for a term of up to 15 years. The Abraxas Loan has an 18-month term and an interest rate of 13% per annum on advanced funds, compounded monthly. The Company received a gross revenue royalty of 2.0% on the Projects for the term of the PPAs.

In November 2024, the Company entered into an agreement with a wholly-owned subsidiary of SolarBank Corporation, an independent renewable energy project developer and owner, focusing on distributed and community solar projects in Canada and the United States, to support the construction of three 4.99 MW Battery Energy Storage System ("BESS") projects to be located in Ontario, Canada. The BESS have long term contracts with the Ontario Independent Electricity System Operator under the E-LT1 program. The Company provided a secured loan of $3.0 Million with a 12-month term at an interest rate of 11% per annum. The Company also received a 0.40% royalty on the gross revenues generated for the life of the BESS, estimated at 20 years. The royalty rate will be reduced to 0.25% if the loan is repaid within the first six months.

In December 2024, the Company entered into an agreement with Alpin Solar SA, a German-Romanian renewable energy company focused on the development, construction and operation of solar power plants globally. The Company provided a secured loan ("Alpin Loan") to support a $6.3 million letter of credit on behalf of Alpin to meet their security requirement with the Alberta Electricity System Operator for the 200MW Sol Aurora Project located in Sturgeon County, Alberta, Canada. The Alpin Loan carries an annual interest rate of 13% with an initial term of 12 months. The Company will also receive a gross revenue royalty of $0.25 per MWh of energy production from the Sol Aurora Project for the life of the project.

In November 2024, the Company settled the outstanding loans with Switch Power Battery Operating Company ("SPOBOC") and with Switch Power Solar Operating Company ("SPOSOC"). Under the terms of the settlement the Company will retain the shares of SPOBOC and SPOSOC in full and final satisfaction of the outstanding debt. SPOBOC and SPOSOC became a wholly owned subsidiaries of the Company. As of November 1, 2024, the Company owns and operates nine operating battery storage projects totalling 5.3MW/12.3 MWh, and a single operating 428 kWdc rooftop solar project in Ontario, Canada.

In August and November 2024, the Company completed a brokered and non-brokered private placement of Series 4 Green Bonds and issued an aggregate of 5,879 Canadian dollar denominated Green Bonds for aggregate gross proceeds of $5,879,000 and 340 United States dollar denominated Green Bonds for aggregate gross proceeds of US$340,000.

In September 2024, the Company was recognized by the Globe and Mail for the second time as one of Canada's Top Growing Companies. The Company was ranked No. 136 on the 2024 Report on Business magazine's ranking and earned its spot with three-year revenue growth of 314%.

Subsequent to the end of FY2024:

In April 2025, the Company entered into a letter of intent to provide Revolve with a US$8 million secured loan to support Revolve's proposed acquisition of a 95% interest in a 9.6 MW operating wind energy project ("Wind Project") in the United States. The loan will have a term of 24 months and bear interest at 12% on drawn funds, with interest payable on a quarterly basis during the term. The Company will also receive a royalty of 5% on gross revenues generated by the Wind Project for its remaining life. The Wind Project consists of six 1.6 MW wind turbines generating revenue through a PPA with a regional utility. Closing of the loan is expected to occur in Q2 of FY2025 and is subject to several customary closing conditions including the completion of the proposed acquisition.

Key selected financial highlights for FY2024 (compared to the prior year):

| Year ended December 31, |

|

|

|

|

|

|

| ||||||||

| 2024 |

|

| 2023 |

|

| Change ($) |

|

| Change (%) |

| |||||

Royalty revenue |

| $ | 1,468,085 |

|

| $ | 819,388 |

|

| $ | 648,697 |

|

|

| 79 | % |

Finance income |

|

| 6,849,831 |

|

|

| 7,422,413 |

|

|

| (572,582 | ) |

|

| (8 | )% |

Energy revenue |

|

| 269,374 |

|

|

| - |

|

|

| 269,374 |

|

|

| N/A |

|

Gain on royalty buyout |

|

| - |

|

|

| 1,563,783 |

|

|

| (1,563,783 | ) |

|

| N/A |

|

Revenue and income |

| $ | 8,587,290 |

|

| $ | 9,805,584 |

|

| $ | (1,218,294 | ) |

|

| (12 | )% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Adjusted EBITDA 1 |

| $ | 4,449,786 |

|

| $ | 5,699,773 |

|

| $ | (1,249,987 | ) |

|

| (22 | )% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Payment of interest on Green Bonds |

| $ | 3,043,245 |

|

| $ | 2,692,456 |

|

| $ | 350,789 |

|

|

| 13 | % |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Net loss after income tax |

| $ | 9,272,512 |

|

| $ | 1,810,902 |

|

| $ | 7,461,610 |

|

|

| 412 | % |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Cash and cash equivalents, including restricted cash at December 31 |

| $ | 16,547,940 |

|

| $ | 14,439,932 |

|

| $ | 2,108,008 |

|

|

| 15 | % |

Commentary on selected financial results:

Revenue and income for FY2024 was $1.2 million lower than FY2023 due to a one-time gain of $1.6 million on a royalty buyout which occurred in the prior year. Royalty revenue was higher in 2024 mainly due to royalties generated based on proceeds from sale of units by NOMAD. Finance income was slightly lower for FY2024 due to the early repayment of loans, the acquisition of SPOBOC and SPOSOC by the Company, and the timing of deployment of funds in new investments. In November 2024, the Company also commenced generating energy revenues SPOBOC battery assets, and SPOSOC solar assets in Ontario (further discussion below).

Adjusted EBITDA for FY2024 was $4.5 million compared to $5.7 million in FY2023. This decrease was due mainly to the one-time gain of $1.6 million on a royalty buyout which occurred in FY2023. Adjusted EBITDA is presented as a supplemental measure of the Company's performance and ability to service its Green Bonds and compliance with its Green Bond covenants. Adjusted EBITDA is used by investors, analysts, rating agencies and other interested parties as a useful tool in measuring and evaluating the ability of companies in the industry to meet debt service obligations. Please see the reconciliation in the accompanying footnote.

Payment of interest on Green Bonds increased in FY2024 mainly due to the issuance of the Series 4 Green Bonds in the second half of FY2024.

Net loss after income tax of $9.3 million in FY2024 increased compared to FY2023, was due mainly to a $4.8 million non-cash non-recurring adjustment for the derecognition of the SPOBOC and SPOSOC loans upon acquisition of those entities by the Company, and a $4.1 million non-cash provision for potential credit losses.

In November 2024, the Company settled the outstanding loans with SPOBOC and with SPOSOC whereby both entities were acquired and became wholly owned subsidiaries of the Company. The Company accounted for this acquisition as a business combination under IFRS 3 Business Combinations ("IFRS 3") and recognized the net identifiable assets and liabilities acquired of $3.8 million for SPOBOC, and $1.2 million for SPOSOC. The difference of $4.8 million between the carrying value of the loans and the acquisition value was recognized as a loss upon derecognition of the secured loans, which loss was mainly attributable to SPOBOC, as the acquisition date value of its net identifiable assets and liabilities recorded in the Financial Statements was significantly lower than the carrying value of the loan receivable from SPOBOC. In accordance with IFRS 3, the acquisition date value of SPOBOC's Battery Energy Storage Systems (BESS), as recorded in the Financial Statements, was completed provisionally; the Company intends to hire an independent appraiser to fair value the asset. As a wholly-owned subsidiary of the Company, management expects that SPOBOC will generate approximately $1.4 to $1.5 million in energy revenues and net cash flows of $1.1 million to $1.2 million for the current fiscal year. SPOBOC has nine energy services contracts with clients with remaining terms ranging from 3.8 to 9.4 years remaining, with options to extend for additional 5 year terms. For SPOSOC, management expects that SPOSOC will generate $0.23 million in energy revenues and net cash flows of $0.19 million for the current fiscal year.

The Company recorded a $0.9 million provision for expected credit loss on the OCEP loan due to revised timing and discounting in the repayment of the loan. Based on management's review of OCEP's expected cash flows and discussions with OCEP, the loan is expected to be fully repaid, along with accrued interest by September 2026, from OCEP's operational cash flows and in accordance with the OCEP loan agreement. Upon repayment, the provision for expected credit loss is expected to reverse.

The Company recorded a $1.3 million provision for expected credit loss on the Delta loan due to delays in repayment. Delta is currently in the process of being acquired by a third party whereby upon completion of the acquisition, the Delta loan will be fully repaid, along with accrued interest, and the royalty and warrants will be bought out. Delta's management has communicated to management they expect this acquisition to be completed during the current fiscal year. Upon repayment, the provision for expected credit loss is expected to reverse.

The Company recorded a $1.9 million provision for the Cleanlight loan due to delays in refinancing by Cleanlight. Cleanlight continues to operate and generate revenues from their distributed solar and battery business in Chile. The Company is currently in active discussion with Cleanlight on providing additional assistance on refinancing and/or modifying the terms of the loan agreement.

RE Royalties continues to actively monitor its loan portfolio on an ongoing basis and engages closely with clients. These proactive measures are designed to minimize the potential for loan defaults.

Conference Call on Monday, May 5, 2025

Management will be hosting a fourth quarter conference call and live webcast to discuss its fourth quarter 2024 results on Monday, May 5, 2025 at 1:30 p.m. PST (4:30 p.m. EST). After opening remarks by management there will be a question-and-answer session. Questions can be submitted in advance to investor@reroyalties.com .

Microsoft Teams

Date: Monday, May 5, 2025

Time: 1:30 p.m. PST (4:30 p.m. EST)

Join the meeting

Meeting ID: 254 346 678 901 8

Passcode: HU6fv3m4

Dial in by phone

+1 778-725-6875"454548153# Canada, Vancouver

Find a local number

Phone conference ID: 454 548 153#

1 Non-GAAP Performance Measures

This document contains presentation of Adjusted Earnings Before Interest, Taxes, Depreciation, and Amortization ("Adjusted EBITDA") as a non-GAAP financial measure. This measure may differ from similar measures used by, and may not be comparable to such measures as reported by, other companies. Adjusted EBITDA is presented as a supplemental measure of the Company's performance and ability to service debt. Adjusted EBITDA is frequently used by certain investors and other interested parties for evaluation of the Company's results and measuring its ability to meet debt service obligations. Adjusted EBITDA eliminates the impact of a number of items that are not considered indicative of ongoing operating performance. Certain items of expense are added and certain items of income are deducted from net income that are not likely to recur or are not indicative of the Company's underlying operating results for the reporting periods presented or for future operating performance.

Adjusted EBITDA has been derived from the Company's financial statements and applied on a consistent basis. This measure is intended to provide additional information, not to replace IFRS Accounting Standards measures, and does not have a standard definition under IFRS Accounting Standards and should not be considered in isolation or as a substitute for measures of performance prepared in accordance with IFRS Accounting Standards.

The tables below reconcile net loss as per the Financial Statements to Adjusted EBITDA:

Net loss after income tax, as presented in the Financial Statements |

| $ | (9,272,512 | ) |

| $ | (1,810,902 | ) |

Adjustments: |

|

|

|

|

|

|

|

|

Finance expenses |

|

| 3,879,572 |

|

|

| 3,432,665 |

|

Income tax expense |

|

| 371,604 |

|

|

| 240,256 |

|

Depletion of royalty interests |

|

| 699,488 |

|

|

| 352,644 |

|

Depreciation and amortization - BESS and solar |

|

| 104,013 |

|

|

| - |

|

Depreciation of right-of-use asset |

|

| 19,478 |

|

|

| 19,478 |

|

Consulting - financing |

|

| 67,156 |

|

|

| 67,960 |

|

Equity-settled share-based payments |

|

| 141,204 |

|

|

| 409,923 |

|

Change in fair value of cash-settled share-based payments |

|

| (2,916 | ) |

|

| (5,296 | ) |

Provision for expected credit loss and loss upon derecognition of secured loans |

|

| 9,076,781 |

|

|

| 4,305,775 |

|

Impairment of royalty interest |

|

| 488,384 |

|

|

| - |

|

Net income attributable to non-controlling interests |

|

| (1,122,468 | ) |

|

| (1,312,730 | ) |

Adjusted EBITDA |

| $ | 4,449,784 |

|

| $ | 5,699,773 |

|

|

|

|

|

|

|

|

|

|

About RE Royalties Ltd.

RE Royalties Ltd. acquires revenue-based royalties from renewable energy facilities and technologies by providing a non-dilutive financing solution to privately held and publicly traded companies in the renewable energy sector. RE Royalties is the first to apply this proven business model to the renewable energy sector. The Company currently owns over 100 royalties on solar, wind, hydro, battery storage, energy efficiency and renewable natural gas projects in Canada, United States, Mexico and Chile. The Company's business objectives are to provide shareholders with a strong growing yield, robust capital protection, high rate of growth through re-investment and a sustainable investment focus.

For further information, please contact:

Investor and Media Contact:

Talia Beckett, Vice President of Communications and Sustainability

T: (778) 374-2000

E: investor@reroyalties.com

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange), nor any other regulatory body or securities exchange platform, accepts responsibility for the adequacy or accuracy of this release.

This news release shall not constitute an offer to sell or the solicitation of an offer to buy the securities in any jurisdiction, nor shall there be any offer or sale of the securities in any jurisdiction in which such offer, solicitation or sale would be unlawful. The securities being offered have not been approved or disapproved by any regulatory authority nor has any such authority passed upon the accuracy or adequacy of the short form base shelf prospectus or the prospectus supplement. The offer and sale of the securities has not been and will not be registered under the United States Securities Act of 1933, as amended (the "U.S. Securities Act") or any state securities laws and may not be offered or sold in the United States or to United States persons absent registration or an applicable exemption from the registration requirements of the U.S. Securities Act and applicable state securities laws.

Forward Looking Statements

This news release includes forward-looking information and forward-looking statements (collectively, "forward-looking information") with respect to the Company and within the meaning of Canadian securities laws. Forward looking information is typically identified by words such as: believe, expect, anticipate, intend, estimate, postulate and similar expressions, or are those, which, by their nature, refer to future events. This information represents predictions and actual events or results may differ materially. Forward-looking information may relate to the Company's future outlook and anticipated events or results and may include statements regarding the Company's financial results, future financial position, expected growth of cash flows, business strategy, budgets, projected costs, projected capital expenditures, taxes, plans, objectives, industry trends and growth opportunities including financing. The reader is referred to the Company's most recent filings on SEDAR as well as other information filed with the OTC Markets for a more complete discussion of all applicable risk factors and their potential effects, copies of which may be accessed through the Company's profile page at www.sedar.com .

SOURCE: RE Royalties Ltd.

View the original press release on ACCESS Newswire:

https://www.accessnewswire.com/newsroom/en/business-and-professional-services/re-royalties-announces-fiscal-2024-year-end-results-and-highligh-1023155