VANCOUVER, BC / ACCESS Newswire / May 5, 2025 / Irving Resources Inc. (CSE:IRV)(OTCQX:IRVRF) ("Irving" or the "Company") is pleased to announce that its first ever shallow angle diamond core hole drilled at its Omui Mining License has encountered a 101.1m wide intercept of silicified rocks grading 1.14 gpt Au, 16.0 gpt Ag and 84% silica. The following is a full breakdown of significant mineralized intervals from this hole:

Hole | From (m) | To (m) | Length (m) | Au (gpt) | Ag (gpt) | AuEq (gpt) | SiO2 (%) |

24OMI-001 | 0.00 | 101.10 | 101.10 | 1.14 | 15.97 | 1.34 | 83.9 |

including | 0.00 | 8.40 | 8.40 | 1.53 | 5.13 | 1.59 | 90.6 |

and | 19.00 | 32.00 | 13.00 | 1.39 | 8.50 | 1.50 | 85.8 |

and | 36.10 | 51.00 | 14.90 | 1.57 | 22.55 | 1.85 | 83.8 |

and | 70.00 | 72.00 | 2.00 | 7.19 | 52.64 | 7.85 | 80.9 |

and | 76.00 | 84.00 | 8.00 | 1.31 | 16.97 | 1.52 | 81.3 |

and | 87.00 | 89.00 | 2.00 | 1.25 | 47.20 | 1.84 | 86.0 |

AuEq = Au + (Ag/80); recovery of both Au and Ag is expected to be +95% as smelter flux

"Given the shallow angle of hole 24OMI-001, the end of this hole is a mere 35m below surface," commented Dr. Quinton Hennigh, director and technical advisor to Irving. "This drill hole provides the first confirmation of extensive gold-rich silicified rocks near-surface at Omui. Although more shallow drilling will soon be conducted in other areas across the property, Irving and earn-in partner, JX Advanced Metals Corporation ("JX"), consider this a very promising start. Having a large volume of near-surface gold-rich silicified rocks at Omui could complement our efforts to develop a silica body at Omu Sinter, just a few kilometres away. We are seeing a very strong case for a significant precious metal-rich smelter flux production centre at the Omu gold project."

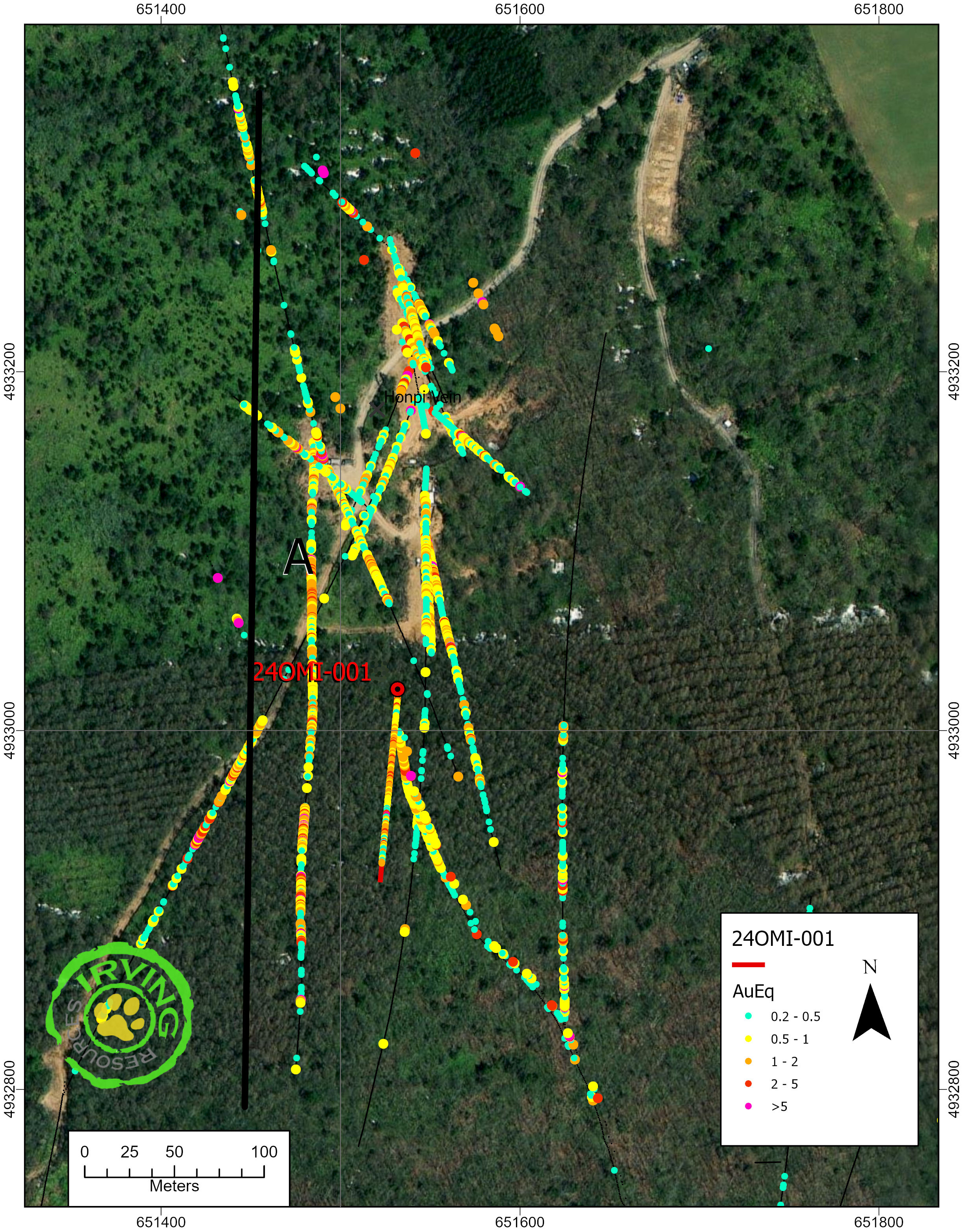

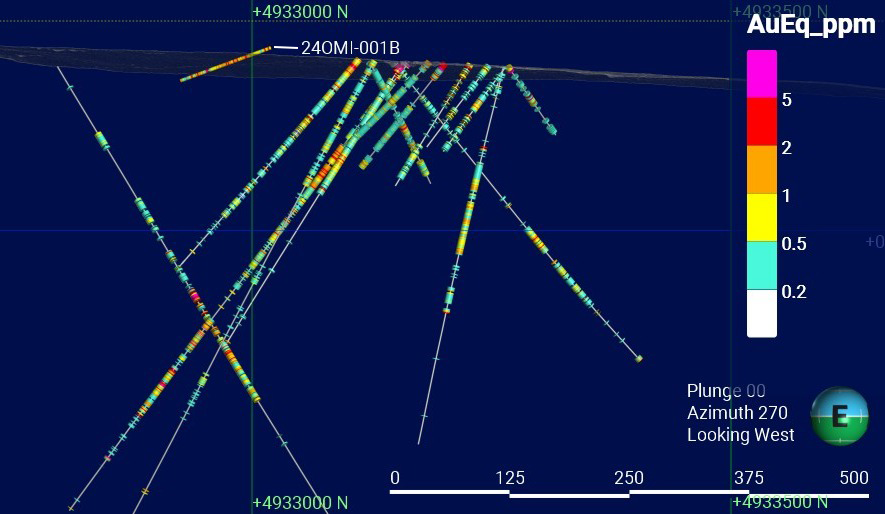

Figure 1 shows the location of hole 24OMI-001 and Figure 2 illustrates its cross-sectional position with respect to historic drill holes completed by Irving at Omui between 2019 and 2023. Hole 24OMI-001 encountered a 101.1m-wide intercept of silicified rocks grading 1.14 gpt Au, 16.0 gpt Ag and 84% silica. There are no other holes in the immediate area of 24OMI-001 at this time. Based upon the pervasive nature of silicification observed in this interval, Irving believes there could be significant potential to find larger volumes of gold-rich silica in this area.

In November 2024, Irving signed an option agreement with JX over select areas at the Omu gold project. Current work is focused on the vision to make Omu into a new source of gold-bearing silica smelter flux. During 2025, JX and Irving plan to drill an additional four such holes testing more parts of Omui for shallow silicification and veins. Drilling is expected to commence in late May. Assuming the outcome of the next four holes is favourable, Irving and JX plan to advance Omui alongside the Omu Sinter project to evaluate the potential for creating a new domestic Au-rich smelter flux production centre that is capable of providing significant quantities of silica flux to numerous base metal smelters scattered across Japan.

Yamagano JV Update

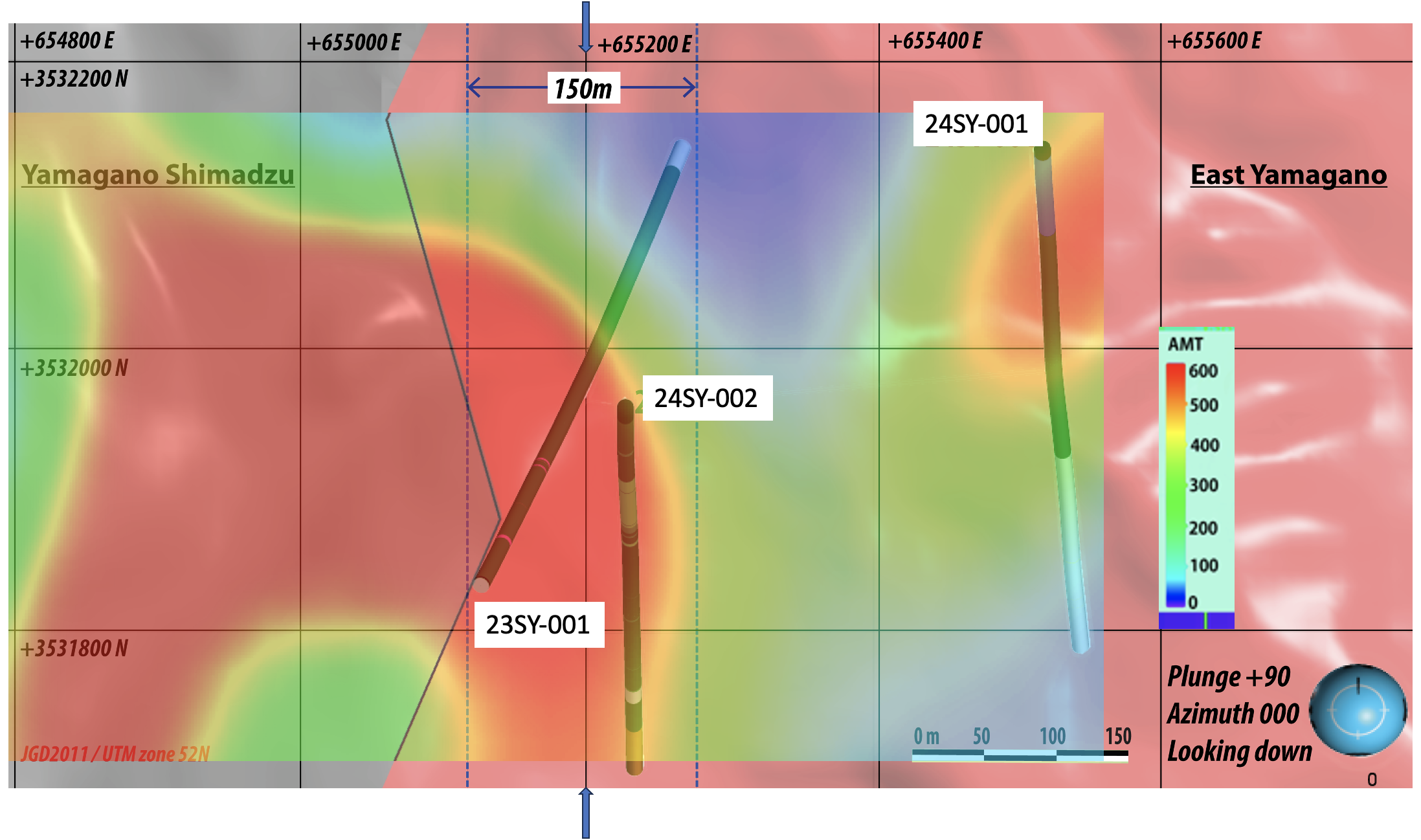

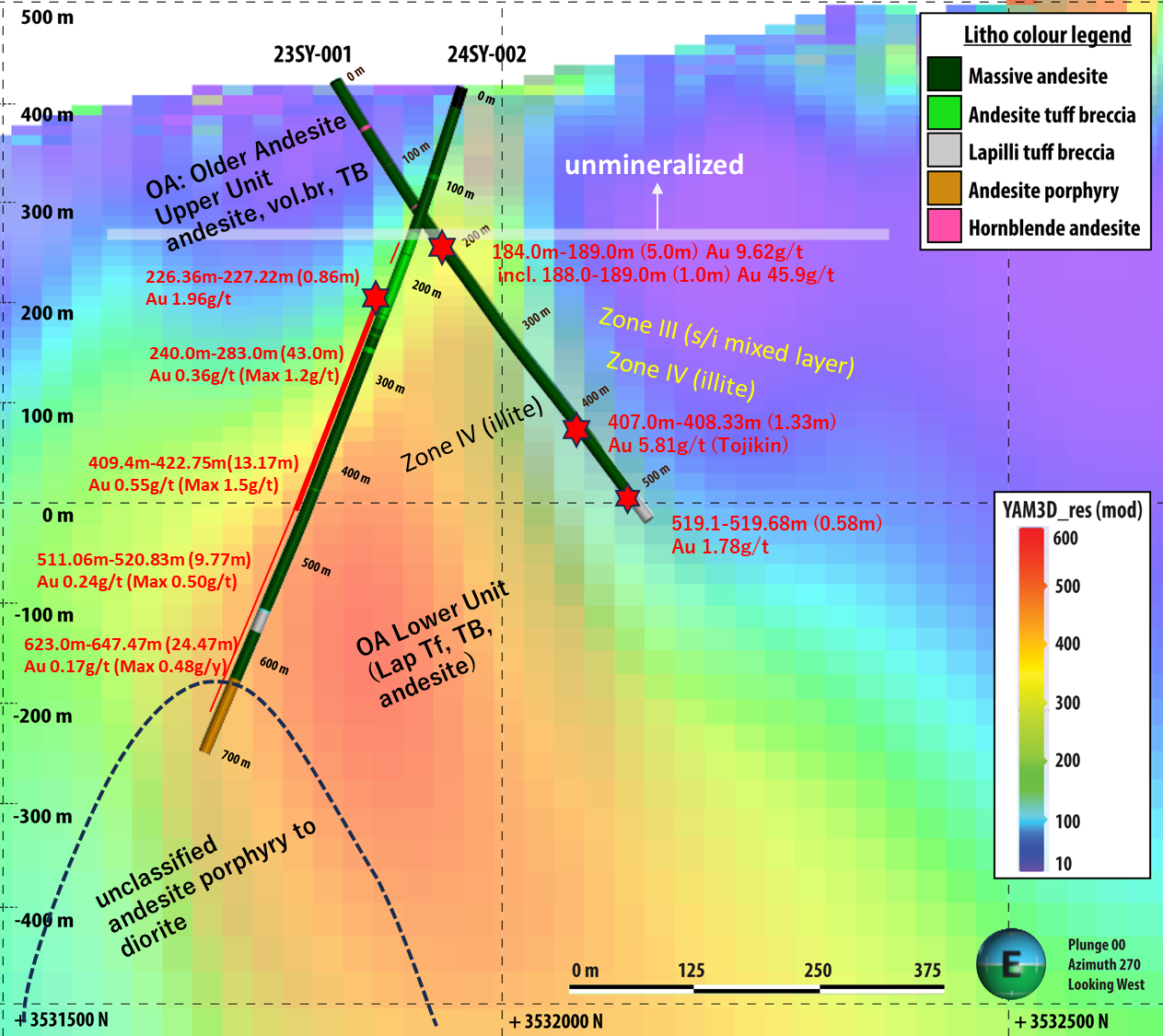

In the fourth quarter of 2024, Irving initiated drilling of its third diamond drill hole at East Yamagano, 24SY-002, a south-oriented 702.1m deep drill hole inclined at -70 degrees designed to test a steeply oriented electrically resistive zone evident in AMT data (Figures 3 and 4). This hole was completed in the middle of February 2025. Figure 3 shows a plan view of the drill trace of hole 24SY-002 and Figure 4 shows a sectional view of this hole overlain on AMT resistivity data. It is evident that 24SY-002 paralleled the southern margin of the targeted resistive zone. Although this hole did not encounter any high-grade veins, several broad zones of silicification and anomalous levels of gold, generally ranging between 0.1 and 1 gpt Au, were intersected between 226-278m, 292-314m, 409-442m and 623-648m. The highest-grade individual vein that was intersected ran 1.90 gpt Au over 0.86m starting at 226.36m.

Results from 24SY-002 are notably lower grade than those encountered in nearby hole 23SY-001, a north directed drill hole that crossed the same resistive feature being tested by 24SY-002. Hole 23SY-001 encountered a stockwork vein zone grading 9.6 gpt Au over 5.0m that is positioned inside the resistive feature. Irving believes that further drilling across this resistive zone is warranted to better ascertain the orientation of the high-grade vein encountered in hole 23SY-001.

Four weeks ago, Irving commenced drilling hole 25SY-001, a -82 degree southerly inclined hole collared approximately 350m northeast of 24SY-002. Similar to the latter hole, this hole tests a similar steeply dipping resistive zone. It is currently at a depth of approximately 660m and is targeting a final depth of 800m. It is anticipated that two drill holes will be completed by mid-2025. Permitting of at least another six holes is currently underway which are expected to be drilled after mid-year, pending approvals.

East Yamagano is a joint venture between Newmont Overseas Exploration Limited ("Newmont"), a wholly-owned subsidiary of Newmont Corporation, Sumitomo Corporation ("Sumitomo") and Irving. The initial interests of the parties in the joint venture are Newmont, 60%, Sumitomo, 12.5%, and Irving, 27.5%.

All samples discussed in this news release are ½ split sawn diamond core samples. Irving submitted samples to ALS Global, Australia, for analysis. Au and Ag were analyzed by fire assay with AA finish. Overlimit samples were assayed by fire assay with gravimetric finish. Multielements were analyzed by mass spectrometry following four acid digestion. Irving routinely inserts standard and blank samples in assay batches submitted to the laboratory. Company staff are responsible for geologic logging and sampling of core. Au equivalent is calculated by adding Au (gpt) to Ag (gpt)/80. Results referred to in this news release are not necessarily representative of mineralization throughout each respective project.

Quinton Hennigh (Ph.D., P.Geo.) is the qualified person pursuant to National Instrument 43-101 Standards of Disclosure for Mineral Projects responsible for, and having reviewed and approved, the technical information contained in this news release. Dr. Hennigh is a technical advisor and a director of Irving and has verified the data disclosed including sampling, through review of photographs of core prior to and after sawing and sampling, and analytical, through review of standard and blank analyses.

About Irving:

Irving is a junior exploration company with a focus on gold in Japan. Irving resulted from completion of a plan of arrangement involving Irving, Gold Canyon Resources Inc. and First Mining Finance Corp. Additional information can be found on the Company's website: www.IRVresources.com.

Akiko Levinson,

President, CEO & Director

For further information, please contact:

Tel: (604) 682-3234 Toll free: 1 (888) 242-3234 Fax: (604) 971-0209

info@IRVresources.com

Forward-looking information

Some statements in this news release may contain forward-looking information within the meaning of Canadian securities legislation including, without limitation, statements as to planned exploration activities. Forward-looking statements address future events and conditions and, as such, involve known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by the statements. Such factors include, without limitation, customary risks of the mineral resource exploration industry, the funding of planned drilling and other exploration activities, as well as the performance of services by third parties.

THE CSE HAS NOT REVIEWED AND DOES NOT ACCEPT RESPONSIBILITY FOR THE ACCURACY OR ADEQUACY OF THIS RELEASE

(Figure 1: Plan view showing traces of drill holes and AuEq values at Omui. Hole 24OMI-001 is labeled in red. The section line presented in Figure 2 is shown by a white line with an arrow indicating the orientation of the view.)

(Figure 2: Cross sectional view of drill holes at Omui looking west. Note that hole 24OMI-001 is shallow and tests an area with no prior drilling. Irving considers the results from this hole a strong indication of much more extensive gold-rich silicified rock in the near-surface environment.)

(Figure 3: Plan view of drill holes 23SY-001 and 24SY-002 at East Yamagano with AMT resistivity data in colors as a backdrop. The section line for Figure 4 is highlighted with blue arrows.)

(Figure 4: Cross sectional view of drill holes 23SY-001 and 24SY-002 looking west. AMT resistivity data is the coloured backdrop. Hole 24SY-002 followed the southern margin of a steeply dipping resistive feature encountering broad zones of low-grade gold over much of the length of the hole. Above the white line, rocks are generally fresh and unmineralized.)

SOURCE: Irving Resources Inc

View the original press release on ACCESS Newswire:

https://www.accessnewswire.com/newsroom/en/metals-and-mining/irving-encounters-broad-shallow-interval-of-gold-rich-silica-at-omui-and-updates-1023395