NOT FOR DISSEMINATION IN THE UNITED STATES OR FOR DISTRIBUTION TO U.S. NEWSWIRE SERVICES

HALIFAX, Nova Scotia, May 08, 2025 (GLOBE NEWSWIRE) -- NOVA LEAP HEALTH CORP. (TSXV: NLH) ("Nova Leap" or "the Company"), a growing home health care organization, is pleased to announce the release of financial results for the quarter ended March 31, 2025. All amounts are in United States dollars unless otherwise specified.

Nova Leap Q1 2025 Financial Results

Financial results for the first quarter ended March 31, 2025 include the following:

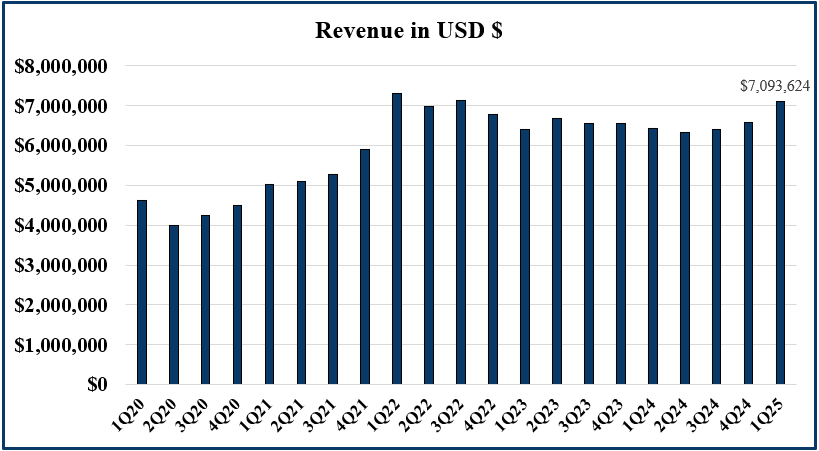

- Q1 2025 revenues of $7,093,624 increased by 7.7% relative to Q4 2024 revenues of $6,585,825 and 10.3% relative to Q1 2024 revenues of $6,429,721.

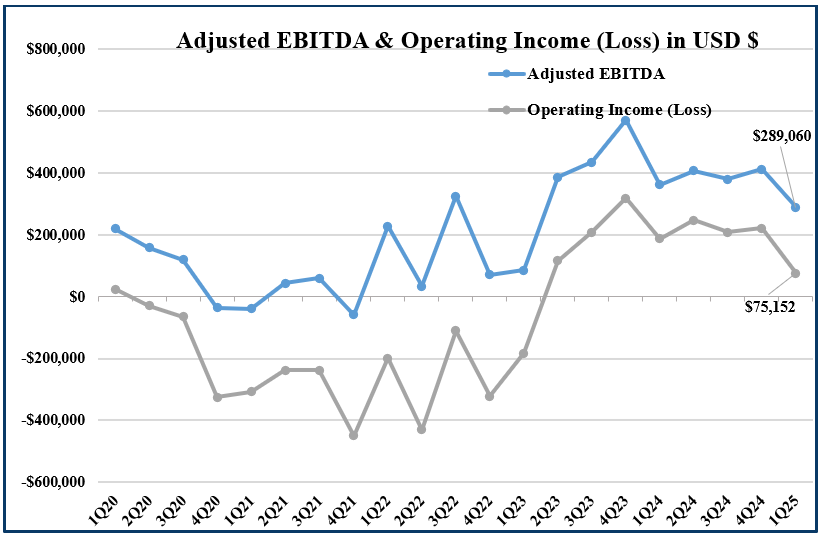

- Q1 2025 Adjusted EBITDA of $289,060 was a decrease of 30.0% over Q4 2024 Adjusted EBITDA of $412,947 and 20.1% over Q1 2024 Adjusted EBITDA of $361,802 (see calculation of Adjusted EBITDA below).

- Gross profit margin as a percentage of revenues remained strong at 39.0% in Q1 2025. Gross profit margin percentage was 39.1% in Q4 2024 and 38.0% in Q1 2024

- The Company generated income from operating activities in Q1 2025 of $75,152, a decrease of $111,557 and $146,032 from Q1 2024 and Q4 2024.

- The Company recorded a net loss of $78,299 in Q1 2025 as compared to net income of $473,073 and $886,268 in Q1 2024 and Q4 2024.

- On January 20, 2025, the Company acquired two affiliated home care businesses located in Nova Scotia. The acquisition was for total consideration of CAD$1,380,000, plus working capital adjustments. The acquisition was financed with the proceeds of a non-readvanceable demand loan issued from the company's credit agreement.

- On May 5, 2025, the Company acquired a home care business located in Nova Scotia. The acquisition was for total consideration of CAD$390,000, all of which was paid on closing. The acquisition was financed with cash on hand.

- The Company had available cash of $1,333,115 as of March 31, 2025 as well as full access to the unutilized revolving credit facility of $1,043,406 (CAD$1,500,000).

- The Company had total demand loans and promissory notes outstanding as of March 31, 2025 of $2,526,202, representing a leverage ratio of 1.70 times to Adjusted EBITDA of $1,489,019 for the 12-month period ending March 31, 2025.

- As of the current date, the Company has access of to up to $4,691,000 in available credit through its existing credit agreement to support its long-term growth strategy.

President & CEO's Comments

"During Q1, we were focused on the integration of the recent Florida and Nova Scotia acquisitions as well as further expansion opportunities," said Chris Dobbin, President & CEO of Nova Leap. "Earlier this week, we announced another acquisition in Nova Scotia which follows the one made in January. As a result of these recent acquisitions, Nova Scotia represents the fastest growing segment of our business. Q1 got off to a slower start than what we would have liked. However, we are seeing a positive trend as we move through Q2. We anticipate that Nova Leap will set a record for quarterly revenues in Q2, surpassing the previous quarterly record set in Q1 2022.

In addition to the three acquisitions the Company has made over the past five months, we have been investing significantly in existing operations both in the U.S. and Canada. This is consistent with my comments around Nova Leap's capital allocation plans for 2025 as outlined in my letter to shareholders on March 6, 2025.

In parallel with our M&A strategy, we have also begun organic office expansion with the official opening of a new office in Kentucky earlier this week, building upon our success in the Bluegrass State. While we anticipate setting record quarterly revenues in the near term, we expect Adjusted EBITDA to lag somewhat given all of the investments we have been making. However, we do anticipate that these investments will pay off significantly in the long term."

This news release should be read in conjunction with the Unaudited Condensed Interim Consolidated Financial Statements for the three months ended March 31, 2025 and 2024 including the notes to the financial statements and Management's Discussion and Analysis dated May 8, 2025, which have been filed on SEDAR+.

About Nova Leap

Nova Leap is an acquisitive home health care services company operating in one of the fastest-growing industries in the U.S. & Canada. The Company performs a vital role within the continuum of care with an individual and family centered focus, particularly those requiring dementia care. Nova Leap achieved the #42 ranking on the 2021 Report on Business ranking of Canada's Top Growing Companies, the #2 ranking on the 2020 Report on Business ranking of Canada's Top Growing Companies and the #10 Ranking in the 2019 TSX Venture 50 in the Clean Technology & Life Sciences sector. The Company is geographically diversified with operations in 10 different U.S. states within the New England, Southeastern, South Central and Midwest regions as well as in Nova Scotia, Canada.

NON-IFRS AND OTHER MEASURES:

This release contains references to certain measures that do not have a standardized meaning under IFRS as prescribed by the International Accounting Standards Board ("IASB") and are therefore unlikely to be comparable to similar measures presented by other companies. Rather, these measures are provided as additional information to complement IFRS measures by providing a further understanding of operations from management's perspective. Accordingly, non-IFRS financial measures should not be considered in isolation or as a substitute for analysis of financial information reported under IFRS. The Company presents non-IFRS financial measures, specifically Adjusted EBITDA (as such term is hereinafter defined), as well as supplementary financial measures such as annualized revenue and annualized adjusted EBITDA. The Company believes these non-IFRS financial measures are frequently used by lenders, securities analysts, investors and other interested parties as a measure of financial performance, and it is therefore helpful to provide supplemental measures of operating performance and thus highlight trends that may not otherwise be apparent when relying solely on IFRS financial measures.

Adjusted Earnings before interest, taxes, amortization and depreciation ("Adjusted EBITDA"), is calculated as income from operating activities plus amortization and depreciation and stock-based compensation expense. The most directly comparable IFRS measure is income from operating activities.

The reconciliation of Adjusted EBITDA to the income from operating activities is as follows:

| Q1 2025 $ | Q1 2024 $ | Q4 2024 $ | |

| Income from operating activities | 75,152 | 186,709 | 221,184 |

| Amortization and depreciation | 196,753 | 150,275 | 148,358 |

| Stock-based compensation | 17,155 | 24,818 | 43,405 |

| Adjusted EBITDA | 289,060 | 361,802 | 412,947 |

FORWARD LOOKING INFORMATION:

Certain information in this press release may contain forward-looking statements, such as statements regarding future expansions and cost savings and plans regarding future acquisitions and business growth, including anticipated revenues growth, annualized revenue or annualized recurring revenue run rate growth and anticipated consolidated Adjusted EBITDA margins. This information is based on current expectations and assumptions, including assumptions described elsewhere in this release and those concerning general economic and market conditions, availability of working capital necessary for conducting Nova Leap's operations, availability of desirable acquisition targets and financing to fund such acquisitions, and Nova Leap's ability to integrate its acquired businesses and maintain previously achieved service hour and revenue levels, that are subject to significant risks and uncertainties that are difficult to predict. Actual results might differ materially from results suggested in any forward-looking statements. All forward-looking statements, including any financial outlook or future-oriented financial information, contained in this press release are made as of the date of this release and included for the purpose of providing information about management's current expectations and plans relating to the future, and these statements may not be appropriate for other purposes. The Company assumes no obligation to update the forward-looking statements, or to update the reasons why actual results could differ from those reflected in the forward-looking statements unless and until required by securities laws applicable to the Company. Additional information identifying risks and uncertainties is contained in the Company's filings with the Canadian securities regulators, which filings are available at www.sedarplus.com.

CAUTIONARY STATEMENT:

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Photos accompanying this announcement are available at

https://www.globenewswire.com/NewsRoom/AttachmentNg/dbe96b07-706f-4524-89b1-e09bcf5dfb22

https://www.globenewswire.com/NewsRoom/AttachmentNg/ab18c3af-5161-40b3-9d7b-a746af977964