AB "Ignitis grupe" publishes its First three months 2025 interim report, which is attached to this notice.

Financial performance

Our Adjusted EBITDA for the first three months of 2025 amounted to EUR 188.5 million (+3.7% YoY). The growth was driven by the stronger performance of our two largest segments: Green Capacities and Networks. The Green Capacities segment remained the largest contributor with a 58.0% share of our total Adjusted EBITDA.

In 3M 2025, our Investments amounted to EUR 146.5 million (-30.1% YoY). In total, around half (48.7%) of the Investments were made in the Green Capacities segment, mainly for new solar and onshore wind farms. With several projects reaching COD or nearing completion, total Investments decreased compared to 3M 2024.

Our leverage metrics remained strong. The FFO LTM/Net Debt ratio remained robust with a 0.9 pp decrease to 28.8% (compared to 29.7% as of 31 December 2024).

Business development

Green Capacities: Portfolio increased to 8.4 GW (from 8.0 GW), Secured Capacity stands at 3.1 GW, Installed Capacity at 1.4 GW.

Key milestones:

- finished construction works at Kelme WF I (114.1 MW) in Lithuania; COD reached after the reporting period;

- acquired a hybrid development project (285 MW) in Lithuania, which includes a 200 MW WF, a 65 MW SF and a 20 MW (80 MWh) BESS (Advanced Development Pipeline);

- acquired co-development wind farm projects (204 MW) in Estonia (Early Development Pipeline);

- received the first segments for the new 840 m penstock at Kruonis PSHP expansion project (fifth unit, 110 MW).

Networks: 3.5 EURb (+40%) Investments set in the 10-year (2024-2033) Investment Plan aligned with the regulator (NERC) on 23 January 2025; installed smart meters exceeded 1.1 million.

Reserve Capacities: won a Polish capacity mechanism auction for ensuring 381 MW and 484 MW capacity availability in Q1 and Q4 2026.

Customers & Solutions: 1,286 (+195 since 31 December 2024) EV charging points installed.

Sustainability

Our Green Share of Generation amounted to 60.7% (-19.3 pp YoY) due to proportionally higher electricity generation in CCGT (Reserve Capacities).

In 3M 2025, our total GHG emissions amounted to 1.43 million t CO2-eq (+22.8% YoY). Our Scope 2 emissions decreased by 4.5% YoY due to the use of renewable energy guarantees of origin for energy consumption at Kruonis PSHP. Scope 1 emissions increased by 103.6% YoY as a result of new services provided by Elektrenai Complex, and Scope 3 emissions increased by 13.6% YoY due to higher electricity sales in Poland and an increase in overall gas sales.

Carbon intensity (Scope 1 and 2) emissions amounted to 244 g CO2-eq/kWh (+20.9% YoY), primarily due to the new services provided by Elektrenai complex.

In 3M 2025, no fatal accidents were recorded. Employee TRIR stood at 1.41 (+0.29 since 31 December 2024) and contractor TRIR at 0.46 (-0.38 since 31 December 2024). Our eNPS remained stable at 65.1 (-0.4 YoY), and 27.7% of the top management positions were held by women, with no changes since 31 December 2024.

Shareholder returns and 2025 outlook

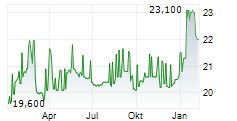

In line with our Dividend Policy, a dividend of EUR 0.663 per share, corresponding to EUR 48.0 million, was paid for H2 2024.

We reiterate our full-year 2025 Adjusted EBITDA guidance of EUR 500-540 million, and Investments guidance of EUR 700-900 million.

Key financial indicators (APM1)

| EUR, millions | 3M 2025 | 3M 2024 | Change |

| Adjusted EBITDA | 188.5 | 181.7 | 3.7% |

| Green Capacities | 109.3 | 77.1 | 41.8% |

| Networks | 74.1 | 65.5 | 13.1% |

| Reserve Capacities | 17.4 | 20.0 | (13.0%) |

| Customers & Solutions | (14.2) | 17.4 | n/a |

| Other activities and eliminations2 | 1.9 | 1.7 | 11.8% |

| Adjusted EBITDA Margin | 23.5% | 28.1% | (4.6 pp) |

| EBITDA | 160.1 | 188.9 | (15.2%) |

| Adjusted EBIT | 138.4 | 140.3 | (1.4%) |

| Operating profit (EBIT) | 110.0 | 147.5 | (25.4%) |

| Adjusted Net Profit | 107.8 | 112.6 | (4.3%) |

| Net profit | 83.9 | 118.7 | (29.3%) |

| Investments | 146.5 | 209.5 | (30.1%) |

| Green Capacities | 71.4 | 138.9 | (48.6%) |

| Networks | 65.5 | 63.7 | 2.8% |

| Reserve Capacities | 0.5 | 0.2 | 150.0% |

| Customers & Solutions | 5.2 | 2.6 | 100.0% |

| Other activities and eliminations2 | 3.9 | 4.1 | (4.9%) |

| FFO | 149.2 | 169.5 | (12.0%) |

| FCF? | 16.7 | 5.0 | 234.0% |

| Adjusted ROE LTM | 11.3% | 14.2% | (2.9 pp) |

| ROE LTM | 10.0% | 14.2% | (4.2 pp) |

| Adjusted ROCE LTM | 8.9% | 11.1% | (2.2 pp) |

| ROCE LTM | 8.1% | 10.7% | (2.6 pp) |

| EPS | 1.16 | 1.64 | (29.3%) |

| 31 Mar 2025 | 31 Dec 2024 | Change | |

| Net Debt | 1,593.3 | 1,612.3 | (1.2%) |

| Net Working Capital | 97.5 | 102.6 | (5.0%) |

| Net Debt/Adjusted EBITDA LTM, times | 2.98 | 3.05 | (2.3%) |

| FFO LTM/Net Debt | 28.8% | 29.7% | (0.9 pp) |

1 All, except 'Net profit', are Alternative Performance Measures (APMs). Definitions and formulas of the financial indicators are available on our website.

2 'Other activities and eliminations' includes consolidation adjustments, related-party transactions and financial results of the parent company.

Earnings call

In relation to the announcement of the First three months 2025 interim report and Strategic Plan 2025-2028, an earnings call for investors and analysts will be held on Wednesday, 14 May 2025, at 1:00 pm Vilnius / 11:00 am London time.

To join the earnings call, please register at:

https://edge.media-server.com/mmc/go/Ignitis3M2025resultsandStrategicPlan2025-2028

It will be also possible to join the earnings call by phone. To access the dial-in details, please register here. After completing the registration, you will receive dial-in details on screen and via email. You will be able to dial in using the provided numbers and a unique pin or by selecting 'Call me' option and providing your phone details for the system to connect you automatically as the earnings call starts.

All questions of interest can be directed to the Group's Investor Relations team in advance, after registration or live during the earnings call.

Presentation slides will be available for download prior the call at:

https://ignitisgrupe.lt/en/reports-presentations-and-fact-sheets

The First three months 2025 interim report, fact sheet (in Excel) and other published documents will be available for download at:

https://ignitisgrupe.lt/en/reports-presentations-and-fact-sheets

Strategic Plan 2025-2028 will be available for download at:

https://ignitisgrupe.lt/en/about-us/strategy

For additional information, please contact:

Communications

Valdas Lopeta

+370 621 77993

valdas.lopeta@ignitis.lt

Investor Relations

Aine Riffel-Grinkeviciene

+370?643 14925

aine.riffel-grinkeviciene@ignitis.lt