The Group in summary

01/01/25 | 01/01/24 | 01/01/24 | ||||

-31/03/25 | -31/03/24 | -31/12/24 | ||||

Net sales | 4 574 | 2 394 | 11 787 | |||

Operating result | -13 537 | -17 979 | -77 277 | |||

Result after financial items | -13 172 | -17 389 | -75 515 | |||

Cash flow from operating activities | -11 692 | -16 312 | -52 937 | |||

Cash flow for the period | 181 689 | -16 464 | -53 937 | |||

Balance sheet total | 363 315 | 238 844 | 187 317 | |||

Equity ratio | 94% | 92% | 87% | |||

Number of shares outstanding end of period | 340 813 188 | 75 736 264 | 75 736 264 | |||

Average number of shares before dilution | 167 040 538 | 75 736 264 | 75 736 264 | |||

Average number of shares after dilution | 167 040 538 | 75 736 264 | 75 736 264 | |||

Earnings per share before dilution | -0,08 | -0,23 | -1,00 | |||

Earnings per share after dilution | -0,08 | -0,23 | -1,00 |

Figures in brackets indicate outcome for the corresponding period of the previous financial year. The financial information presented relates to the Group and is expressed in thousands of Swedish kronor (TSEK) unless otherwise stated.

CEO Comments

On the right track

During the first quarter of 2025, we nearly doubled our revenue compared to the previous year, while also improving cash flow from operations by over SEK 4.6 million. The successful rights issue during the quarter increased our cash by over SEK 193 million, bringing it to approximately SEK 216 million at the end of the first quarter. The growth-oriented business plan has been initiated, and we are on the right track.

2025 has started strong, and sales of Strangvac are hitting new records. At the beginning of the quarter, we announced that the company had received orders from the distribution partner Dechra Pharmaceuticals amounting to SEK 5.8 million for delivery during the first half of 2025, and it is particularly in the UK that Dechra has been successful in driving market penetration. During the first quarter of 2025, sales of doses in the UK were about three times higher than what had been sold cumulatively since the start in 2022.

Operating profit has improved by SEK 4.5 million compared to the same period last year. The improved result is not only due to increased sales. The company has also had lower costs, which is partly due to the work on improved analysis and manufacturing methods not being as extensive as in 2024.

Manufacturing biological drugs is complex, and in collaboration with world-leading partners, we accumulate knowledge that leads to both improved and simplified manufacturing processes. In addition to the previously announced variation applications approved by EMA and VMD during the quarter, further improvements have recently been approved. Improvements in the manufacturing process are one of the cornerstones of the growth-oriented business plan and will lead to improved margins through increased stability and flexibility in manufacturing. These are crucial factors for volume growth and lay the foundation for the company's path to profitability and positive cash flow.

With increased volumes, margins will improve as a significant portion of manufacturing costs are fixed or semi-fixed and will therefore have less impact with higher sales. This also applies to other costs such as compliance, marketing, and sales costs, where costs relative to revenue will decrease and further improve profitability.

We have also made progress in the USA, where the Center for Veterinary Biologics (CVB) has conducted its own tests and approved our Master Seedlots. The USA is the single largest horse market with approximately 10 million horses, and market approval for Strangvac in the USA is of the highest priority. We can now take further steps together with CVB and plan and implement our plan to make Strangvac available on the American market.

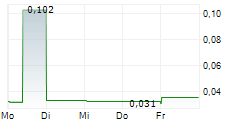

With the successful rights issue in February, the financing for our growth-oriented business plan is in place, and the oversubscribed issue meant that no guarantees were utilized. The company raised approximately SEK 225 million before deduction of share issue costs, and the issue proceeds provide the company with the resources to accelerate the volume expansion of Strangvac, complete the approval process in the USA, and continue the development of our vaccine against Streptococcus suis infections in pigs.

I am pleased to note that with HealthCap IX Investments AB's investment, which has resulted in an ownership in the company of nearly 26%, we have a main owner with extensive experience in investing in and building companies within Life Science. HealthCap's investment strategy is to invest in companies that address diseases with a significant unmet medical need, where groundbreaking treatments and pharmaceuticals have great potential to improve health by preventing or reducing the consequences of disease.

With a strong financial position, increasing sales volumes, and improved results, we have laid the foundation for the journey towards profitability and the goal of establishing Strangvac as part of the standard vaccination for horses. The journey has begun, and we are on the right track.

Stockholm May 14, 2025

Jonas Sohlman

President and CEO

Certified adviser

Eminova Fondkommission is Intervacc's Certified Adviser.

Eminova Fondkommission AB

Biblioteksgatan 3, 3 tr.

114 46 Stockholm

Tel: +46 8 684 211 10

adviser@eminova.se

Dates for upcoming reports

August 29, 2025 | Interim report Q2 January 1 - June 30, 2025 |

November 19, 2025 | Interim report Q3 January 1 - September 30, 2025 |

February 17, 2026 | Year-end report January 1 - December 31, 2025 |

Contact information

Jonas Sohlman, CEO

Phone: +46 (0)8 120 10 600

E-mail: jonas.sohlman@intervacc.se

The interim report for the period January - March 2025 is attached to this press release and is available on the company's website www.intervacc.se/investors/reports.

This information is information that Intervacc AB (publ) is obliged to make public pursuant to the EU Market Abuse Regulation. The information was submitted for publication, through the agency of the contact person set out above, at 08.30 CET on May 14, 2025.

About Intervacc

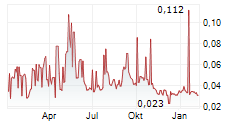

Intervacc AB is a Swedish company within animal health developing vaccines for animals. The Company's vaccine and vaccine candidates are based on research at Karolinska Institutet and Swedish University of Agricultural Research where the foundation was laid for the Company's research and development work. The Intervacc share has been listed on the Nasdaq First North Growth Market since April 2017.