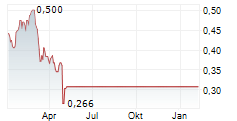

Tidlor Holdings Public Company Limited ("Tidlor Holdings") is set to commence its first trading day on the Stock Exchange of Thailand (SET) on May 15, 2025, under the ticker symbol "TIDLOR", replacing Ngern Tid Lor Public Company Limited, which will be delisted on the same day. This follows the successful completion of a tender offer with an exceptionally high share swap acceptance rate of 99.4%, reflecting strong shareholder confidence.

The group's transition to a holding company structure is expected to enhance operational flexibility, create more opportunities for business expansion, and provide greater flexibility in paying cash dividends to shareholders. It is also expected to mitigate the impact of share dilution and earnings per share (EPS) dilution.

Tidlor Holdings will continue to focus on its core vehicle title loan business under the "Ngern Tid Lor" brand, and a face-to-face insurance brokerage business through "Shield Insurance" brand, while further strengthening the InsurTech capabilities through "Areegator" platforms and "heygoody.com".

The company is confident that this restructuring will further enhance its competitive advantage and lay a strong foundation for sustainable long-term growth.

The group's transition to a holding company structure is expected to enhance operational flexibility, create more opportunities for business expansion, and provide greater flexibility in paying cash dividends to shareholders. It is also expected to mitigate the impact of share dilution and earnings per share (EPS) dilution.

Tidlor Holdings will continue to focus on its core vehicle title loan business under the "Ngern Tid Lor" brand, and a face-to-face insurance brokerage business through "Shield Insurance" brand, while further strengthening the InsurTech capabilities through "Areegator" platforms and "heygoody.com".

The company is confident that this restructuring will further enhance its competitive advantage and lay a strong foundation for sustainable long-term growth.

© 2025 PR Newswire