Beijing, May 14, 2025 (GLOBE NEWSWIRE) -- AGM Group Holdings Inc. ("AGM Holdings" or the "Company") (NASDAQ: AGMH), an integrated technology company specializing in the assembling and sales of high-performance hardware and computing equipment, today announced that the Company's board of directors approved on May 9, 2025 that the ordinary shares of the Company be consolidated on a 50 for 1 ratio. The effective date is scheduled to be June 3, 2025, subject to the Company's satisfaction of Nasdaq Operations notice requirements, with trading of the Company's Class A ordinary shares to begin on a reverse-split-adjusted basis at the market open on that day. Trading in the Class A ordinary shares will continue on the Nasdaq Capital Market, under the same symbol "AGMH" but under a new CUSIP Number, G0132V121.

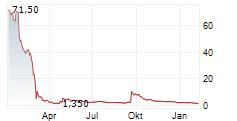

The objective of the share consolidation is to enable the Company to regain compliance with the minimum bid price requirement pursuant to Nasdaq Marketplace Rule 5550(a)(2) and maintain its listing on Nasdaq.

As a result of the share consolidation, each 50 ordinary shares will automatically combine and convert to one ordinary share without any action on the part of the shareholders. No fractional shares will be issued to any shareholders in connection with the share consolidation, and any fractional shares which would have resulted from the share consolidation will be rounded down to the next whole number and the Company will make a cash payment (without interest) to all the holders of Class A Ordinary Shares and Class B Ordinary Shares equal to such fraction multiplied by the average of the closing sales prices of the ordinary shares on Nasdaq during regular trading hours for the five consecutive trading days immediately preceding the expected first trading day of the share consolidation (with such average closing sales prices being adjusted to give effect to the share consolidation) subject to a de minimums. The share consolidation affects all shareholders uniformly and will not alter any shareholder's percentage interest in the Company's ordinary shares, except for adjustments that may result from the treatment of fractional shares.

At the time the share consolidation is effective, the Company's maximum number of authorized shares will be reduced from 400,000,000 divided into (i) 200,000,000 Class A Ordinary Shares with a par value of US$0.001 per share; and (ii) 200,000,000 Class B Ordinary Shares with a par value of US$0.001 per share to 8,000,000 divided into (i) 4,000,000 Class A Ordinary Shares with a par value of US$0.05 per share; and (ii) 4,000,000 Class B Ordinary Shares with a par value of US$0.05 per share. The Company's total issued and outstanding Class A ordinary shares will be changed from 98,713,955 Class A ordinary shares with a par value of US$0.001 each to approximately 1,974,279 Class A ordinary shares with a par value of US$0.05 each. The Company's total issued and outstanding Class B ordinary shares will be changed from 2,100,000 Class B ordinary shares with a par value of US$0.001 each to approximately 42,000 Class B ordinary shares with a par value of US$0.05 each.

About AGM Group Holdings Inc.

AGM Group Holdings Inc. (NASDAQ: AGMH) is an integrated technology company specializing in the assembling and sales of high-performance hardware and computing equipment. With a mission to become a key participant and contributor in the global blockchain ecosystem, AGMH focuses on the research and development of blockchain-oriented Application-Specific Integrated Circuit (ASIC) chips, the assembling and sales of high-end crypto miners for Bitcoin and other cryptocurrencies. For more information, please visit www.agmprime.com.

Forward-Looking Statements

Certain statements in this announcement are forward-looking statements. These forward-looking statements involve known and unknown risks and uncertainties and are based on the Company's current expectations and projections about future events that the Company believes may affect its financial condition, results of operations, business strategy and financial needs. Investors can identify these forward-looking statements by words or phrases such as "approximates," "assesses," "believes," "hopes," "expects," "anticipates," "estimates," "projects," "intends," "plans," "will," "would," "should," "could," "may" or similar expressions. The Company undertakes no obligation to update or revise publicly any forward-looking statements to reflect subsequent occurring events or circumstances, or changes in its expectations, except as may be required by law. Although the Company believes that the expectations expressed in these forward-looking statements are reasonable, it cannot assure you that such expectations will turn out to be correct, and the Company cautions investors that actual results may differ materially from the anticipated results and encourages investors to review other factors that may affect its future results in the Company's registration statement and other filings with the U.S. Securities and Exchange Commission.

For more information, please contact:

AGM Group Holdings Inc.

Email: ir@agmprime.com

Website: http://www.agmprime.com

Ascent Investor Relations LLC

Tina Xiao

President

Phone: +1-646-932-7242

Email: investors@ascent-ir.com