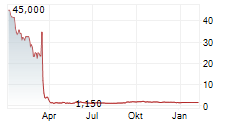

XI'AN, China, May 15, 2025 (GLOBE NEWSWIRE) -- Bon Natural Life Limited (Nasdaq: BON) ("BON" or the "Company"), one of the leading bio-ingredient solutions providers in the natural, health and personal care industries, announced today that it will effect a 1-for-25 reverse stock split ("Reverse Stock Split") of its authorized, issued and outstanding Class A ordinary shares, par value $0.001 per share. The Reverse Stock Split will become effective at 12:01a.m., Eastern Time, on May 19, 2025. At such time, each 25 issued and outstanding Class A ordinary shares will automatically be reclassified into one new Class A ordinary share. Proportional adjustments will be made to outstanding equity awards, warrants and convertible notes, and to the number of shares issued and issuable under the Company's stock incentive plans and certain existing agreements. No fractional shares will be issued in connection with the Reverse Stock Split. All fractional shares will be rounded up. The Reverse Stock Split will affect all Class A holders uniformly and will not alter any stockholder's percentage interest in the Company's equity.

Bon's Class A ordinary shares will continue to trade on The Nasdaq Capital Market under the existing symbol "BON" and will begin trading on a split-adjusted basis when the market opens on May 19, 2025. The new CUSIP number for the Class A ordinary shares following the Reverse Stock Split will be G14492204.

The Reverse Stock Split is primarily intended to bring the Company into compliance with the $1.00 minimum bid price requirement in order to maintain its listing on Nasdaq. There is no guarantee the Company will meet the minimum bid price requirement.

Immediately following the Reverse Split our authorized share capital will increase to 1,000,000,000 Class A ordinary shares, par value $0.025 per share; (ii) 50,000,000 Class B ordinary shares, par value $0.001 per share; and (iii) 50,000,000 preference shares, par value $0.001 per share.

In addition to the Reverse Split and increase in authorized shares, the conversion rate of the Class B ordinary shares, which are currently convertible to Class A ordinary shares on a one-to-one (1:1) basis, will be convertible to Class A ordinary shares on a one-to-twenty-five (1:25) basis (the "Variation of Class Rights").

The Reverse Split, Variation of Class Rights, and increase in authorized shares was approved by our shareholders at their April 15, 2025 extraordinary general meeting and was accomplished by way of an amendment to our charter documents filed on April 28, 2025.

About Bon Natural Life Limited

BON is a Cayman Islands company engaged in the business of natural, health, and personal care industries. For more information, please visit http://www.bnlus.com.

Forward-Looking Statements

Certain statements in this announcement are "forward-looking statements" within the meaning of the Private Securities Litigation Reform Act of 1995, as amended. Investors can identify these forward-looking statements by words or phrases such as "may," "will," "expect," "anticipate," "aim," "estimate," "intend," "plan," "believe," "potential," "continue," "is/are likely to" or other similar expressions. Although the Company believes that the expectations expressed in these forward-looking statements are reasonable, it cannot assure you that such expectations will turn out to be correct, and the Company cautions investors that actual results may differ materially from the anticipated results. These forward-looking statements are based only on our current beliefs, expectations and assumptions regarding the future of our business, future plans and strategies, projections, anticipated events and trends, the economy, activities of regulators and future regulations and other future conditions. Because forward-looking statements relate to the future, they are subject to inherent uncertainties, risks and changes in circumstances that are difficult to predict and many of which are outside of our control. Therefore, you should not rely on any of these forward-looking statements. These risks and uncertainties include, among others: the completion of the offering, the satisfaction of customary closing conditions related to the offering, the intended use of proceeds from the offering, BON's limited operating history and historical losses; BON's ability to raise additional funding; competition from third parties that are developing or have products for similar uses; BON's ability to obtain, maintain and protect its intellectual property; and BON's expectations regarding its growth, strategy, progress towards its goals. These forward-looking statements involve known and unknown risks and uncertainties and are based on current expectations and projections about future events and financial trends that the Company believes may affect its financial condition, results of operations, business strategy and financial needs. The Company undertakes no obligation to update forward-looking statements to reflect subsequent occurring events or circumstances, or changes in its expectations, except as may be required by law. Although the Company believes that the expectations expressed in these forward-looking statements are reasonable, it cannot assure you that such expectations will turn out to be correct, and the Company cautions investors that actual results may differ materially from the anticipated results and encourages investors to review other factors that may affect its future results in the Company's registration statement and in its other filings with the U.S. Securities and Exchange Commission.

Investor Relations Contact:

Cindy Liu | IR

Email: bonnatural@appchem.cn