During the First Quarter of the Year, Grupo Nutresa Reported Revenues of More Than COP 4.9 Trillion, an Increase of 13.1%. In Terms of Profitability, the Company Reported a 15.0% EBITDA Margin, the Highest in Over Five Year.

MEDELLÍN, CO / ACCESS Newswire / May 15, 2025 / Grupo Nutresa S.A. (BVC:NUTRESA):

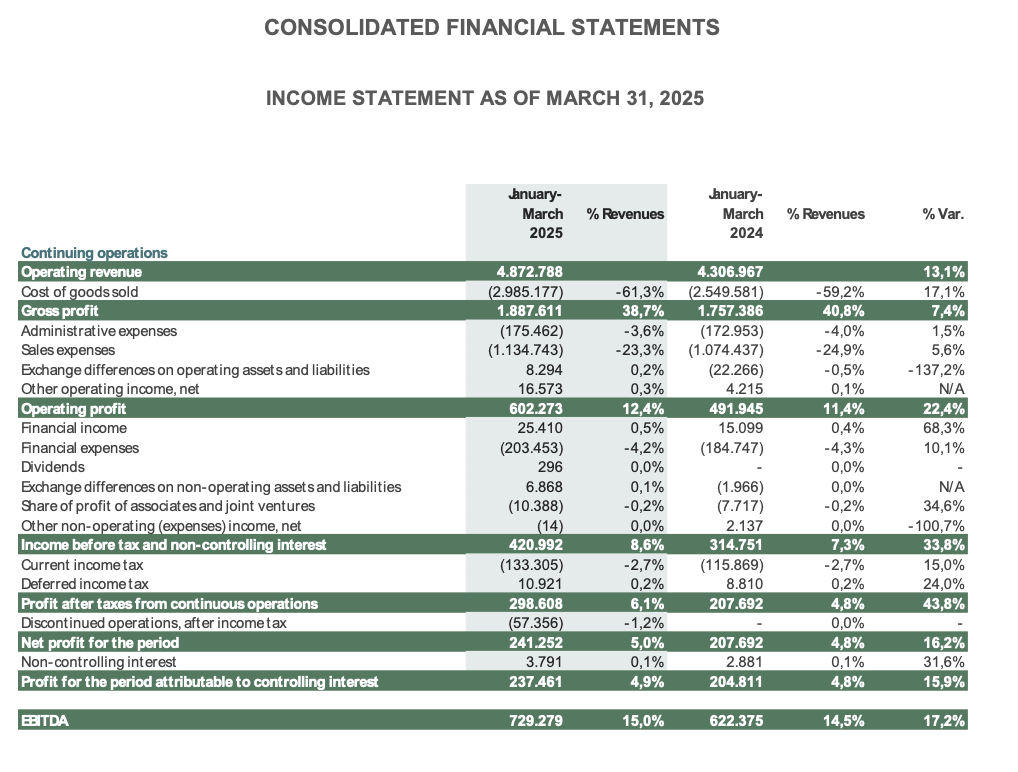

INCOME STATEMENT AS OF MARCH 31, 2025

Grupo Nutresa's sales showed a positive performance, reaching COP 4.9 trillion, 13.1% higher than the first quarter of 2024. Broad-based growth was reported across of all the Group's geographies.

In Colombia, revenues grew 9.7% reaching COP 2.9 trillion, with notable growth in Chocolates, Biscuits, Coffee, and in the Others category.

International revenues, in U.S. dollars, amounted to 478.2 million, representing a 10.9% increase. In Colombian pesos, these revenues reached COP 2.0 trillion, representing an 18.5% increase.

The Group is making substantial progress in its organizational transformation efforts and efficient expense management. Consequently, EBITDA is growing at a faster rate than sales, with an increase of 17.2%, reaching COP 729,279 million. EBITDA margin on sales stands at 15.0%.

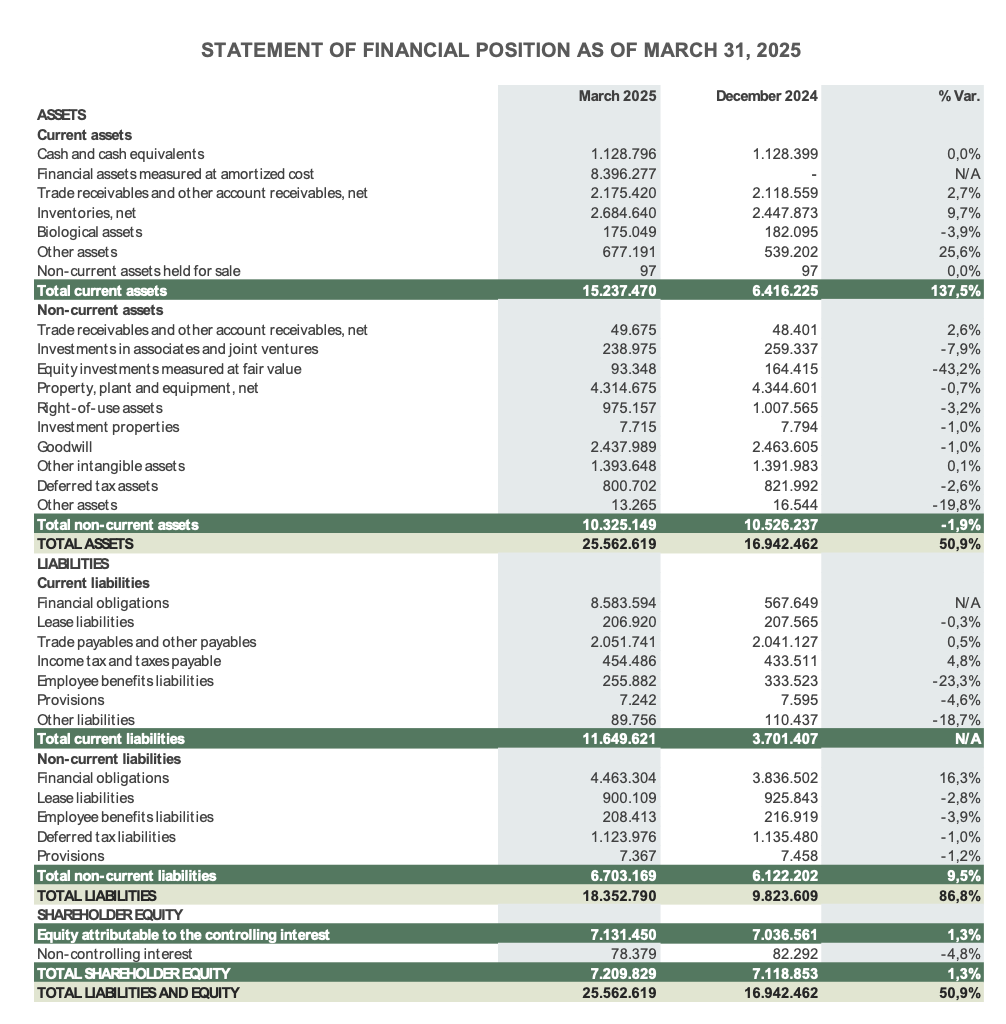

Grupo Nutresa successfully issued its first bond in the international market with a dual tranche issuance of USD 2.0 billion. The transaction marked the largest debut bond by a Latin American company in history.

Grupo Nutresa S.A. (BVC:NUTRESA) publicly shares its progress on several relevant issues for the Organization and reports its consolidated financial results as of March 31, 2025.

Grupo Nutresa successfully launched its first bond in the international market with a dual-tranche issuance of USD 2.0 trillion (2030 and 2035) at rates of 8.0% and 9.0%, respectively.

The issue generated a demand of USD 5.1 trillion (2.6 times the placement amount) and was classified as the largest debut bond issue by a Latin American company in such market.

The proceeds from the issue will be used to repay the USD 2 trillion bridge loan under the "club deal" model granted on March 7 by Goldman Sachs Bank USA, Citigroup Global Markets Inc., N.A., JP Morgan Chase Bank, Deutsche Bank AG, and Banco BTG Pactual S.A. - Cayman Branch.

Grupo Nutresa S.A.'s consolidated financial results for the first quarter of 2025.

At the close of the first quarter of 2025, Grupo Nutresa's sales showed a positive growth dynamic, reaching COP 4.9 trillion,13.1% higher than the same period of the previous year. Broad-based growth is reported across all of the Group's geographies.

In Colombia, revenues grew 9.7% reaching COP 2.9 trillion, equivalent to 58.9% of consolidated sales. International sales reached COP 2.0 trillion, an increase of 18.5%, and represented 41.1% of the total sales. In U.S. dollars, these revenues reached 478.2 million, with a 10.9% growth.

Amid a volatile and price-rising environment for some of our key raw materials, the company achieved a gross profit of COP 1.9 trillion, representing a 7.4% increase. In terms of profitability and aligned with the implementation of initiatives aimed at improving the Group's operational efficiency and productivity, expenses grew at a lower rate than sales, which boosted the results in operating profit and EBITDA.

During the period, operating profit was reported at COP 602,273 million, 22.4% higher than the same quarter in 2024; and EBITDA, at COP 729,279 million, representing a 17.2% increase, with a 15.0% margin.

In post-operating items, the Organization reported a COP 10,311 million increase in financial returns on the Group's operating cash flow, and a 10.1% growth in financial expenses due to an increase in financial obligations.

Finally, and consolidating the aforementioned effects, the Group's net profit amounted to COP 237,461 million, growing 15.9% compared to the same period of the previous year.

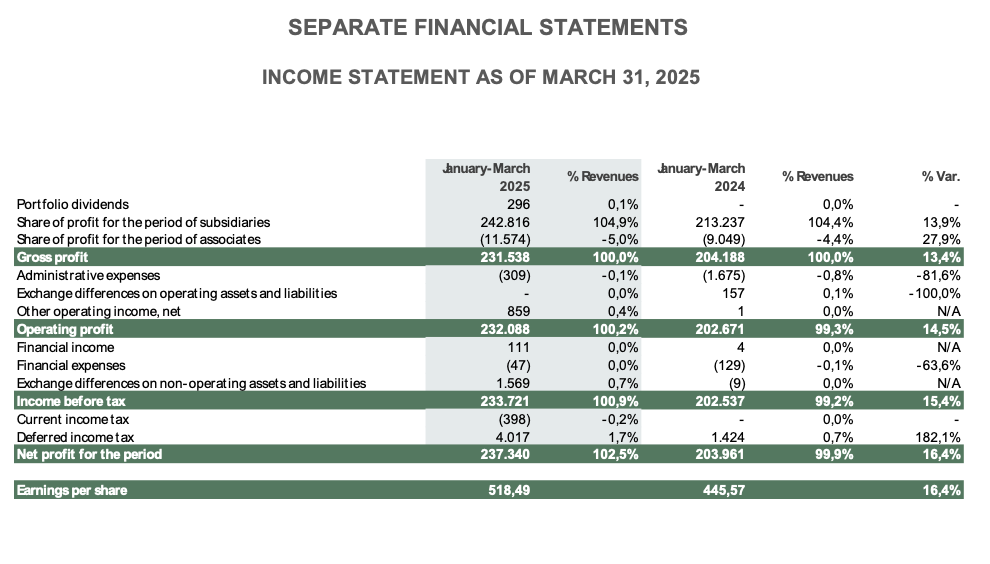

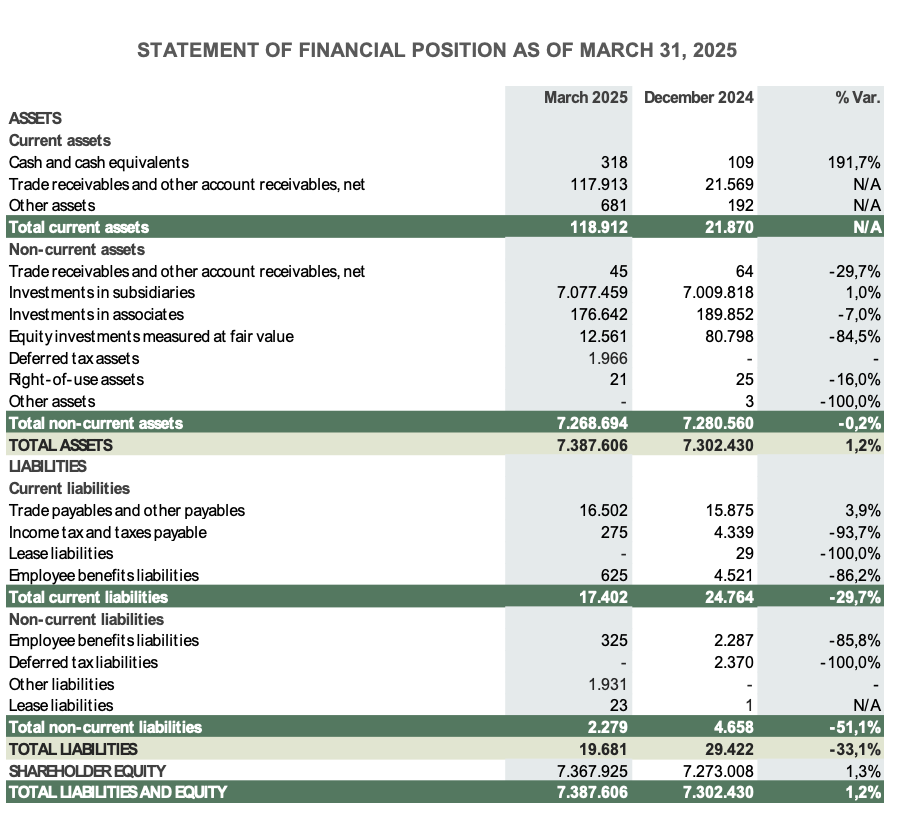

Separate Financial Statements

Grupo Nutresa S.A.'s Separate Financial Statements report a net operating income of COP 231,538 million, of which COP 231,242 million corresponds to profit using the equity method for investments in food companies, and COP 296 million to dividends from the investment portfolio. Net income is COP 237,340 million. The consolidated and separate financial statements, the statement of financial position as of March 31, 2025, and the related financial indicators, are integral parts of this press release.

Contact Information

CAMILA REY

Directora de Cuentas

camila.rey@publicisgroupe.com

SOURCE: NUTRESA

Related Images

INCOME STATEMENT AS OF MARCH 31, 2025

Related Documents:

- Comunicado de Resultados 1Q25.pdf

- Grupo Nutresa - Press Release 1Q25.pdf

View the original press release on ACCESS Newswire:

https://www.accessnewswire.com/newsroom/en/food-and-beverage-products/grupo-nutresa-reports-first-quarter-revenues-increased-13.1-and-15.0-ebi-1028124