First Quarter 2025 and Recent Company Highlights:

- AleAnna reported basic and diluted net loss per common share of ($0.05) for the quarter ended March 31, 2025, compared with ($3.41) for the same period in 2024.

- AleAnna ended the quarter with cash and cash equivalents of approximately $27.8 million

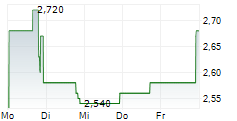

DALLAS, May 15, 2025 (GLOBE NEWSWIRE) -- AleAnna, Inc. ("AleAnna" or "the Company") (NASDAQ: ANNA) today announced financial results for the first quarter of 2025. While revenue from Longanesi field production was not recognized during the quarter, in May 2025 AleAnna achieved first sales and the Company expects to report revenue from the Longanesi field as a part of second quarter results.

For the first quarter 2025, AleAnna reported net loss of $2.0 million. This amounts to a basic and diluted net loss per common share of ($0.05), compared with ($3.41) net loss per common share recorded by the Company in the first quarter 2024.

As of March 31, 2025, AleAnna had cash and cash equivalents of $27.8 million, providing the necessary liquidity to support development activities and pursue strategic opportunities.

Management Commentary

Marco Brun, Chief Executive Officer, remarked on AleAnna's recent accomplishments: "We continue to execute on our business strategy and are encouraged by the initial performance at the Longanesi field. Although first quarter results did not include revenue from Longanesi, with the onset of sales in early May 2025 we expect to report revenue in our second quarter results. With a healthy balance sheet and growing operational momentum, we're focused on delivering long-term value to our shareholders."

About AleAnna

AleAnna is a technology-driven energy company focused on bringing sustainability and new supplies of low-carbon natural gas and RNG to Italy, aligning traditional energy operations with renewable solutions, with developments like the Longanesi field leading the way in supporting a responsible energy transition. With three conventional gas discoveries in Italy already made and with a potential of up to fourteen new natural gas exploration projects that could be initiated this decade, our goal is to play a pivotal role in Italy's energy transition. Italy's extensive infrastructure, featuring 33,000 kilometers of gas pipelines, three major gas storage facilities, and a strong base of existing RNG facilities, aligns with AleAnna's commitment to sustainability. AleAnna's RNG projects' portfolio includes three plants under development and almost 100 potential projects that would represent up to a €1.1 billion potential investment in the next few years. AleAnna operates regional headquarters in Dallas, Texas, and Rome, Italy.

Forward-Looking Statements

This press release contains "forward-looking statements" within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. All statements, other than statements of present or historical fact included in this press release, regarding AleAnna's expectations and future financial performance, the Company's strategy, future operations, financial position, prospective plans, goals, and objectives are forward-looking statements. When used herein, including any statements made in connection herewith, the words "could," "should," "will," "may," "believe," "anticipate," "intend," "plan," "potential," "goal," "focus," "estimate," "expect," "project," the negative of such terms and other similar expressions are forward-looking statements. However, not all forward-looking statements contain such identifying words. Forward-looking statements are neither historical facts nor assurances or guarantees of future performance. Instead, they are based only on AleAnna's current beliefs, expectations and assumptions regarding the future of its business, future plans and strategies, the economy and other future conditions. Because forward-looking statements relate to the future, they are subject to inherent uncertainties, risks and changes in circumstances that are difficult to predict and many of which are outside of AleAnna's control. As a result, these factors could cause AleAnna's actual results and financial condition to differ materially from those indicated in the forward-looking statements. Therefore, you should not rely on any of these forward-looking statements, which speak only as of the date made. Except as otherwise required by applicable law, the Company disclaims any duty to update any forward-looking statements, all of which are expressly qualified by the statements in this section, to reflect events or circumstances after the date hereof. Important factors that could cause our actual results and financial condition to differ materially from those indicated in the forward-looking statements include, but are not limited to, those under "Risk Factors" in AleAnna's Form 10-K filed with the SEC on March 31, 2025, as well as general economic conditions; AleAnna's need for additional capital and ability to obtain any required capital; political, general economic, financial and legal conditions; changes in domestic and foreign markets; risks associated with the implementation of AleAnna's business strategy and the ability to execute on AleAnna's business strategy; timing of any business milestones; and changes in the regulatory environment in which AleAnna operates. Additional information concerning these and other factors that may impact AleAnna's expectations and projections can be found in filings it makes with the SEC, and other documents filed or to be filed with the SEC by AleAnna. SEC filings are available on the SEC's website at www.sec.gov. Except as otherwise required by applicable law, AleAnna disclaims any duty to update any forward-looking statements, all expressly qualified by the statements in this section, to reflect events or circumstances after the date hereof.

Investor Relations Contact

Bill Dirks

wkdirks@aleannagroup.com

Website

https://www.aleannainc.com/

Source: AleAnna, Inc.

ALEANNA, INC.

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS AND COMPREHENSIVE LOSS (unaudited)

FOR THE THREE MONTHS ENDED MARCH 31, 2025 AND MARCH 31, 2024

| For the Three Months Ended March 31, | |||||||

| 2025 | 2024 | ||||||

| Revenues | $ | 644,600 | $ | - | |||

| Operating expenses: | |||||||

| Cost of revenues | $ | 838,395 | $ | - | |||

| General and administrative | 3,324,845 | 2,018,524 | |||||

| Depreciation | 73,106 | - | |||||

| Accretion of asset retirement obligation | 33,505 | 33,311 | |||||

| Total operating expenses | 4,269,850 | 2,051,835 | |||||

| Operating loss | (3,625,250 | ) | (2,051,835 | ) | |||

| Other income: | |||||||

| Interest and other income | 237,605 | 289,337 | |||||

| Change in fair value of derivative liability | - | 173,177 | |||||

| Total other income | 237,605 | 462,514 | |||||

| Loss before income taxes | (3,387,646 | ) | (1,589,321 | ) | |||

| Income tax benefit | 48,276 | - | |||||

| Net loss | (3,339,370 | ) | (1,589,321 | ) | |||

| Deemed dividend to Class 1 Preferred Units redemption value | - | (112,673,176 | ) | ||||

| Net loss attributable to noncontrolling interests | 1,333,231 | - | |||||

| Net loss attributable to Class A Common stockholders or holders of Common Member Units | $ | (2,006,139 | ) | $ | (114,262,497 | ) | |

| Other comprehensive loss | |||||||

| Currency translation adjustment | 1,139,303 | 113,872 | |||||

| Comprehensive loss | (2,200,067 | ) | (1,475,449 | ) | |||

| Comprehensive loss attributable to noncontrolling interests | 1,333,231 | - | |||||

| Total comprehensive loss attributable to Class A Common stockholders or holders of Common Member Units | $ | (866,836 | ) | $ | (1,475,449 | ) | |

| Weighted average shares of Class A Common Stock outstanding, basic and diluted | 40,564,475 | 33,467,205 | |||||

| Net loss per share of Class A Common Stock, basic and diluted | $ | (0.05 | ) | $ | (3.41 | ) | |

ALEANNA, INC.

CONDENSED CONSOLIDATED BALANCE SHEETS

AS OF MARCH 31, 2025 (unaudited) AND DECMBER 31, 2024

| March 31, 2025 | December 31, 2024 | ||||||

| ASSETS | |||||||

| Current Assets: | |||||||

| Cash and cash equivalents | $ | 27,810,160 | $ | 28,330,159 | |||

| Accounts receivable | 402,874 | 1,225,297 | |||||

| Prepaid expenses and other assets | 987,414 | 1,666,155 | |||||

| Total Current Assets | 29,200,448 | 31,221,611 | |||||

| Non-current assets: | |||||||

| Natural gas and other properties, successful efforts method | 34,794,734 | 33,979,014 | |||||

| Renewable natural gas properties, net of accumulated depreciation of $209,009 and $132,094, respectively | 9,592,268 | 9,296,039 | |||||

| Value-added tax refund receivable | 6,578,604 | 6,845,030 | |||||

| Operating lease right-of-use assets | 1,777,356 | 1,744,897 | |||||

| Deferred tax assets | 48,276 | - | |||||

| Total Non-current Assets | 52,791,238 | 51,864,980 | |||||

| Total Assets | $ | 81,991,686 | $ | 83,086,591 | |||

| LIABILITIES AND STOCKOLDERS' EQUITY | |||||||

| Current Liabilities: | |||||||

| Accounts payable and accrued expenses | $ | 1,980,897 | $ | 2,204,208 | |||

| Lease liability, short-term | 174,127 | 163,865 | |||||

| Total Current Liabilities | 2,155,024 | 2,368,073 | |||||

| Non-current Liabilities: | |||||||

| Asset retirement obligation | 4,409,230 | 4,375,919 | |||||

| Lease liability, long-term | 1,601,573 | 1,579,443 | |||||

| Contingent consideration liability, long-term | 25,980,832 | 24,994,315 | |||||

| Total Non-current Liabilities | 31,991,635 | 30,949,677 | |||||

| Total Liabilities | 34,146,659 | 33,317,750 | |||||

| Commitments and Contingencies (Note 6) | |||||||

| Stockholders' Equity: | |||||||

| Class A Common Stock, par value $0.0001 per share, 150,000,000 shares authorized, 40,584,455 and 40,560,433 shares issued and outstanding as of March 31, 2025 and December 31, 2024 | 4,058 | 4,056 | |||||

| Class C Common Stock, par value $0.0001 per share, 70,000,000 shares authorized, 25,994,400 shares issued and outstanding as of March 31, 2025 and December 31, 2024 | 2,599 | 2,599 | |||||

| Additional paid-in capital | 226,998,675 | 226,722,424 | |||||

| Accumulated other comprehensive loss | (5,109,054 | ) | (5,803,378 | ) | |||

| Accumulated deficit | (193,054,092 | ) | (191,047,953 | ) | |||

| Noncontrolling interest | 19,002,841 | 19,891,093 | |||||

| Total Stockholders' Equity | 47,845,027 | 49,768,841 | |||||

| Total Liabilities and Stockholders' Equity | $ | 81,991,686 | $ | 83,086,591 | |||