SHANGHAI, May 15, 2025 /PRNewswire/ -- XChange TEC.INC (NASDAQ: XHG) (the "Company") today announced that it received a delisting letter dated May 13, 2025 (the "Determination Letter") from The Nasdaq Stock Market ("Nasdaq"). The Determination Letter will have no immediate impact on the trading and listing of the Company's American Depositary Shares (the "ADSs") on Nasdaq.

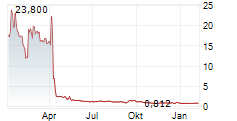

As previously disclosed, the Company received a notice (the "Notice") from the Nasdaq dated November 13, 2024 stating that the Company is not in compliance with the requirement to maintain a minimum Market Value of Listed Securities of $35 million as set forth under Nasdaq Listing Rule 5550(b)(2) (the "MVLS Rule") for continued listing on The Nasdaq Capital Market. The Notice further stated that the Company had a 180-calendar-day period to regain compliance, which expired on May 12, 2025.

The Determination Letter that the Company received on May 13, 2025 states that the Company has not regained compliance with the MVLS Rule, and that the Company's ADSs will be delisted from The Nasdaq Capital Market.

As permitted, the Company intends to appeal the determination to a Hearings Panel (the "Panel") by May 20, 2025, pursuant to the procedures set forth in the Nasdaq Listing Rule, which will stay any further delisting actions through the Panel determination or extension provided. The Company plans to actively address the deficiencies; however, there can be no assurance as to the decision of the Panel or the Company's ability to regain compliance.

About XChange TEC.INC

XChange TEC.INC, through its subsidiaries and consolidated variable interest entities, operates insurance agency and insurance technology business. The insurance agency is PRC-licensed and operates nationwide in the PRC with a wide range of insurance products underwritten by major insurance companies, including industry leading and/or state-owned property and casualty insurance companies as well as certain regional property and casualty insurance companies in the PRC. The insurance technology business is focused on operating and developing insurance technology in the PRC, including developing SaaS platform to connect consumers and underwriting support.

Forward-Looking Statements

This press release contains forward-looking statements. Forward-looking statements include statements concerning plans, objectives, goals, strategies, future events or performance, and underlying assumptions and other statements that are other than statements of historical facts. The Company's actual results may differ materially from those expressed in any forward-looking statements as a result of various factors and uncertainties. The reports filed by the Company with the Securities and Exchange Commission discuss these and other important factors and risks that may affect the Company's business, results of operations and financial conditions. For these reasons, among others, investors are cautioned not to place undue reliance upon any forward-looking statements in this press release. The Company undertakes no obligation to publicly revise these forward-looking statements to reflect events or circumstances that arise after the date hereof.

SOURCE XChange TEC.INC