SINGAPORE, May 16, 2025 (GLOBE NEWSWIRE) -- Concorde International Group Ltd. (NASDAQ: CIGL) ("Concorde" or the "Company"), an integrated security services provider that combines physical manpower and innovative technology to deliver effective security solutions, today announced financial results and provided a business update for the year ended December 31, 2024.

2024 Financial Highlights

- Maintained stable revenues at approximately $10.5 million for the year ended December 31, 2024, compared to $10.7 million in 2023.

- Gross profit increased by approximately 20.8% to $3.6 million in 2024 compared to approximately $3.0 million in 2023, driven in part by an improvement in gross profit margin, which increased to approximately 34.5% in 2024, compared to approximately 28.1% in 2023.

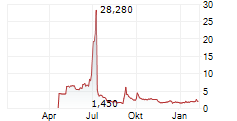

- Completed an IPO on April 22, 2025, raising gross proceeds of $5.75 million (including over-allotment option), and commenced trading on the Nasdaq Capital Market on April 22, 2025.

Swee (Alan) Kheng Chua, Chairman and Chief Executive Officer of Concorde, commented, "2024 was a transformative year for Concorde, culminating in our successful IPO on April 22, 2025. We raised a total of $5.75 million in gross proceeds, including the full exercise of the over-allotment option, and proudly commenced trading on the Nasdaq Capital Market. This milestone not only validates our business model but also provides the capital foundation to accelerate our next phase of growth."

"Our position as a leading integrated security services provider in Singapore is built on our ability to blend skilled manpower with patented technologies that deliver scalable, cost-effective, and high-performance solutions. At the core of our offering is our suite of smart security technologies, known as I-Guarding Services. Supported by 4 granted global patents and our proprietary innovations-such as the I-Man Facility Sprinter ("IFS"), a mobile platform transforming security and facility maintenance, and the Intelligent Facility Authenticator, a kiosk-based system that enhances access control and visitor management-are redefining industry standards. These technologies help reduce operational costs, improve security performance, and optimize overall efficiency for our clients."

"While our 2024 revenue remained stable at approximately $10.5 million, we anticipate strong year over year growth going forward. Specifically, our 2025 growth strategy is focused on scaling our high-margin recurring revenue, largely driven by the continued deployment of our i-Guarding services. These solutions generate incremental revenue with minimal additional cost, as each IFS unit can service 15 or more locations. We also plan to expand internationally over the next 24 months, targeting Malaysia, Australia, and North America through partnerships with established local security providers to address rising labor costs and growing demand for smart, tech-enabled solutions. Moreover, our net results in 2024 were impacted by a one-time, non-cash share-based compensation expense of $83.2 million. Excluding this, we maintained positive operating profit, reflecting the strength and earnings potential of our core business. Since our founding in 1997, and especially following our strategic shift in 2014 toward a tech-integrated model-we've built a reputation for excellence, agility, and innovation. With increasing demand for intelligent security and facility solutions, we are well-positioned to scale sustainably and deliver long-term value to our clients, employees, and shareholders."

Financial Overview

Revenue remained relatively flat year over year, with a slight decrease of approximately 1.5% to $10.5 million for 2024, compared to $10.7 million for 2023. Gross profit increased to approximately $3.6 million for 2024, compared to approximately $3.0 million for 2023.

Operating loss was approximately $83.6 million in 2024, compared to operating profit of approximately $1.0 million in 2023. Operating loss in 2024 was impacted by a one-time, non-cash share-based compensation expense of $83.2 million. As of December 31, 2024, and 2023, the Company had cash and cash equivalents of approximately $1.0 million and $957 thousand, respectively. Subsequently, in April 2025, the Company completed its IPO, raising gross proceeds of $5.75 million, including the full exercise of the over-allotment option.

About Concorde International Group Ltd

Concorde International Group Limited (Nasdaq: CIGL) is a Singapore-based company specializing in integrated security solutions and facilities management services. Established in 1997, the Company has transitioned from traditional security services to a technology-driven approach. This shift involves deploying advanced systems like CCTV, sensors, and mobile command vehicles, significantly reducing the need for physical guards and enhancing operational efficiency.

For more information, please visit: https://www.concordesecurity.com/

Forward-Looking Statements

This press release contains forward-looking statements. Forward-looking statements include statements concerning plans, objectives, goals, strategies, future events or performance, and underlying assumptions and other statements that are other than statements of historical facts. When the Company uses words such as "may, "will, "intend," "should," "believe," "expect," "anticipate," "project," "estimate" or similar expressions that do not relate solely to historical matters, it is making forward-looking statements. Forward-looking statements are not guarantees of future performance and involve risks and uncertainties that may cause the actual results to differ materially from the Company's expectations discussed in the forward-looking statements. These statements are subject to uncertainties and risks including, but not limited to, the uncertainties related to market conditions and other factors discussed in the "Risk Factors" section of the registration statement and annual report filed with the SEC. For these reasons, among others, investors are cautioned not to place undue reliance upon any forward-looking statements in this press release. Additional factors are discussed in the Company's filings with the SEC, which are available for review at www.sec.gov. The Company undertakes no obligation to publicly revise these forward-looking statements to reflect events or circumstances that arise after the date hereof.

For more information, contact:

Investor Relations Contact:

Crescendo Communications, LLC

David Waldman/Natalya Rudman

Tel: (212) 671-1020

Email: CIGL@crescendo-ir.com

CONCORDE INTERNATIONAL GROUP LTD.

CONSOLIDATED STATEMENTS OF FINANCIAL POSITION

AS AT DECEMBER 31, 2024 AND 2023

| 2024 | 2023 | |||||||

| USD | USD | |||||||

| Assets | ||||||||

| Non-current assets: | ||||||||

| Property and equipment, net | 3,720,807 | 2,904,413 | ||||||

| Right-of-use asset, net | 322,332 | 177,429 | ||||||

| Intangible assets, net | 9,325 | 65,396 | ||||||

| Other financial assets | 393,019 | - | ||||||

| Deferred offering cost | 449,110 | 116,022 | ||||||

| Total non-current assets | 4,894,593 | 3,263,260 | ||||||

| Current assets: | ||||||||

| Trade and other receivables | 3,825,146 | 3,485,364 | ||||||

| Amount due from related parties | 553,184 | 844,982 | ||||||

| Cash and cash equivalents | 1,000,284 | 956,975 | ||||||

| Total current assets | 5,378,614 | 5,287,321 | ||||||

| Total assets | 10,273,207 | 8,550,581 | ||||||

| Equity and liabilities | ||||||||

| Equity | ||||||||

| Share capital | 209 | 1 | ||||||

| Merger reserves | 2,336,848 | 2,336,848 | ||||||

| Other reserves | 83,085,159 | 50,739 | ||||||

| (Accumulated deficit)/Retained earnings | (83,313,648 | ) | 177,649 | |||||

| Equity attributable to equity holders of the parent company | 2,108,568 | 2,565,237 | ||||||

| Non-controlling interests | 151,629 | 137,339 | ||||||

| Total equity | 2,260,197 | 2,702,576 | ||||||

| Liabilities | ||||||||

| Non-current liabilities: | ||||||||

| Lease liabilities, net of current portion | 170,724 | 90,082 | ||||||

| Long-term debt | 2,906,113 | 2,109,538 | ||||||

| Deferred tax liabilities | 182,096 | 133,488 | ||||||

| Other financial liabilities | 173,551 | - | ||||||

| Total non-current liabilities | 3,432,484 | 2,333,108 | ||||||

| Current liabilities: | ||||||||

| Trade and other payables | 1,091,188 | 1,186,334 | ||||||

| Amount due to related parties | 216,940 | 405,632 | ||||||

| Tax payable | 60,282 | - | ||||||

| Lease liabilities | 89,438 | 59,821 | ||||||

| Current maturities of long-term debt | 3,122,678 | 1,863,110 | ||||||

| Total current liabilities | 4,580,526 | 3,514,897 | ||||||

| Total liabilities | 8,013,010 | 5,848,005 | ||||||

| Total equity and liabilities | 10,273,207 | 8,550,581 | ||||||

CONCORDE INTERNATIONAL GROUP LTD.

CONSOLIDATED STATEMENTS OF PROFIT OR LOSS AND OTHER COMPREHENSIVE (LOSS)/INCOME

FOR THE YEAR ENDED DECEMBER 31, 2024, 2023 and 2022

| 2024 | 2023 | 2022 | ||||||||||

| USD | USD | USD | ||||||||||

| Revenue | 10,490,668 | 10,655,993 | 5,006,345 | |||||||||

| Cost of revenue (exclusive of depreciation and amortization expenses shown separately below) | (6,875,141 | ) | (7,662,024 | ) | (3,648,637 | ) | ||||||

| 3,615,527 | 2,993,969 | 1,357,708 | ||||||||||

| Other income | 501,660 | 236,911 | 205,201 | |||||||||

| Depreciation and amortization expenses | (279,543 | ) | (329,836 | ) | (389,449 | ) | ||||||

| Employee benefit expenses | (2,151,970 | ) | (1,311,345 | ) | (912,772 | ) | ||||||

| Other expenses | (1,819,903 | ) | (314,639 | ) | (989,635 | ) | ||||||

| Share-based compensation | (83,155,336 | ) | - | - | ||||||||

| Finance costs | (218,630 | ) | (149,626 | ) | (75,033 | ) | ||||||

| (Loss) /Profit before tax | (83,508,195 | ) | 1,125,434 | (803,980 | ) | |||||||

| Income tax expense | (114,902 | ) | (131,240 | ) | - | |||||||

| (Loss) /Profit for the year | (83,623,097 | ) | 994,194 | (803,980 | ) | |||||||

| Other comprehensive (loss)/income | ||||||||||||

| Other comprehensive (loss)/income that may be reclassified to profit or loss in subsequent periods (net of tax): | ||||||||||||

| Foreign currency translation | (106,213 | ) | 26,610 | 46,459 | ||||||||

| Total comprehensive (loss)/income for the year, net of tax | (83,729,310 | ) | 1,020,804 | (757,521 | ) | |||||||

| (Loss) /Profit for the year attributable to: | ||||||||||||

| Equity holders of the parent company | (83,637,387 | ) | 960,686 | (783,037 | ) | |||||||

| Non-controlling interests | 14,290 | 33,508 | (20,943 | ) | ||||||||

| (83,623,097 | ) | 994,194 | (803,980 | ) | ||||||||

| Total comprehensive (loss)/income for the year attributable to: | ||||||||||||

| Equity holders of the parent company | (83,743,600 | ) | 987,296 | (736,578 | ) | |||||||

| Non-controlling interests | 14,290 | 33,508 | (20,943 | ) | ||||||||

| (83,729,310 | ) | 1,020,804 | (757,521 | ) | ||||||||

| (Loss)/Earnings per share | ||||||||||||

| Basic | (5.08 | ) | 9.61 | (7.83 | ) | |||||||

| Diluted | (5.08 | ) | 9.61 | (7.83 | ) | |||||||

CONCORDE INTERNATIONAL GROUP LTD.

CONSOLIDATED STATEMENTS OF CASH FLOWS

FOR THE YEAR ENDED DECEMBER 31, 2024, 2023 and 2022

| 2024 | 2023 | 2022 | ||||||||||

| USD | USD | USD | ||||||||||

| Cash flows from operating activities | ||||||||||||

| (Loss)/Profit before tax | (83,508,195 | ) | 1,125,434 | (803,980 | ) | |||||||

| Adjustments for: | ||||||||||||

| Depreciation of property and equipment | 149,895 | 188,969 | 292,044 | |||||||||

| Depreciation of right-of-use assets | 74,662 | 48,134 | 18,932 | |||||||||

| Amortization of intangible assets | 54,986 | 92,734 | 78,473 | |||||||||

| Interest expense | 218,630 | 149,626 | 75,033 | |||||||||

| Interest income | (35,940 | ) | (29,853 | ) | (48,405 | ) | ||||||

| Amount due from related party written off | 2,131 | - | 233,497 | |||||||||

| Share-based compensation | 83,155,336 | - | - | |||||||||

| Expected credit loss provision | 562,755 | - | - | |||||||||

| Fair value adjustment | 117,973 | - | - | |||||||||

| Operating cash flows before movements in working capital | 792,233 | 1,575,044 | (154,406 | ) | ||||||||

| Change in working capital: | ||||||||||||

| Decrease in trade and other receivables | (892,894 | ) | (930,482 | ) | (1,537,479 | ) | ||||||

| Increase in trade and other payables | (446,240 | ) | 190,338 | 661,281 | ||||||||

| Decrease in amount due to related parties | (17,286 | ) | (43,956 | ) | 99,576 | |||||||

| Cash used in operations | (564,187 | ) | 790,944 | (931,028 | ) | |||||||

| Net cash (used in)/provided by operating activities | (564,187 | ) | 790,944 | (931,028 | ) | |||||||

| Cash flows from investing activities | ||||||||||||

| Purchase of property and equipment | (1,052,484 | ) | (407,203 | ) | - | |||||||

| Premium paid for purchase of keyman insurance | (85,913 | ) | - | - | ||||||||

| Proceeds from disposal of property and equipment | - | 30,942 | - | |||||||||

| Acquired intangible asset | - | (4,819 | ) | - | ||||||||

| Loan repaid from / (to) related parties | 185,407 | 71,449 | (912,089 | ) | ||||||||

| Net cash used in investing activities | (952,990 | ) | (309,631 | ) | (912,089 | ) | ||||||

| Cash flows from financing activities | ||||||||||||

| Proceeds from issuance of shares | 208 | - | - | |||||||||

| Payment of deferred offering cost | (333,088 | ) | - | - | ||||||||

| Proceeds from borrowings | 3,259,062 | 2,036,696 | 1,116,450 | |||||||||

| Repayment of borrowings | (1,255,766 | ) | (1,984,699 | ) | (493,431 | ) | ||||||

| Repayment of lease liabilities | (80,581 | ) | (51,050 | ) | (20,096 | ) | ||||||

| Net cash provided by financing activities | 1,589,835 | 947 | 602,923 | |||||||||

| Net (decrease)/increase in cash and cash equivalents | 72,658 | 482,260 | (1,240,194 | ) | ||||||||

| Cash and cash equivalents at beginning of year | 956,975 | 441,278 | 1,606,611 | |||||||||

| Effect of foreign exchange rate changes on cash and cash equivalents | (29,351 | ) | 33,437 | 74,861 | ||||||||

| Cash and cash equivalents at December 31, 2024 | 1,000,284 | 956,975 | 441,278 | |||||||||

| Non-cash investing and financing activities | ||||||||||||

| Fair value measurement of share-based compensation | 83,155,336 | - | - | |||||||||

| Fair value adjustment for other financial assets | 16,615 | - | - | |||||||||

| Fair value adjustment for other financial liabilities | 101,357 | - | - | |||||||||

| Initial measurement of right-of-use asset and lease liability | 223,755 | 76,713 | - | |||||||||