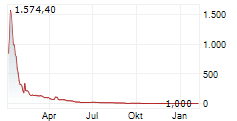

NAPLES, Fla. and CAMBRIDGE, United Kingdom, May 16, 2025 (GLOBE NEWSWIRE) -- Conduit Pharmaceuticals Inc. (Nasdaq: CDT) ("Conduit" or the "Company"), a dynamic, multi-asset clinical stage, life science company delivering an efficient model for compound development, announces that its board of directors has approved a 1-for-15 reverse stock split of the Company's common stock. The Company's stockholders approved the reverse stock split proposal at the Company's Special Meeting of Stockholders held on May 5, 2025. They granted the board of directors the authority to determine the exact split ratio and when to proceed with the reverse stock split.

The reverse stock split will become effective on May 19, 2025, at 5:00 pm, Eastern Time (the "Effective Time"), and the Company's common stock is expected to begin trading on a reverse stock split-adjusted basis on The Nasdaq Global Market ("Nasdaq") at market open under the existing ticker symbol, "CDT" on May 20, 2025, the date which has been approved by Nasdaq for the effectiveness of such split.

As of the Effective Time, every fifteen shares of the Company's issued and outstanding common stock will be combined into one share of common stock. The par value per share of the Company's common stock will remain unchanged at $0.0001. Proportional adjustments will be made to the number of shares of common stock issuable upon the exercise of the Company's equity awards, convertible securities and warrants, as well as the applicable exercise price, and the number of shares authorized and reserved for issuance pursuant to the Company's equity incentive plans.

The Company's common stock will continue to trade on The Nasdaq Stock Market under the symbol "CDT" following the reverse stock split, with a new CUSIP number of 20678X 304. After the effectiveness of the reverse stock split, the number of outstanding shares of common stock will be reduced to approximately 755,900. No fractional shares will be issued in connection with the reverse stock split, and stockholders who would otherwise be entitled to a fractional share will receive a proportional cash payment.

The Company's transfer agent, VStock Transfer, LLC, will serve as the exchange agent for the reverse stock split. Registered stockholders holding pre-reverse stock split shares of common stock electronically in book-entry form are not required to take any action to receive post-reverse stock split shares. Those stockholders who hold their shares in brokerage accounts or in "street name" will have their positions automatically adjusted to reflect the reverse stock split, subject to each broker's particular processes, and will not be required to take any action in connection with the reverse stock split.

Additional information about the reverse stock split can be found in the Company's definitive proxy statement filed with the Securities and Exchange Commission on April 25, 2025, a copy of which is available at www.sec.gov.

About Conduit Pharmaceuticals

Conduit is a dynamic, multi-asset clinical stage, life science company delivering an efficient model for compound development. Conduit both acquires and funds the development of Phase 2-ready assets, building an integrated and advanced platform-driven approach powered by artificial intelligence (AI) and cybernetics, and seeking an exit through third-party license deals following successful clinical trials. Led by a highly experienced team of executives including Dr. Andrew Regan and Dr. Freda Lewis-Hall, this novel approach is a departure from the traditional pharma/biotech business model of taking assets through regulatory approval.

Cautionary Statement Regarding Forward-Looking Statements

This press release contains certain forward-looking statements within the meaning of the federal securities laws. All statements other than statements of historical facts contained in this press release, including statements regarding Conduit's future results of operations and financial position, Conduit's business strategy, prospective product candidates, product approvals, research and development costs, timing and likelihood of success, plans and objectives of management for future operations, future results of current and anticipated studies and business endeavors with third parties, and future results of current and anticipated product candidates, are forward-looking statements. These forward-looking statements generally are identified by the words "believe," "project," "expect," "anticipate," "estimate," "intend," "strategy," "future," "opportunity," "plan," "may," "should," "will," "would," "will be," "will continue," "will likely result," and similar expressions. These forward-looking statements are subject to a number of risks, uncertainties and assumptions, including, but not limited to: the effect that the reverse stock split may have on the price of the Company's common stock; the ability or inability to maintain the listing of Conduit's securities on Nasdaq; the ability to recognize the anticipated benefits of the business combination completed in September 2023, which may be affected by, among other things, competition; the ability of the combined company to grow and manage growth economically and hire and retain key employees; the risks that Conduit's product candidates in development fail clinical trials or are not approved by the U.S. Food and Drug Administration or other applicable authorities on a timely basis or at all; changes in applicable laws or regulations; the possibility that Conduit may be adversely affected by other economic, business, and/or competitive factors; and other risks as identified in filings made by Conduit with the U.S. Securities and Exchange Commission. Moreover, Conduit operates in a very competitive and rapidly changing environment. Because forward-looking statements are inherently subject to risks and uncertainties, some of which cannot be predicted or quantified and some of which are beyond Conduit's control, you should not rely on these forward-looking statements as predictions of future events. Forward-looking statements speak only as of the date they are made. Readers are cautioned not to put undue reliance on forward-looking statements, and except as required by law, Conduit assumes no obligation and does not intend to update or revise these forward-looking statements, whether as a result of new information, future events, or otherwise. Conduit gives no assurance that it will achieve its expectations.

Investors

Conduit Pharmaceuticals Inc.

Info@conduitpharma.com