DJ Coinsilium Group Limited: Strategic Update on Forza! Bitcoin Treasury Accumulation Roadmap and Live X Space

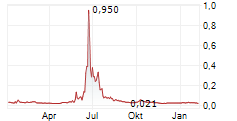

Coinsilium Group Limited (COIN)

Coinsilium Group Limited: Strategic Update on Forza! Bitcoin Treasury Accumulation Roadmap and Live X Space

22-May-2025 / 10:36 GMT/BST

=----------------------------------------------------------------------------------------------------------------------

Coinsilium Group Limited

("Coinsilium" or the "Company")

Strategic Update on Forza! Bitcoin Treasury Accumulation Roadmap and Live X Space

Gibraltar - 22 May 2025 Coinsilium Group Limited (AQSE: COIN | OTCQB: CINGF), is pleased to provide a strategic update

regarding its dedicated Bitcoin treasury vehicle, Forza!, and to reaffirm its commitment to the long-term development

of a scalable, institution-grade Bitcoin adoption model.

With Bitcoin recently breaking through to new all-time highs, the Company remains focused on its long-term view of

Bitcoin as a resilient store of value and a cornerstone of future financial infrastructure-an understanding recognised

by retail investors and now increasingly acknowledged by institutional investors.

Coinsilium Executive Chairman Malcolm Pallé commented:

"This is a strategic build with a clear long-term goal: to position Forza! as a treasury vehicle that aligns with the

standards of institutional allocators, while never losing sight of the early conviction and support of retail

investors. Retail investors have been proven to be the smartest players in the room during this cycle, and Forza! gives

them a rare opportunity to lead before the institutions follow."

Coinsilium Chief Executive Eddy Travia added:

"We are developing Forza! to deliver a scalable and resilient Bitcoin treasury proposition. The initial 15 Bitcoin

allocation marks the beginning of a deliberate and sustained accumulation strategy, and we intend to grow this

aggressively. Our strategic focus remains on credibility, transparency, and building real long-term value."

Following the successful completion of its most recent fundraising round, Coinsilium confirms that it has now initiated

the process of scaling up Forza!'s Bitcoin holdings with an initial allocation of a minimum of 15 Bitcoin, as announced

in its 20 May 2025, "Initial Bitcoin Purchase Plan and Allocation to Forza!". This allocation represents the foundation

of an aggressive Bitcoin accumulation strategy, as a core driver of Forza!'s value proposition going forwards. For each

Bitcoin acquisition made for Forza's treasury, Coinsilium will report the quantity purchased and the aggregate price

paid.

The structure of Forza! has been designed from the outset to meet the standards of institutional investors, with a

strong emphasis on transparent governance, robust custodial security, regulatory compatibility, and operational best

practices. It aims to serve as a professional-grade vehicle through which investors can gain exposure to a

Bitcoin-focused strategy as it evolves and scales.

In this respect, the Company is already receiving a significant level of institutional interest in Forza! -an

anticipated development given the limited availability of institutional-grade Bitcoin exposure opportunities in the UK

market, particularly when compared to the more advanced landscape in the United States. With Coinsilium's established

reputation as a recognised and listed company for over 10 years, this early engagement further validates the Company's

strategic model and its focus on progressively establishing the operational and governance framework required to

support institutional investment.

While discussions remain at an early stage, the Company is encouraged by the current level of engagement and will

continue to engage with relevant parties in the weeks and months ahead. The Company will announce to the market any

material developments in this regard.

For retail investors, this interest highlights the early stage of market engagement, at a time when institutions are

only beginning to explore structured exposure to Bitcoin through professionally managed treasury vehicles.

Strategic Advisory and Industry Engagement

As part of its broader strategic alignment efforts, Coinsilium has appointed two highly regarded advisers to support

the development and positioning of Forza!:

-- James Van Straten, Senior Bitcoin analyst at Coindesk is widely respected as a thought leader in the

Bitcoin space, known for his market intelligence, data-driven insights, and deep understanding of macro and

on-chain trends. James has been instrumental in shaping the analytical frameworks now being used to assess the

credibility and performance of public Bitcoin treasury companies.

His latest article in CoinDesk, titled "Days to Cover and MNAV: The New Standard for Evaluating Bitcoin Equities",

introduces powerful valuation metrics such as its multiple to Net Asset Value (MNAV) and Days to Cover, which are

quickly becoming industry standards for evaluating Bitcoin-focused equities.

Notably, the article highlights MetaPlanet as a benchmark example of a public company capturing market attention

through transparent Bitcoin accumulation. This context will be highly relevant to Forza!'s development, and

investors tracking this trend will find Van Straten's insights especially pertinent.

-- Kevin Follonier, a seasoned strategist, communicator, and podcast host, brings deep expertise in media

engagement and Web3 positioning. Kevin is known for curating thoughtful conversations with high-profile guests

across the Bitcoin, crypto, and macroeconomic arenas via his widely followed podcast series "When Shift Happens".

His ability to elevate narratives to the right audiences-particularly through U.S.-focused and global investor

channels-is a critical asset as Coinsilium looks to expand awareness of Forza!

By working with advisers who are recognised by both traditional investors and leading players in the Bitcoin space,

Coinsilium aims to position Forza! at the forefront of a new generation of treasury-focused initiatives.

In parallel, Forza! is actively progressing media and investor engagement initiatives across both leading industry

platforms and retail-focused investor outreach channels. These efforts, now underway following the successful close of

the recent fundraising, are intended to ensure that the Forza!'s aggressive Bitcoin accumulation strategy is clearly

communicated and visible to a widest possible audience.

X Space Friday 12pm UK Time

A live X Space event hosted by James Van Straten will take place on Friday, 23 May 2025, with participation from

Malcolm Pallé (Executive Chairman) and Eddy Travia (Chief Executive). Topics will include the UK regulatory landscape

and the Forza! Bitcoin treasury strategy. Other participants include the Head of Policy at @bitcoinpolicyuk and

Co-Founder of @IcdefResearch. The X Space can be accessed at the following address:

https://x.com/i/spaces/1OwxWXoopzkKQ

Coinsilium will continue to provide regular updates on Forza!'s Bitcoin acquisition milestones and treasury deployment

developments, including additional details around its yield optimisation strategy - designed to enhance long-term

treasury performance through internally generated returns.

The Directors of Coinsilium Group Limited take responsibility for this announcement.

Coinsilium Group Limited +350 2000 8223

Malcolm Palle, Executive Chairman +44 (0) 7785 381 089

Eddy Travia, Chief Executive www.coinsilium.com

Peterhouse Capital Limited

+44 (0) 20 7469 0930

(AQUIS Growth Market Corporate Adviser and Corporate Broker)

SI Capital Limited (Joint Broker) +44 (0)1483 413 500

Nick Emerson

Oberon Capital (Joint Broker)

+44 (0) 20 3179 5300

Nick Lovering, Adam Pollock

OAK Securities (Joint Broker)

Tel. +44 (0) 20 3973 3678

Damion Carruel, Calvin Man

Notes to Editors

About Coinsilium

Coinsilium is an investor, advisor and venture builder at the forefront of Web3 convergence. The Company invests in and accelerates Web3 and AI-powered technology start-ups whilst supporting their development and commercialisation.

Coinsilium also provides strategic advisory services to start-ups looking to issue tokens through token generation events. Coinsilium's wholly owned subsidiary, Coinsilium (Gibraltar) Limited, serves as the Company's operational hub in Gibraltar.

In 2025, the Company launched Forza Gibraltar Limited ("Forza!"), its wholly owned Gibraltar-based subsidiary focused on holding Bitcoin and deploying digital asset strategies. In addition to acting as a Bitcoin treasury vehicle, Forza! utilises stablecoins to generate yield, with the objective of enhancing the productivity of its Bitcoin holdings. Forza! also promotes the broader adoption of digital assets, with a particular emphasis on Bitcoin.

In 2015, Coinsilium became the first blockchain company to IPO. Coinsilium shares are traded on the AQSE Growth Market in London, under the ticker symbol "COIN", and on the OTCQB Venture Market in the United States under the ticker symbol "CINGF".

----------------------------------------------------------------------------------------------------------------------- Dissemination of a Regulatory Announcement that contains inside information in accordance with the Market Abuse Regulation (MAR), transmitted by EQS Group. The issuer is solely responsible for the content of this announcement.

-----------------------------------------------------------------------------------------------------------------------

ISIN: VGG225641015 Category Code: MSCM TIDM: COIN Sequence No.: 390121 EQS News ID: 2143698 End of Announcement EQS News Service =------------------------------------------------------------------------------------

Image link: https://eqs-cockpit.com/cgi-bin/fncls.ssp?fn=show_t_gif&application_id=2143698&application_name=news&site_id=dow_jones%7e%7e%7ef1066a31-ca00-4e1a-b0a4-374bd7d0face

(END) Dow Jones Newswires

May 22, 2025 05:37 ET (09:37 GMT)