NESS ZIONA, Israel, May 23, 2025 (GLOBE NEWSWIRE) -- Sol-Gel Technologies, Ltd. (NASDAQ: SLGL), a clinical-stage dermatology company, today announced financial results for the first quarter ended March 31, 2025.

Financial Results for the First Quarter Year Ended March 31st, 2025

Total revenue in the first quarter was $1 million compared to $0.5 million revenues for the same period in 2024.

Research and development expenses were $8.8 million?compared to $5.3 million?in the same period in 2024. The increase of $3.5 million?was primarily attributed to an increase of $3.6 million due to expenses associated with supplier-led manufacturing development to support future commercialization of SGT-610, an increase of $0.5 million related to the commercialization of EPSOLAY and TWYNEO in territories outside of the U.S., offset by a decrease of $0.5 million in clinical trial expenses related to SGT-610.

General and administrative expenses were $1.3 million compared to $1.8 million for the same period in 2024. The decrease of $0.5 million was mainly attributed to a decrease in payroll and stock-based compensation expenses due to cost measures being taken in 2024.

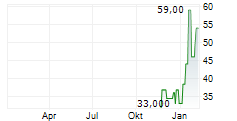

Sol-Gel reported a net loss of $8.8 million for the first quarter of 2025 and of $3.2 basic and diluted loss per share, compared to a net loss of $6.3 million and a loss of $2.3 per basic and diluted share for the same period in 2024.

As of March 31, 2025, Sol-Gel had $16.9 million in cash, cash equivalents, and deposits and no marketable securities for a total balance of $16.9 million.

The Company expects its cash resources to fund cash requirements into the first quarter of 2027.

About Sol-Gel Technologies

Sol-Gel Technologies, Ltd. is a dermatology company focused on identifying, developing and commercializing or partnering drug products for the treatment of skin diseases. Sol-Gel developed TWYNEO which is approved by the FDA for the treatment of acne vulgaris in adults and pediatric patients nine years of age and older; and EPSOLAY, which is approved by the FDA for the treatment of inflammatory lesions of rosacea in adults.

The Company's pipeline includes Orphan Drug candidate, SGT-610 under investigation for the prevention of new basal cell carcinomas in Gorlin syndrome patients, and also includes topical drug candidate SGT-210 under investigation for the treatment of rare skin keratodermas.

For additional information, please visit www.sol-gel.com.

Forward Looking Statements

This press release contains "forward-looking statements" within the meaning of the Private Securities Litigation Reform Act of 1995. All statements contained in this press release that do not relate to matters of historical fact should be considered forward-looking statements, including, but not limited to our expected cash runway. In some cases, you can identify forward-looking statements by terminology such as "believe," "may," "estimate," "continue," "anticipate," "intend," "should," "plan," "expect," "predict," "potential," or the negative of these terms or other similar expressions. Forward-looking statements are based on information we have when those statements are made or our management's current expectations and are subject to risks and uncertainties that could cause actual performance or results to differ materially from those expressed in or suggested by the forward-looking statements. Important factors that could cause such differences include, but are not limited to, our ability to enter into further collaborations, lower than anticipated annual revenue income from new collaborations, a delay in the timing of our clinical trials, the success of our clinical trials, and an increase in our anticipated costs and expenses, as well as the following factors: (i) the adequacy of our financial and other resources, particularly in light of our history of recurring losses and the uncertainty regarding the adequacy of our liquidity to pursue our complete business objectives; (ii) our ability to complete the development of our product candidates; (iii) our ability to find suitable co-development partners; (iv) our ability to obtain and maintain regulatory approvals for our product candidates in our target markets, the potential delay in receiving such regulatory approvals and the possibility of adverse regulatory or legal actions relating to our product candidates even if regulatory approval is obtained; (v) our collaborators' ability to commercialize our pharmaceutical product candidates; (vi) our ability to obtain and maintain adequate protection of our intellectual property; (vii) our collaborators' ability to manufacture our product candidates in commercial quantities, at an adequate quality or at an acceptable cost; (viii) our collaborators' ability to establish adequate sales, marketing and distribution channels; (ix) acceptance of our product candidates by healthcare professionals and patients; (x) the possibility that we may face third-party claims of intellectual property infringement; (xi) the timing and results of clinical trials that we may conduct or that our competitors and others may conduct relating to our or their products; (xii) intense competition in our industry, with competitors having substantially greater financial, technological, research and development, regulatory and clinical, manufacturing, marketing and sales, distribution and personnel resources than we do; (xiii) potential product liability claims; (xiv) potential adverse federal, state and local government regulation in the United States, China, Europe or Israel; and (xv) loss or retirement of key executives and research scientists; (xvi) general market, political and economic conditions in the countries in which the Company operates; and, (xvii) the current war between Israel and Hamas and any deterioration of the war in Israel into a broader regional conflict involving Israel with other parties. These factors and other important factors discussed in the Company's Annual Report on Form 20-F filed with the Securities and Exchange Commission ("SEC") on April 29, 2025, and our other reports filed with the SEC, could cause actual results to differ materially from those indicated by the forward-looking statements made in this press release. Except as required by law, we undertake no obligation to update any forward-looking statements in this press release.

| SOL-GEL TECHNOLOGIES LTD. | |||||||||

| CONDENSED CONSOLIDATED BALANCE SHEETS | |||||||||

| (U.S. dollars in thousands) | |||||||||

| (Unaudited) | |||||||||

| December 31, | March 31, | ||||||||

| 2024 | 2025 | ||||||||

| Assets | |||||||||

| CURRENT ASSETS: | |||||||||

| Cash and cash equivalents | $ | 19,489 | $ | 16,890 | |||||

| Bank deposits | 12 | 12 | |||||||

| Marketable securities | 4,425 | - | |||||||

| Accounts receivables | 3,595 | 3,883 | |||||||

| Prepaid expenses and other current assets | 3,774 | 2,647 | |||||||

| TOTAL CURRENT ASSETS | 31,295 | 23,432 | |||||||

| NON-CURRENT ASSETS: | |||||||||

| Restricted long-term deposits and cash equivalents | 1,291 | 1,293 | |||||||

| Long-term receivables | 1,024 | 518 | |||||||

| Property and equipment, net | 202 | 183 | |||||||

| Operating lease right-of-use assets | 1,426 | 1,332 | |||||||

| Other long-term assets | 13 | - | |||||||

| Funds in respect of employee rights upon retirement | 595 | 305 | |||||||

| TOTAL NON-CURRENT ASSETS | 4,551 | 3,631 | |||||||

| TOTAL ASSETS | $ | 35,846 | $ | 27,063 | |||||

| Liabilities and shareholders' equity | |||||||||

| CURRENT LIABILITIES: | |||||||||

| Accounts payable | $ | 1,265 | $ | 438 | |||||

| Other accounts payable | 3,590 | 3,702 | |||||||

| Current maturities of operating leases | 430 | 433 | |||||||

| TOTAL CURRENT LIABILITIES | 5,285 | 4,573 | |||||||

| LONG-TERM LIABILITIES: | |||||||||

| Operating leases liabilities | 878 | 746 | |||||||

| Liability for employee rights upon retirement | 833 | 363 | |||||||

| Other long-term Liability | 1,209 | ||||||||

| TOTAL LONG-TERM LIABILITIES | 1,711 | 2,318 | |||||||

| TOTAL LIABILITIES | 6,996 | 6,891 | |||||||

| SHAREHOLDERS' EQUITY: | |||||||||

| Ordinary shares, NIS 0.1 par value - authorized: 5,000,000 as of December 31, | |||||||||

| 2024 and March 31, 2025, respectively; issued and outstanding: 2,785,762 as of December 31, 2024 and March 31, 2025, respectively (*) | 774 | 774 | |||||||

| Additional paid-in capital | 258,959 | 259,089 | |||||||

| Accumulated deficit | (230,883) | (239,691) | |||||||

| TOTAL SHAREHOLDERS' EQUITY | 28,850 | 20,172 | |||||||

| TOTAL LIABILITIES AND SHAREHOLDERS' EQUITY | $ | 35,846 | $ | 27,063 | |||||

| (*) All share amounts have been retroactively adjusted to reflect a 1-for-10 reverse share split. | |||||||||

| SOL-GEL TECHNOLOGIES LTD. | ||||||

| CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS | ||||||

| (U.S. dollars in thousands) | ||||||

| (Unaudited) | ||||||

| Three months ended March 31 | ||||||

| 2024 | 2025 | |||||

| LICENSE REVENUES | $ | 466 | $ | 1,031 | ||

| RESEARCH AND DEVELOPMENT EXPENSES | 5,345 | 8,843 | ||||

| GENERAL AND ADMINISTRATIVE EXPENSES | 1,833 | 1,257 | ||||

| OPERATING LOSS | 6,712 | 9,069 | ||||

| FINANCIAL INCOME,net | (368) | (261) | ||||

| LOSS FOR THE PERIOD | 6,344 | 8,808 | ||||

| BASIC AND DILUTED LOSS PER ORDINARY SHARE | 2.3 | 3.2 | ||||

| WEIGHTED AVERAGE NUMBER OF | ||||||

| SHARES*OUTSTANDING USED IN COMPUTATION OF BASIC AND DILUTED LOSS PER SHARE (*) | 2,785,762 | 2,785,762 | ||||

| (*)All share amounts have been retroactively adjusted to reflect a 1-for-10 reverse share split. | ||||||

Sol-Gel Contact:

Eyal Ben-Or

Chief Financial Officer

ir@sol-gel.com

+972-8-9313429

Source: Sol-Gel Technologies Ltd.