CUPERTINO, CA / ACCESS Newswire / May 23, 2025 / In an era defined by geopolitical volatility and increasing supply chain complexity, the ability to accurately calculate the true cost of goods is more critical than ever. Jerry Kun-Zhe Lee, a seasoned supply chain expert with a distinguished career spanning Apple, Hewlett Packard Enterprise, Texas Instruments, Merck, Microsoft, and Yahoo, has long been at the forefront of this challenge. His foundational work at the Massachusetts Institute of Technology (MIT), culminating in the publication of his "Total Landed Cost Model," laid the groundwork for strategic global sourcing.

As multinational corporations increasingly seek cost efficiencies through sourcing from diverse global locations, the need to precisely account for dynamic variables such as materials, labor, energy, transportation, customs duties, and tariffs has become paramount. In today's rapidly evolving geopolitical landscape, Lee emphasizes that Artificial Intelligence (AI)-powered solutions are no longer a luxury but an essential tool for enabling agile, data-driven purchasing decisions that are vital for maintaining both corporate profitability and national competitiveness.

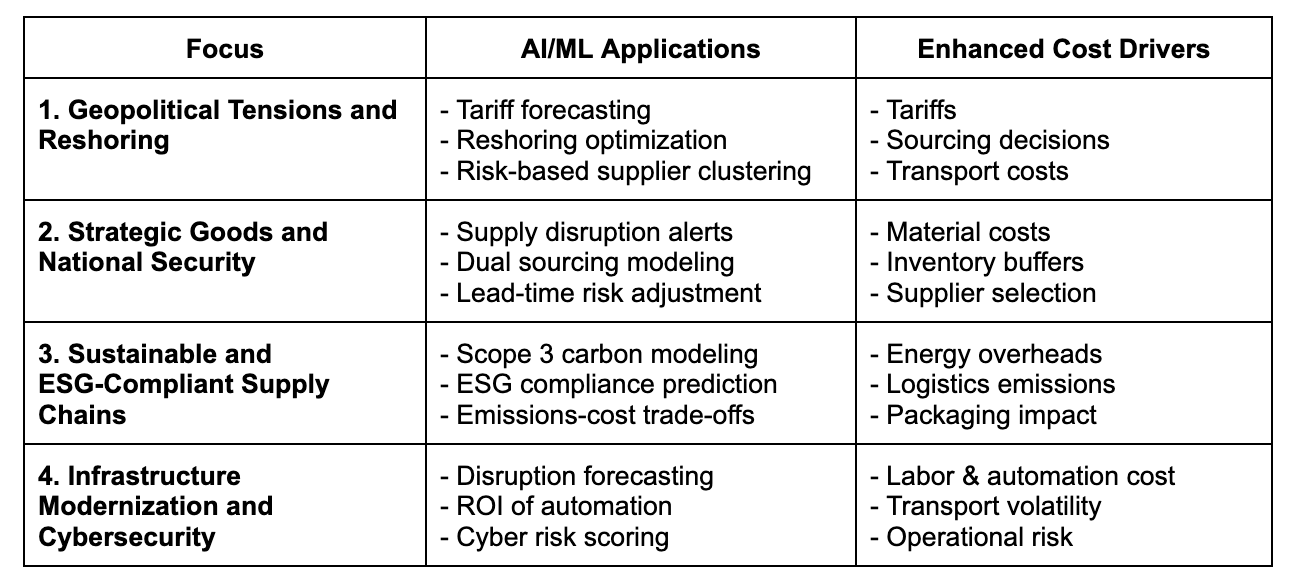

Drawing upon his extensive experience and academic rigor, Lee has identified four key focus areas for U.S. supply chains in 2025:

1. Geopolitical Tensions and Reshoring: The ongoing complexities of U.S.-China relations, coupled with tariffs on key materials like steel and aluminum, are compelling companies to re-evaluate their reliance on foreign manufacturing. This shift is manifesting in increased reshoring and nearshoring initiatives aimed at mitigating both geopolitical and logistical vulnerabilities. Simultaneously, strategic trade agreements such as the USMCA and the Indo-Pacific Economic Framework are being leveraged to fortify regional supply chain networks.

2. Strategic Goods and National Security: Ensuring secure access to critical resources such as semiconductors, essential minerals, battery materials, and pharmaceuticals remains a top national priority. Recognizing the dual importance of semiconductors for defense and consumer industries, the CHIPS and Science Act has allocated significant funding to bolster domestic production. Furthermore, the growing adoption of electric vehicles is driving investments in domestic mining and the formation of strategic alliances to secure the supply of vital materials like lithium, cobalt, nickel, and rare earth elements.

3. Sustainable and ESG-Compliant Supply Chains: Environmental, social, and governance (ESG) standards are increasingly shaping corporate supply chain strategies. Driven by regulatory mandates and evolving consumer expectations, companies are under pressure to reduce their carbon footprint, enhance supply chain transparency, and embrace circular economy principles. The reporting of Scope 3 emissions, which encompasses indirect emissions throughout the supply chain, is gaining significant traction.

4. Infrastructure Modernization and Cybersecurity: Persistent bottlenecks in ports, driver shortages, and rail congestion continue to strain the nation's logistics infrastructure. Federal investments through the Infrastructure Investment and Jobs Act are targeting critical upgrades to ports, railways, and highways. Concurrently, labor shortages are accelerating the adoption of automation in both logistics and manufacturing sectors. As supply chains become increasingly digitized, the threat of cyberattacks is also growing, prompting heightened federal efforts to strengthen cyber resilience across supply networks.

Lee's insights highlight the urgent need for businesses to adopt advanced tools-such as AI-powered total landed cost models-to navigate growing complexity and build resilient, secure, and sustainable global supply chains. This requires a wide range of structured and unstructured data, including tariff schedules, trade agreements (e.g., USMCA, IPEF), political risk indices, labor market data, and global commodity prices (e.g., LME, CME). ESG modeling depends on environmental metrics like carbon intensity, transportation emissions, and Scope 3 data. Complementary inputs-such as freight indices, supplier ESG scores, and cyber risk data (e.g., CISA alerts)-sharpen forecasting and risk evaluation. These predictive models rely on near real-time public and proprietary data to simulate complex global sourcing dynamics.

It's a vital framework for companies-and even countries-looking to make informed, strategic sourcing decisions in an increasingly volatile world. In today's environment, agility and data-driven foresight are no longer optional-they're essential.

Contact:

Katie Hsieh

kthu1031@gmail.com

SOURCE: TaiwanNext Foundation

View the original press release on ACCESS Newswire:

https://www.accessnewswire.com/newsroom/en/electronics-and-engineering/how-ai-powered-total-landed-cost-models-are-revolutionizing-global-supp-1030936