Toronto, Ontario--(Newsfile Corp. - May 27, 2025) - PTX Metals Inc. (TSXV: PTX) (OTCQB: PANXF) (FSE: 9PX) ("PTX" or the "Company"), a mineral exploration company focused on Cu-Ni-Au-PGE and Gold projects in Ontario, announces initial assay results from two drill holes of its Phase 1 of 2025 drilling program at the W2 Cu-Ni-PGE and Gold Project located in the Ring of Fire, northwestern Ontario, Canada (the "W2 Project"). This marks the first drill campaign in the CA zones (CA1 and CA2 see attached image) since 1990s, aiming to infill, confirm and expand historical reported drill results. Assays are pending for the additional drillholes.

The W2 Project drilling strategy targets near-surface copper-bearing disseminated sulphide mineralization and aims to demonstrate the continuity of the system along strike and at depth. Based on the current and historical drilling, combined with geophysical surveys, the central target area is interpreted to extend for approximately 8 km in strike length and remains open at depth (see press release of May 7th, 2025).

The second objective of the exploration program was to better delineate semi-massive to massive sulfides mineralization as well as Nickel sulphides in the CA zones reported by historical mineral exploration work, and to evaluate the presence of Gold and Platinum Group Elements (PGEs) that were not assayed in many historical drill holes.

Historical drilling was selective in assaying for all commodities and selective sampling procedures occurred. As a result, the Company has systematically assayed for Copper, Nickel, Gold, Palladium, Platinum and Cobalt and is now not reporting using Metal Equivalents and seen substantial improvements in the widths of mineralization with these practices. Additionally, for simplification purposes, Cu+Ni (%) and Au+Pt+Pd (g/t) are reported below as the arithmetic sum of individual commodity per interval chosen. Individual grades by commodity are also shown in table 1.

Highlights - Drill Holes W225-10 and W225-11

- Drillhole W225-10 intercepted the widest mineralized near-surface intercept to date, which reports a width of 235.14 m of mineralization, starting directly after the overburden at 19.86m. Located 3 km away to the east, drillhole W225-11 intersected a zone of higher-grade near surface mineralization demonstrating consistence along strike of the targeted geophysical anomaly connecting CA1 and CA2 zones (see Figure 1).

- Highest-grades by individual commodity in the two holes combined include: 1.81% Copper, 1.48% Nickel, 5.59 g/t Gold, 0.66 g/t Platinum and 0.57 g/t Palladium and Cobalt 0.13%

- Drillhole W225-11 intercepted the CA2 Zone 58.00 of core length from 37.00 m to 95.00 m and returned 0.27% Cu, 0.21% Ni, and 0.23 g/t Au+Pt+Pd, including multiple shorter higher-grade intervals such as:

- 17.00 m of 0.50% Cu, 0.40% Ni and 0.33 g/t (Au+Pt+Pd) and 2.07 m of 1.32% Cu, 0.26% Ni, and 0.20 g/t (Au+Pt+Pd) (see Table 1 below for details):

- Drillhole W225-10 intercepted a near-surface significant number of continuous higher-grade intervals throughout the length of the 235.14 m that reported 0.17% Cu, 0.08% Ni and 0.18 g/t (Au+Pt+Pd) to 255.00 m, including multiple higher-grade intervals:

- 26.14 m of 0.30% Cu, 0.07% Ni, and 0.14 g/t (Au+Pt+Pd)

- 5.36 m of 0.59% Cu, 0.14% Ni and 0.29 g/t (Au+Pt+Pd)

- 29.00 m of 0.25% Cu, 0.15% Ni and 0.14 g/t (Au+Pt+Pd)

- 42.00 m at 0.22% Cu, 0.12% Ni and 0.15 g/t (Au+Pt+Pd)

- 13.00 m of 0.30% Cu, 0.14% Ni, and 0.36 g/t (Au+Pt+Pd)

- 6.60 m of 0.43% Cu, 0.20% Ni and 0.42 g/t (Au+Pt+Pd)

- 0.68 m of 1.50% Cu, 0.29% Ni and 0.43 g/t (Au+Pt+Pd)

- Systematic sampling in both holes shows improved widths over nearby historical drillholes suggesting potential to improve width and tonnage of the mineralized zones at depth (Figure 2 and 3). Additionally, a repeating pattern of higher-grade Cu-Ni mineralization within the broader hole has been observed throughout the holes, suggesting that further mineralization could extend at depth. Hole W225-10 intercepted 0.79% (Cu+Ni) and 0.54 g/t (Au+Pt+Pd) at 247.00-249.00m.

Greg Ferron, President and CEO of PTX Metals, stated: "We are very encouraged by the results from drill holes W225-10 and W225-11 that were drilled into CA1 and CA2 zones respectively at our W2 Cu-Ni-PGE and Gold Project. These results start validating the exploration target issued last September, which outlines a large near-surface project and improves the understanding of our exploration model. Hole W225-10 and W225-11 intersected broader and deeper zones of mineralization than previously reported, demonstrating improved continuity and the potential to significantly expand both CA1 and CA2 zone at depth."

Table 1: Selected Results from drill holes W225-10 and W225-11. Intervals reported as core lengths. True widths are unknown at this time.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/7277/253464_ptxtable1.jpg

Drillhole W225-10, drilled into the CA1 Zone, was designed as an infill and expansion hole near historical holes 54004-0 and 54007-0 drilled by Inco. The new results not only confirmed the continuity of the mineralized horizon but defined a wider and deeper intercept than previously reported in historical data (Figure 2). Historical holes 54007-0 and 54005-0 were drilled at shallower depth and weren't sampled throughout (up to 37.85m in hole 54007-0 and 42.43m in hole 54005-0 not sampled). PTX's more comprehensive sampling in W225-10 demonstrates better continuity of the near-surface mineralization over a thicker interval; this could potentially lead to a growth upside toward the exploration target and toward a potential resource estimate. Follow-up drilling is being planned to further test continuity and grade of the CA1 zone.

Drillhole W225-11 was designed to infill and to validate historical drill holes, which duplicated holes 54002-0 drilled by Inco (noting with small adjustment in the azimuth and dip, allowing better definition of the true width). Also, historical Inco holes at CA2 zone were selectively sampled as well (Figure 3), which left largely the possibility for more positive results. Geochemically, copper, nickel, cobalt and PGEs seem to be correlated well over wide intercepts, while gold seems more erratic, even though Gold is present at lower grade in most of the drill holes. Further drilling in this area will be followed to confirm and to try to build a larger mineralized system.

Figure 1: Plan Map showing CA1 and CA2 Zones along with drill hole locations for W225-10 and W225-11.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/7277/253464_4b99ca4dc4811bac_002full.jpg

Figure 2: Cross section of drill hole W225-10, confirming and expanding the potential of the CA1 Zone. Refer to [1] below for historical drillholes data.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/7277/253464_4b99ca4dc4811bac_003full.jpg

Figure 3: Cross section of drill hole W225-11, also confirming and expanding the potential of the CA2 Zone. Refer to [1] below for historical drillholes data.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/7277/253464_4b99ca4dc4811bac_004full.jpg

- High-grade individual commodity intersections within drill Hole W225-10 include:

- 1.50% Copper over 0.68 m from 243.32 m to 244.00 m

- 0.55% Nickel over 0.82 m from 242.50 m to 243.32 m

- 5.59 g/t Gold over 1.00 m from 205.00 m to 206.00 m

- 0.66 g/t Platinum over 1.00 m from 141.00 m to 142.00 m

- 0.57 g/t Palladium over 0.82 m from 242.50 m to 243.32 m

- High-grade individual commodity intersections within drill Hole W225-11 include:

- 1.81% Copper over 0.53 m from 42.47 m to 43.00m

- 1.48% Nickel over 0.98 m from 38.82 m to 39.80 m

- 0.22 g/t Gold over 1.00 m from 33.00 m to 34.00 m

- 0.59 g/t Palladium over 0.98 m from 38.82 m to 39.80 m

- 0.54 g/t Platinum over 0.98 m from 38.82 m to 39.80 m

Table 2: Drill Hole Collar Information Datum used in UTM NAD83 Z16N.

| DRILL OLE | Easting | Northing | Elev (m) | Azimuth | Dip | Length (m) |

| W225-10 | 460077 | 5813378 | 251 | 180 | -55 | 272.00 |

| W225-11 | 462430 | 5812573 | 244 | 200 | -56 | 123.50 |

[1] Data from historical drillhole were referred from a NI 43-101 report titled "NI 43-101 Updated Technical Report on the W2 Copper-Nickel-PGE Property" authored by I.A. Osmani et al., effective on September 4th, 2024.

QAQC:

Samples (NQ core diameter = 4.76 cm) were cut using a diamond blade saw, inserted into labeled bags, and delivered by representatives of PTX to Activation Laboratories Ltd. in Thunder Bay, Ontario. Activation Laboratories Ltd. is an ISO 17025:2005 accredited testing laboratory.

Samples were analyzed for Au, Pt, and Pd using the lead fire-assay 1C-OES package, and multi-element analysis was completed by near-total digestion (four-acid) with an ICP-OES finish (1F2 package). For over-range samples (Cu, Ni) over 1% Cu or Nickel, the 8-4 Acid Near Total ICP-OES method was utilized.

PTX inserted standards and blanks and performs duplicate analysis as part of its QA/QC program. Activation Laboratories also performs an internal QA/QC program which includes the insertion of CRM's, blanks, sample repeats, and duplicate samples.

Qualified Person:

The technical information of the drilling program presented in this news release has been reviewed and approved by Joerg Kleinboeck, P.Geo. The technical information presented in this news release has been reviewed and approved by Joerg Kleinboeck, P. Geo., a non-independent qualified person, and Shuda Zhou, P.Geo., and independent qualified person to PTX Metals who are responsible for ensuring that the related technical information provided in this news release is accurate and who act as a "qualified persons" (QP's) as defined by National Instrument 43-101, Standards of Disclosure for Mineral Projects.

About PTX Metals Inc.:

PTX is a mineral exploration company focused on high-quality strategic metals assets in northern Ontario, allowing exposure for shareholders to Copper, Gold, Nickel, and PGEs discovery. The Province of Ontario is renowned as a first-class mining jurisdiction for its abundance of mineral resources and safe jurisdiction.

Our corporate objective is to advance our assets, and unveil the potential of two Flagship Projects, the W2 Cu-Ni-PGE located in the strategic Ring of Fire region, and the Shining Tree Gold Project neighbor to multi-million ounces gold deposits in the Timmins Gold Camp.

PTX's portfolio of assets was strategically acquired for their geologically favorable attributes, and proximity to established mining companies.

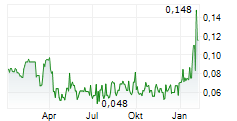

PTX is based in Toronto, Canada, with a primary listing on the TSX under the symbol PTX. The Company is also listed in Frankfurt under the symbol 9PX and on the OTCQB in the United States as PANXF.

For additional information on PTX, please visit the Company's website at https://ptxmetals.com/.

For further information, please contact:

Greg Ferron, President and Chief Executive Officer

Phone: +1 (416) 270-5042

Email: gferron@ptxmetals.com

Forward-Looking Information:

This news release contains forward-looking information which is not comprised of historical facts. Forward-looking information is characterized by words such as "plan", "expect", "project", "intend", "believe", "anticipate", "estimate" and other similar words, or statements that certain events or conditions "may" or "will" occur. Forward-looking information involves risks, uncertainties and other factors that could cause actual events, results, and opportunities to differ materially from those expressed or implied by such forward-looking information, including statements regarding the ability of the Company to satisfy the regulatory, stock exchange and commercial closing conditions of Private Placement, and the potential development of mineral resources and mineral reserves which may or may not occur. Factors that could cause actual results to differ materially from such forward-looking information include, but are not limited to, changes in the state of equity and debt markets, fluctuations in commodity prices, delays in obtaining required regulatory or governmental approvals, and general economic and political conditions. Forward-looking information in this news release is based on the opinions and assumptions of management considered reasonable as of the date hereof, including that all necessary approvals, including governmental and regulatory approvals, will be received as and when expected. Although the Company believes that the assumptions and factors used in preparing the forward-looking information in this news release are reasonable, undue reliance should not be placed on such information. The Company disclaims any intention or obligation to update or revise any forward-looking information, whether because of new information, future events or otherwise, other than as required by applicable laws. For more information on the risks, uncertainties and assumptions that could cause our actual results to differ from current expectations, please refer to the Company's public filings available under the Company's profile at www.sedarplus.ca.

This news release does not constitute an offer to sell or a solicitation of an offer to buy nor shall there be any sale of any of the securities in any jurisdiction in which such offer, solicitation or sale would be unlawful, including any of the securities in the United States of America. The securities described herein have not been and will not be registered under the United States Securities Act of 1933, as amended (the "1933 Act") or any state securities laws and may not be offered or sold within the United States or to, or for account or benefit of, U.S. Persons (as defined in Regulation S under the 1933 Act) unless registered under the 1933 Act and applicable state securities laws, or an exemption from such registration requirements is available.

Neither TSX Venture Exchange nor its Regulation Services Provider accepts responsibility for the adequacy or accuracy of this release.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/253464

SOURCE: PTX Metals Inc.