Attendees applaud recently retired CEO Kathy Austin on 40+ years of service to bank and hear about bank's strong performance in Q1 2025

DERBY, VT / ACCESS Newswire / May 29, 2025 / Community Bancorp. (OTCQX:CMTV) held its Annual Shareholders meeting on Tuesday, May 20, 2025.

A quorum of shareholders elected five Directors, David P. Laforce, Wayne A. Lamberton, Stephen P. Marsh, Carol A. Martin and Jeffrey L. Moore, to three-year terms expiring in 2028. They also voted affirmatively on an advisory vote to approve executive compensation, an advisory vote on frequency of future advisory votes on executive compensation every three years and ratifying Berry, Dunn, McNeil & Parker, LLC as the Company's external auditors for 2025.

A Form 8-K detailing the voting results was filed on May 23, 2025.

Community Bancorp. Chair Stephen Marsh recognized and thanked former Director Fred Oeschger for his service and wished him well on his retirement from the Board. Community National Bank President and CEO Christopher (Chris) Caldwell recognized Kathy Austin for her extraordinary 44-year career with Community National Bank. Kathy retired as the bank's CEO at the end of 2024; CEO Caldwell noted the substantial increase in the bank's assets and deposits under her tenure. She remains on the Board of Community Bancorp.

Following the business portion of the meeting, CEO Caldwell shared an overview of the current banking environment in Vermont and New Hampshire, as well as a broader view of the banking industry during this volatile time for the US economy. He also discussed the Bank's loan operations and retail work within this environment and underscored the critical role Community National Bank plays in today's financial landscape.

He stated, "Community National Bank's values-focused approach to business lending, local decision making and flexibility appeals to businesses and consumers more than ever in this uncertain economic climate. Indeed, this approach is the foundation for the steady growth we have generated in the bank's widely diverse commercial loan portfolio that serves almost every industry that makes up our Vermont economy, as well as the continued increases in our deposit base. I also believe our sustained growth reflects the dedication of our employees throughout our branch network system, and we are focusing attention on their pivotal contributions this year through our Deliver WOW! program."

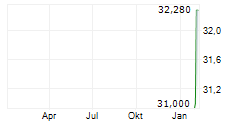

He added, "As our 2024 and strong first quarter results demonstrate, the bank is performing well. Every day we strive to live up to our name as Community National Bank, and we intend to sustain that approach going forward."

In demonstrating Community National Bank's local impact, CEO Caldwell also noted the hours of employee voluntarism in 2024 (+1,000), some of the programs the bank supports, such as Tatum's Totes and Central Vermont Habitat for Humanity, as well as the nearly $400,000 in charitable donations to more than 200 local organizations provided by the bank in 2024.

Executive Vice President and Chief Financial Officer Louise Bonvechio provided a deeper review of the bank's financial results for both the full year 2024 and the first quarter of 2025, the latter of which shows improving trends in the bank's key performance metrics compared to the prior year.

CFO Bonvechio also introduced Joseph Preddy, President and CEO of Community Financial Services Group, which is co-owned by Community National Bank with The National Bank of Middlebury and Woodsville Guaranty Savings Bank. She noted that with the expected closing of the sale of Woodsville to Bar Harbor Bancshares later this year, Community National Bank and Bank of Middlebury will remain co-owners, each with 50%. Mr. Preddy's presentation focused on the recent growth of CFSG despite market volatility.

About Community National Bank

Community National Bank is an independent bank that has been serving its communities since 1851, with retail banking offices located in Derby, Derby Line, Island Pond, Barton, Newport, Troy, St. Johnsbury, Montpelier, Barre, Lyndonville, Morrisville and Enosburg Falls as well as loan offices located in Burlington, Vermont and Lebanon, New Hampshire

Forward-Looking Statements

This press release contains forward-looking statements, including, without limitation, statements about the Company's financial condition, capital status, dividend payment practices, business outlook and affairs. Although these statements are based on management's current expectations and estimates, actual conditions, results, and events may differ materially from those contemplated by such forward-looking statements, as they could be influenced by numerous factors which are unpredictable and outside the Company's control. Factors that may cause actual results to differ materially from such statements include, among others, the following: (1) general national or regional economic conditions, national fiscal or monetary policies, or national or international tariff or trade conditions result in a deterioration of the credit quality of our loan portfolio or diminished demand for the Company's products and services; (2) changes in laws or government rules, or the way in which courts interpret those laws or rules, adversely affect the financial industry generally or the Company's business in particular, or may impose additional costs and regulatory requirements; (3) interest rates change in such a way as to reduce the Company's interest margins and its funding sources; and (4) competitive pressures increase among financial services providers in the Company's northern New England market area or in the financial services industry generally, including pressures from nonbank financial service providers, from increasing consolidation and integration of financial service providers and from changes in technology and delivery systems, and other factors that are listed from time to time in our financial filings with the SEC, including our Forms 10-Q and 10-K. We disclaim any responsibility to update our forward-looking statements, which are valid only as of the date of this release, should circumstances change.

For more information about Community National Bank visit communitynationalbank.com.

To learn more about Community Bancorp. visit communitybancorpvt.com.

For more information, contact:

Investor Relations

ir@communitynationalbank.com

SOURCE: Community Bancorp. Inc Vermont

View the original press release on ACCESS Newswire:

https://www.accessnewswire.com/newsroom/en/banking-and-financial-services/community-bancorp.-holds-annual-shareholders-meeting-1033382