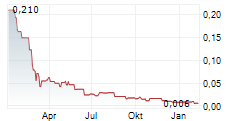

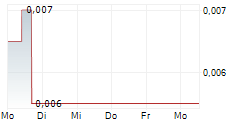

Vancouver, BC, May 29, 2025 (GLOBE NEWSWIRE) -- Spirit Blockchain Capital Inc. (CSE: SPIR) ("Spirit" or the "Company"), a publicly listed investment company focused on blockchain infrastructure and digital asset yield opportunities, is pleased to announce the key milestones and unaudited financial results for the quarter ended March 31, 2025.

Q1 2025 Highlights

- LIFE Offering Completion: Closed a CAD $2.11 million Listed Issuer Financing Exemption Offering in February 2025 to strengthen the balance sheet and extend runway.

- Cash Position: Ended the quarter with cash and cash equivalents of CAD $1,118,585, up from CAD $929,194 at year-end 2024, and a working capital surplus of CAD $729,781.

- Debt Conversion: Converted the entire EOS-tranche of convertible debentures (CAD $1,105,024) into equity, eliminating related interest and derivative liabilities.

- Product Launch: On March 27, Spirit Digital AG launched the Spirit Ethereum Yield+ ETP and Spirit Solana Yield+ ETP on SIX Swiss Exchange and Deutsche Börse, providing a regulated, exchange-listed vehicle for ETH and SOL staking strategies.

- U.S. Market Upgrade: Upgraded to the OTCQB® Venture Market under ticker "SBLCF" on April 22, 2025, enhancing access for U.S. investors.

- Leadership & Partnerships: Appointed Inder Saini as CFO to bolster financial controls and entered a strategic partnership with Astralane to develop a Staked SOL Index.

"Our Q1 progress reflects steady advancement across financing, product launches, and operational capabilities," said Lewis Bateman, CEO of Spirit Blockchain Capital. "With a strengthened balance sheet and clear execution milestones achieved, we remain committed to building institutional-grade blockchain solutions and enhancing shareholder value."

About Spirit Blockchain Capital

?Spirit Blockchain Capital Inc. is a Canadian-based publicly listed company focused on providing shareholders with exposure to the blockchain and digital asset economy through three verticals: infrastructure yield, blockchain investments, and regulated exchange-listed products. The Company holds a diversified portfolio of digital assets and invests in emerging blockchain ventures while developing proprietary yield-generation platforms.

For further information, please contact:

?Investor Relations

?Spirit Blockchain Capital Inc.

?ir@spiritblockchain.com

Forward-Looking Statements

?This news release contains forward-looking statements and forward-looking information within the meaning of applicable securities laws. The use of any of the words "expect", "anticipate", "continue", "estimate", "objective", "may", "will", "project", "should", "believe", "plans", "intends" and similar expressions are intended to identify forward-looking information or statements. The forward-looking statements and information are based on certain key expectations and assumptions made by the Company. Although the Company believes that the expectations and assumptions on which such forward-looking statements and information are based are reasonable, undue reliance should not be placed on the forward-looking statements and information because the Company can give no assurance that they will prove to be correct.

Since forward-looking statements and information address future events and conditions, by their very nature they involve inherent risks and uncertainties. Actual results could differ materially from those currently anticipated due to a number of factors and risks. Factors that could materially affect such forward-looking information are described under the heading "Risk Factors" in the Company's long-form prospectus dated August 8, 2022, that is available on the Company's profile on SEDAR+ at www.sedarplus.ca. The Company undertakes no obligation to update forward-looking information except as required by applicable law. Such forward-looking information represents managements' best judgment based on information currently available. No forward-looking statement can be guaranteed and actual future results may vary materially. Accordingly, readers are advised not to place undue reliance on forward-looking statements or information.

The Canadian Securities Exchange has not reviewed, approved, or disapproved the content of this news release.