Old Harbor Insurance Services, LLC today closed an asset-purchase agreement to bring 56-year-old Brownell, Williams &Fix Insurance & Bond Agency, Inc. ("BWF") into the Old Harbor family. The deal adds BWF's full inventory of personal, commercial, life, and health clients to Old Harbor's rapidly expanding platform and deepens its presence throughout the Inland Empire.

TEMECULA, CALIFORNIA / ACCESS Newswire / June 3, 2025 / Old Harbor Insurance Services, LLC today closed an asset-purchase agreement to bring 56-year-old Brownell, Williams & Fix Insurance & Bond Agency, Inc. ("BWF") into the Old Harbor family. The deal adds BWF's full inventory of personal, commercial, life, and health clients to Old Harbor's rapidly expanding platform and deepens its presence throughout the Inland Empire.

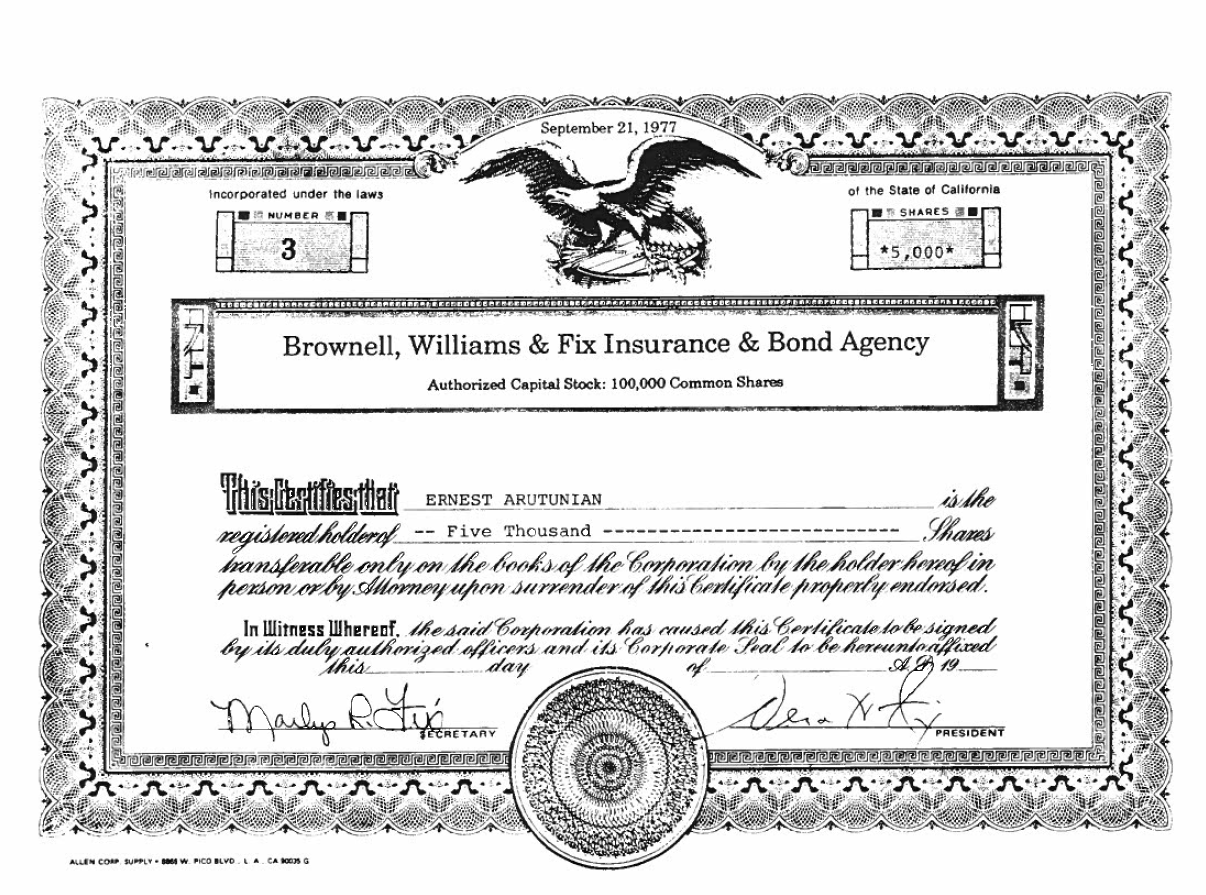

Brownell, Williams & Fix Insurance & Bond Agency Stock Certificate

BWF Insurance has served families and businesses for almost 70 years, earning a reputation for "professional service with personal care" and maintaining relationships with only A-rated carriers.

"BWF's client-first culture mirrors our own," said Christian Richter, Principal of Old Harbor Insurance Services. "By combining our digital tools, carrier depth, and white-glove service with BWF's decades-long community roots, we turn a strong local agency into a springboard for next-level client experience across Southern California."

Ernest Arutunian, President and owner of BWF Insurance, shared the following. "I certainly would not have decided to make this sale if I didn't feel it was in the best interest of all of those who have counted on us for all these years. It was not an easy or quick decision-other buyers showed interest, but they simply didn't meet Old Harbor's specifications."

Arutunian continued: "I would not hesitate to render Old Harbor a full and positive endorsement. Our clients will be in very good hands, and they will continue to receive the same personalized treatment they've come to expect from our agency throughout the years. On top of that, they'll now have the added benefit of being with an agency that has more markets to more competitively place their insurance and keep pace with their ever-increasing needs. For any clients who call me personally, I will deliver this message without hesitation."

A 48-Year Track Record of Building California

Founded in the 50's, BWF began as a one-man outfit focused on surety bonds for Southern California's burgeoning construction sector. Over the years the agency expanded into home, auto, life and commercial programs, all while maintaining its reputation as a "contractor's best friend." In 1977 the firm issued its first stock certificates-a milestone captured in the original share ledgers and certificates included with this release (see image below).

Transaction Benefits

Stronger carrier access

Seamless servicing

No disruption

24/7 client tools coming soon

Local commitment

About Brownell, Williams & Fix Insurance & Bond Agency, Inc.

Founded in Upland, California in the 50's, BWF Insurance is a full-service independent agency specializing in auto, homeowners, business, health, life, and surety bonds. The firm's team of professionals brings more than 100 years of combined industry expertise to clients across the Inland Empire.

About Old Harbor Insurance Services

Old Harbor Insurance Services, LLC is an award-winning independent insurance agency dedicated to delivering concierge-level advice for personal, commercial and life insurance clients. Based in Temecula, Calif., the agency's mission is simple: "Your future, protected." Old Harbor serves more than 10,000 clients in nine states and has earned its stellar reputation for its expertise, transparency and responsive service.

Contact Information

Press and Partnerships

PR Contact

info@oldharbor.com

(951) 297-9740

SOURCE: Old Harbor Insurance

View the original press release on ACCESS Newswire:

https://www.accessnewswire.com/newsroom/en/banking-and-financial-services/old-harbor-insurance-services-acquires-brownell-%e2%80%afwilliams-and-fix-in-1031981