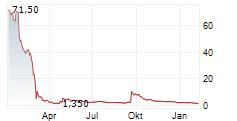

Beijing, June 03, 2025 (GLOBE NEWSWIRE) -- AGM Group Holdings Inc. ("AGM Holdings" or the "Company") (NASDAQ: AGMH), an integrated technology company specializing in the assembling and sales of high-performance hardware and computing equipment, announced that on June 3, 2025 (the "Effective Date"), it completed the consolidation (the "Consolidation") of the ordinary shares of the Company (the "Shares") on the basis of 50 pre-Consolidation Shares for every one (1) post-Consolidation Share.

The Company's ordinary shares began trading on a post-Consolidation basis at market open on June 3, 2025.

As a result of the Consolidation, the Company's total issued and outstanding Class A ordinary shares have been reduced from 98,713,955 Class A ordinary shares with a par value of US$0.001 each to approximately 1,974,279 Class A ordinary shares with a par value of US$0.05 each. The Company's total issued and outstanding Class B ordinary shares have been reduced from 2,100,000 Class B ordinary shares with a par value of US$0.001 each to approximately 42,000 Class B ordinary shares with a par value of US$0.05 each.

As stated in the Company's press release announcing the Consolidation dated May 29, 2025, no fractional shares have been issued to any shareholders in connection with the Consolidation, and any fractional shares which resulted from the Consolidation have been rounded down to the next whole number and the Company has made a cash payment (without interest) to all the holders of Class A Ordinary Shares and Class B Ordinary Shares equal to such fraction multiplied by the average of the closing sales prices of the ordinary shares on Nasdaq during regular trading hours for the five consecutive trading days immediately preceding the first trading day of the Consolidation (with such average closing sales prices being adjusted to give effect to the Consolidation) subject to a de minimums. The Consolidation affected all shareholders uniformly and did not alter any shareholder's percentage interest in the Company's ordinary shares, except for adjustments that may result from the treatment of fractional shares.

Trading in the Class A ordinary shares continues on the Nasdaq Capital Market, under the same symbol "AGMH" but under a new CUSIP Number, G0132V121.

Registered shareholders who hold physical Share certificates will receive a letter of transmittal requesting that they forward pre-Consolidation Share certificates to the Company's transfer agent, VStock Transfer, LLC in exchange for new Share certificates representing Shares on a post-Consolidation basis. Shareholders who hold their Shares through a broker or other intermediary and do not have Shares registered in their own name will not be required to complete a letter of transmittal.

About AGM Group Holdings Inc.

AGM Group Holdings Inc. (NASDAQ: AGMH) is an integrated technology company specializing in the assembling and sales of high-performance hardware and computing equipment. With a mission to become a key participant and contributor in the global blockchain ecosystem, AGMH focuses on the research and development of blockchain-oriented Application-Specific Integrated Circuit (ASIC) chips, the assembling and sales of high-end crypto miners for Bitcoin and other cryptocurrencies. For more information, please visit www.agmprime.com.

Forward-Looking Statements

Certain statements in this announcement are forward-looking statements. These forward-looking statements involve known and unknown risks and uncertainties and are based on the Company's current expectations and projections about future events that the Company believes may affect its financial condition, results of operations, business strategy and financial needs. Investors can identify these forward-looking statements by words or phrases such as "approximates," "assesses," "believes," "hopes," "expects," "anticipates," "estimates," "projects," "intends," "plans," "will," "would," "should," "could," "may" or similar expressions. The Company undertakes no obligation to update or revise publicly any forward-looking statements to reflect subsequent occurring events or circumstances, or changes in its expectations, except as may be required by law. Although the Company believes that the expectations expressed in these forward-looking statements are reasonable, it cannot assure you that such expectations will turn out to be correct, and the Company cautions investors that actual results may differ materially from the anticipated results and encourages investors to review other factors that may affect its future results in the Company's registration statement and other filings with the U.S. Securities and Exchange Commission.

For more information, please contact:

AGM Group Holdings Inc.

Email: ir@agmprime.com

Website: http://www.agmprime.com

Ascent Investor Relations LLC

Tina Xiao

President

Phone: +1-646-932-7242

Email: investors@ascent-ir.com