NOT FOR DISSEMINATION IN THE US OR THROUGH US NEWSWIRE SERVICES

VANCOUVER, British Columbia, June 04, 2025 (GLOBE NEWSWIRE) -- Vizsla Royalties Corp. (TSX-V: VROY, OTCQB: VROYF) ("Vizsla Royalties" or the "Company") is pleased to announce it has entered into a royalty purchase agreement dated June 4, 2025 (the "Purchase Agreement") with Grupo Minero Bacis, S.A. de C.V., pursuant to which the Company will acquire an additional 3.0% net smelter returns ("NSR") royalty (the "3.0% Royalty") on certain concessions (the "Silverstone Concessions") comprising the Panuco-Copala Silver-Gold Project ("Panuco Project") located in the State of Sinaloa, Mexico (the "Transaction"). The Panuco Project is owned and operated by Vizsla Silver Corp. ("Vizsla Silver") (TSX: VZLA; NYSE: VZLA) and is being advanced toward production.

"This is a transformative acquisition for Vizsla Royalties", stated Michael Pettingell, CEO. "We have now fully consolidated all royalties in the Panuco district, significantly increasing shareholder exposure to one of the highest-grade silver-gold districts in the world. Vizsla Royalties is a publicly-traded company with a Tier-1 silver royalty, which could ultimately serve as a cornerstone asset from which to develop a broader portfolio of quality precious metals royalties in the years to come."

Vizsla Royalties currently holds a 0.5% NSR on the Silverstone Concessions, which was established as part of its spin-out from Vizsla Silver in 2024. Upon acquiring the 3.0% Royalty in connection with the Transaction, the Company will hold a 3.5% NSR on the Silverstone Concessions, significantly increasing its exposure to one of the most advanced and high-grade silver-gold development districts in the world, positioning shareholders to benefit from long-term value creation as the Panuco Project progresses toward production. Vizsla Royalties also holds a 2.0% NSR on certain other concessions (the "Rio Panuco Concessions") comprising the Panuco Project.

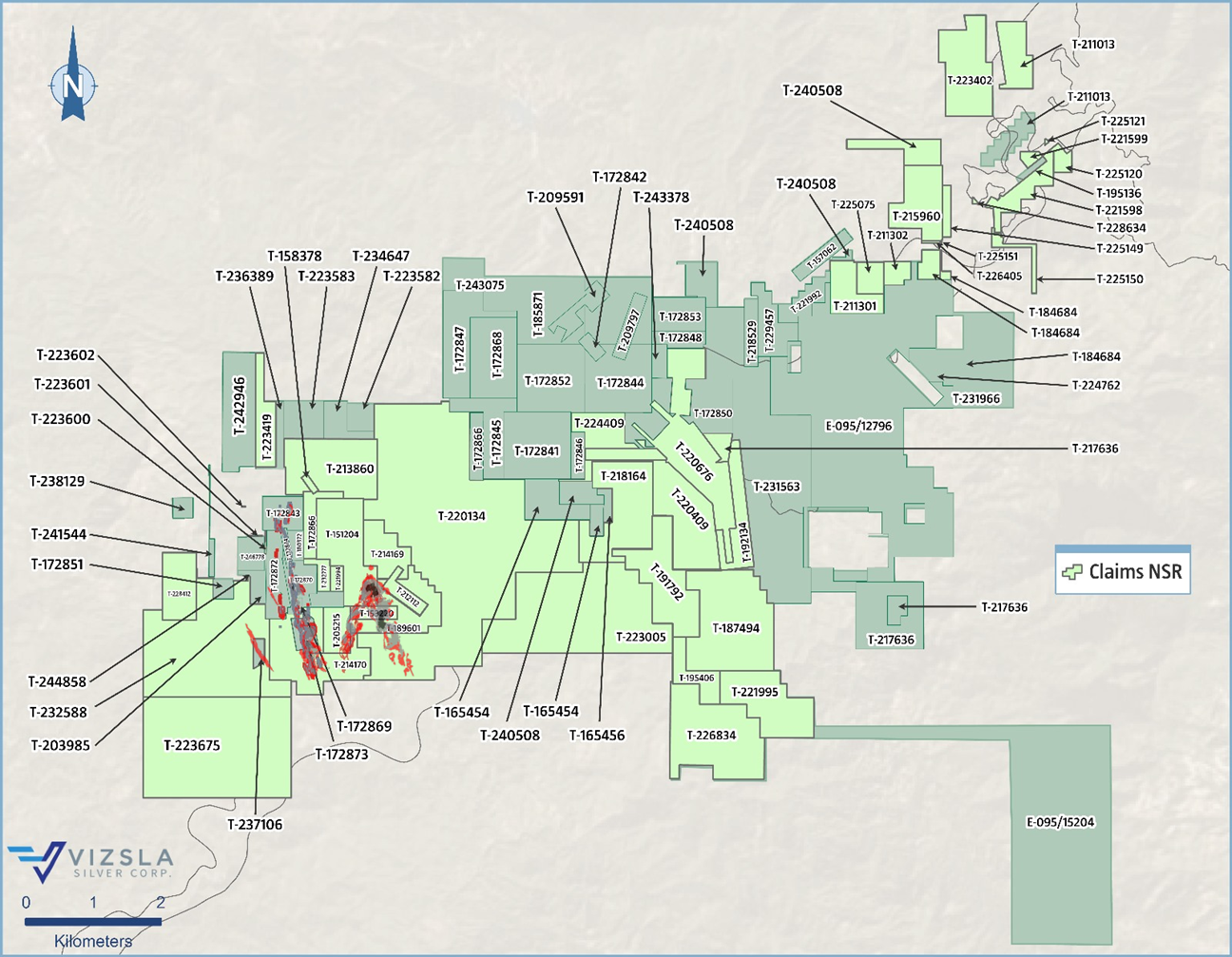

Figure 1 - Map Depicting the Silverstone Concessions and the Rio Panuco Concessions

Source: Vizsla Silver corporate presentation dated June 2025.

Under the terms of the Purchase Agreement, Vizsla Royalties will exercise its right to repurchase 50% of the 3.0% Royalty for US$1.95 million and will purchase the remaining 50% of the 3.0% Royalty for US$38.05 million, for a total cash consideration of US$40 million subject to potential adjustment in customary circumstances.

The Transaction is an arm's length transaction. No finder's fees are payable in connection with the Transaction.

Financing to Fund Acquisition

The Company is pleased to announce that it has entered into an agreement with CIBC Capital Markets ("CIBC"), as lead bookrunner and underwriter, on its own behalf and on behalf of a syndicate of underwriters (the "Underwriters"), pursuant to which the Underwriters have agreed to purchase, on a "bought deal" basis, 27,400,000 common shares (the "Shares") of the Company at a price of C$2.00 per Share for aggregate gross proceeds of C$54,800,000 (the "Offering"), excluding any potential additional proceeds raised from the exercise of the Over-Allotment Option (defined below).

The Company has granted the Underwriters an option to purchase up to an additional 15% of the Shares sold under the Offering (the "Over-Allotment Option"), exercisable in whole or in part at any time for a period of 30 days following the closing date, on the same terms as the Offering.

The net proceeds of the Offering will be used to fund the cash consideration for the acquisition of the 3.0% Royalty and for general corporate purposes.

The Shares will be offered in each of the provinces and territories of Canada (other than Quebec) pursuant to a prospectus supplement to the Company's base shelf prospectus dated May 20, 2025, which will be filed with the securities commissions and other similar regulatory authorities in each of the provinces and territories of Canada. The Shares may also be sold by way of private placement in the United States or such other jurisdictions as agreed by the Company and the Underwriters.

The Transaction and the Offering are expected to close concurrently on or about June 12, 2025, subject to customary closing conditions, including the receipt of all necessary regulatory approvals, including the acceptance of the TSX Venture Exchange (the "TSXV").

This news release does not constitute an offer to sell or a solicitation of an offer to buy any securities in the United States. The securities offered have not been, nor will they be, registered under the United States Securities Act of 1933, as amended (the "U.S. Securities Act"), or any applicable state securities laws, and may not be offered or sold in the United States unless registered under the U.S. Securities Act and applicable state securities laws or pursuant to an exemption therefrom.

This news release shall not constitute an offer to sell or the solicitation of an offer to buy nor shall there be any sale of the securities in any jurisdiction in which such offer, solicitation or sale would be unlawful.

Access to the prospectus supplement, the base shelf prospectus and any amendments to the documents is provided in accordance with securities legislation relating to procedures for providing access to a prospectus supplement, a base shelf prospectus and any amendment. The base shelf prospectus is, and the prospectus supplement will be (within two business days of the date hereof), accessible on SEDAR+ at www.sedarplus.ca. An electronic or paper copy of the prospectus supplement, the base shelf prospectus and any amendment to the documents may be obtained, without charge, from CIBC Capital Markets, 161 Bay Street, 5th Floor, Toronto, ON M5J 2S8 or by telephone at 416-956-6378 or by email at mailbox.canadianprospectus@cibc.com by providing an email address or address, as applicable. The base shelf prospectus and prospectus supplement contain important, detailed information about the Company and the proposed Offering. Prospective investors should read the base shelf prospectus and prospectus supplement (when filed) before making an investment decision.

Advisors and Counsel

CIBC is acting as financial advisor to Vizsla Royalties, with Forooghian + Company Law Corporation acting as legal advisor to the Company in relation to the Transaction and the Public Offering. Borden Ladner Gervais LLP is acting as legal advisor to CIBC in relation to the Offering.

About Vizsla Royalties Corp.

Vizsla Royalties Corp. is a precious metals focused royalty company. The Company's principal asset is a Net Smelter Return Royalty on Vizsla Silver Corp.'s (TSX: VZLA, NYSE: VZLA) flagship Panuco Project located in Mexico. Panuco is a world-class silver and gold development project actively advancing towards production. A Preliminary Economic Study for Panuco was published in July 2024 which highlights 15.2 Moz AgEq of annual production over an initial 10.6-year mine life, an after-tax NPV5% of US$1.1B, 86% IRR and a 9-month payback at US$26/oz Ag and US$1,975/oz Au.

Contact Information: For more information and to sign-up to the mailing list, please contact:

Michael Pettingell, Chief Executive Officer

Tel: (604) 364-2215

Email: info@vizslaroyalties.com

Website: www.vizslaroyalties.com

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

TECHNICAL AND THIRD-PARTY INFORMATION

Except where otherwise stated, the disclosure in this press release relating to the Panuco Project is based on information publicly disclosed by Vizsla Silver and information/data available in the public domain as at the date hereof and none of this information has been independently verified by Vizsla Royalties. Specifically, as a royalty holder, Vizsla Royalties has limited access to the Panuco Project. Although Vizsla Royalties does not have any knowledge that such information may not be accurate, there can be no assurance that such third-party information is complete or accurate. Some information publicly reported on the Panuco Project by Vizsla Silver may relate to a larger property than the area covered by Vizsla Royalties' royalty interests.

Unless otherwise indicated, the technical and scientific disclosure contained or referenced in this press release, including any references to mineral resources or mineral reserves, was prepared in accordance with NI 43-101, which differs significantly from the requirements of the U.S. Securities and Exchange Commission (the "SEC") applicable to U.S. domestic issuers. Accordingly, the scientific and technical information contained or referenced in this press release may not be comparable to similar information made public by U.S. companies subject to the reporting and disclosure requirements of the SEC.

"Inferred mineral resources" have a great amount of uncertainty as to their existence and great uncertainty as to their economic and legal feasibility. It cannot be assumed that all or any part of an inferred mineral resource will ever be upgraded to a higher category. Historical results or feasibility models presented herein are not guarantees or expectations of future performance.

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This press release contains forward-looking statements and forward-looking information (collectively, "forward-looking statements") within the meaning of applicable securities laws. Often, but not always, forward-looking statements can be identified by the use of words such as "plans", "expects", "is expected", "budgets", "scheduled", "estimates", "forecasts", "predicts", "projects", "intends", "targets", "aims", "anticipates" or "believes" or variations (including negative variations) of such words and phrases or may be identified by statements to the effect that certain actions "may", "could", "should", "would", "might" or "will" be taken, occur or be achieved. Forward-looking statements include, but are not limited to: the satisfaction of the conditions required for the closing of the Transaction; the closing of the Transaction; statements with respect to expected construction and production at the Panuco Project, the accretive nature of and value to be derived from the Transaction, the filing of a prospectus supplement for the Offering, the timing, structure, activities and completion of the Offering; the use of proceeds from the Offering and the Over-Allotment Option; future exploration, development, and production of the Panuco Project, and other anticipated developments, achievements and economics of, the Panuco Project. Forward-looking statements and information are based on forecasts of future results, estimates of amounts not yet determinable and assumptions that, while believed by management to be reasonable, are inherently subject to significant business, economic and competitive uncertainties, and contingencies. Forward-looking statements and information are subject to various known and unknown risks and uncertainties, many of which are beyond the ability of Vizsla Royalties to control or predict, that may cause Vizsla Royalties' actual results, performance or achievements to be materially different from those expressed or implied thereby, and are developed based on assumptions about such risks, uncertainties and other factors set out herein, including but not limited to: the risk that the parties may be unable to satisfy the closing conditions for the Transaction or that the Transaction may not be completed; the Company's ability to make the required payments under the Acquisition Agreement including the US$40M payment; risks associated with the impact of general business and economic conditions; the absence of control over mining operations from which Vizsla Royalties will purchase precious metals or from which it will receive stream or royalty payments and risks related to those mining operations, including risks related to international operations, government and environmental regulation, delays in mine construction and operations, actual results of mining and current exploration activities, conclusions of economic evaluations and changes in project parameters as plans are refined; problems related to the ability to market precious metals or other metals; industry conditions, including commodity price fluctuations, interest and exchange rate fluctuations; interpretation by government entities of tax laws or the implementation of new tax laws; regulatory, political or economic developments in any of the countries where properties in which Vizsla Royalties holds a royalty, stream or other interest are located or through which they are held; risks related to the operators of the properties in which Vizsla Royalties holds a royalty or stream or other interest, including changes in the ownership and control of such operators; risks related to global pandemics and the spread of other viruses or pathogens; influence of macroeconomic developments; business opportunities that become available to, or are pursued by Vizsla Royalties; reduced access to debt and equity capital; litigation; title, permit or license disputes related to interests on any of the properties in which Vizsla Royalties holds a royalty, stream or other interest; the volatility of the stock market; competition; future sales or issuances of debt or equity securities; use of proceeds; dividend policy and future payment of dividends; liquidity; market for securities; enforcement of civil judgments; and risks relating to Vizsla Royalties potentially being a passive foreign investment company within the meaning of U.S. federal tax laws; and the other risks and uncertainties disclosed in documents filed with or submitted to the Canadian securities regulatory authorities on the SEDAR+ website at www.sedarplus.ca Although Vizsla Royalties has attempted to identify important factors that could cause actual actions, events or results to differ materially from those described in forward-looking statements, there may be other factors that cause actions, events or results not to be as anticipated, estimated or intended. There can be no assurance that forward-looking statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on forward-looking statements. Vizsla Royalties undertakes no obligation to update forward-looking information except as required by applicable law. Such forward-looking information represents management's best judgment based on information currently available. No forward-looking statement can be guaranteed, and actual future results may vary materially. Accordingly, readers are advised not to place undue reliance on forward-looking statements or information.

A photo accompanying this announcement is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/0aa0c3b0-a63c-48d4-80c1-afc5cdcf542c