Highlights:

- High-Grade Antimony Grab Sample at the Quarry Project - A sample assayed 0.89% g/t Au, 3.8% Cu, 0.34% Zn, 42.5% Pb, and 0.65% g/t Ag and 20% Sb.1

- A High-Grade Tungsten Sample at the Lotto Project - A selected grab sample taken in 1980 from a quartz vein with scheelite assayed 10.97% Wo3.2

- Strategically Positioned Altura Antimony Project - The Altura Project is on strike from Equinox Resources' recent antimony discovery as announced on November 7, 2024, which saw high-grade antimony at the Alturas Project, with assays up to 69.98% Sb.4

- Strategically Positioned Hurley Antimony Project - Endurance Gold's Reliance Gold Project which is adjacent to the Hurley property saw antimony results including 19.2% Sb and 2.16 g/t Au over 0.5m encountered during a 2024 drilling program.7

- Extensive Property Claims Spanning over 4,000 Ha. - Broad exposure highly prospective Antimony and Tungsten projects and underexplored territory situated in a leading Canadian jurisdiction.

VANCOUVER, British Columbia, June 05, 2025 (GLOBE NEWSWIRE) -- Maxus Mining Inc. ("Maxus" or the "Company") (CSE: MAXM | FRA: R7V), is pleased to announce it has entered into a Property Option Agreement (the "Agreement") with two (2) optionors (the "Optionors") to acquire a 100% interest in one tungsten & three antimony exploration properties, located in British Columbia which cover 4,122 hectares in total (the "Project" or the "Properties"). The antimony projects, Quarry, Hurley & Altura cover approximately 3,700 hectares of terrain and the Lotto Tungsten Project covers 422 hectares.

Scott Walters, Chief Executive Officer of the Company, commented, "We are excited to announce the strategic acquisition of four new Projects, focusing on identifying antimony and tungsten. By diversifying our portfolio to include minerals essential for emerging technologies and the future of energy, we are uniquely positioned to capitalize on these evolving markets. Looking ahead, we are eager to drive advancements at our newly acquired Projects and eagerly anticipate the opportunities they will present to our shareholders."

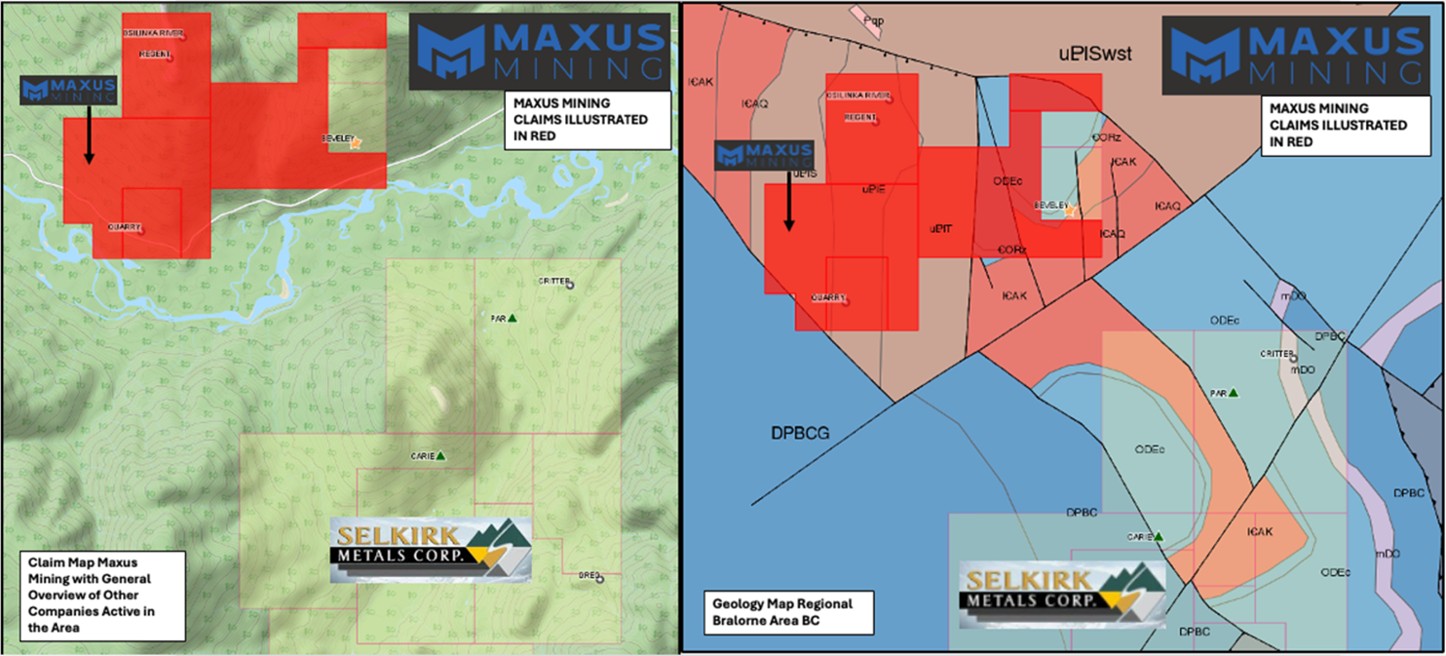

Quarry Antinomy Project Highlights

The Quarry property is exposed in a limestone rock quarry located on the north side of Osilinka River, between Tenakhi and Wasi creeks, about 46 kilometres northwest of the community of Germansen Landing. At the

showing, recrystallized and dolomitized limestones of the Neoproterozoic Ingenika Group host mineralized quartz veins. Minerals identified include sphalerite, galena, cerussite, chalcopyrite, boulangerite, malachite, azurite and possibly stibnite. The Quarry showing is exposed in a limestone rock quarry and consists of the mineral's sphalerite, galena, cerussite, chalcopyrite, boulangerite, malachite, azurite, and stibnite. One sample in 1991 assayed 20% Sb, 0.89 gram/tonne Ag, 3.8% Cu, 42.5% lPb, and 0.65 gram/tonne Au.1

Additionally, grab samples retrieved in 1954 yielded assays which averaged 83.5% Pb and 1576 g/t Ag.1 The site offers reliable, year-round access providing support for ongoing exploration initiatives. The region is underlain by the Neoproterozoic Ingenika Group and Paleozoic rocks of the Big Creek, Otter Lakes, Atan, Razorback and Echo Lake groups.

Figure 1 - Maxus Mining Quarry Antimony Property

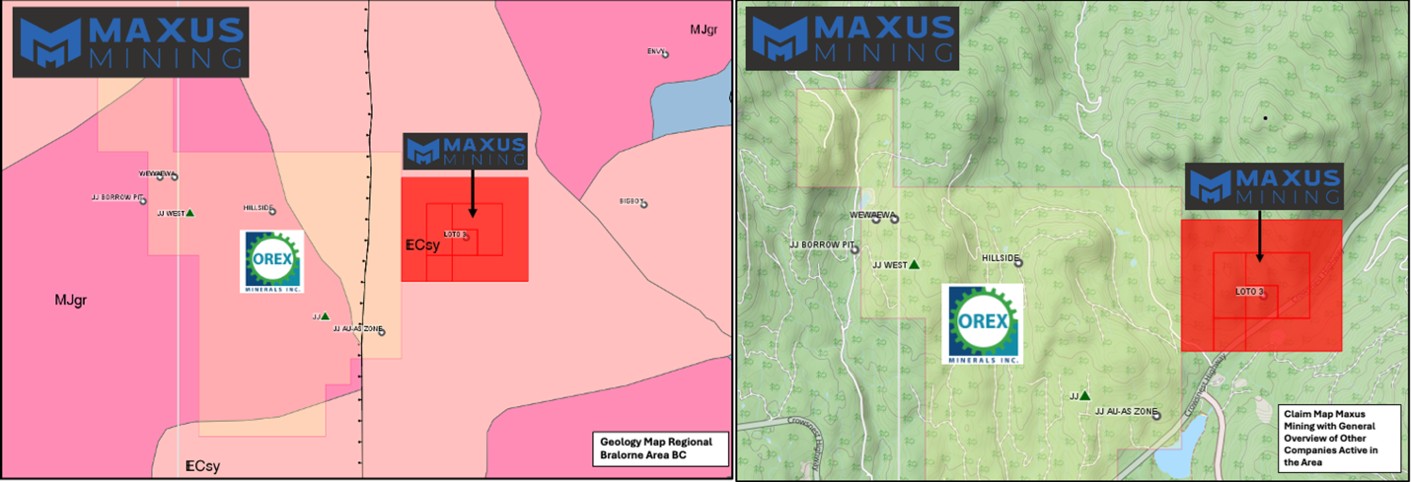

Lotto Tungsten Project Highlights

The Lotto Tungsten Project ("Lotto") lies within the Kootenay region and Trail Creek Mining Division of British Columbia, a prolific mineral district known for its resource potential and well-developed infrastructure that support sustained exploration activity. Lotto is located 19 km west-southwest of Castlegar on the Crowsnest Highway and consists of 426 hectares. Lotto contains the Lotto 3 showing which consists of scheelite (tungsten mineral) mineralization within a 9-meter-wide quartz vein exposed along a highway roadcut. Disseminated scheelite occurs in quartz veins just northwest of the main showing and in several places west of the highway.2

A selected grab sample taken in 1980 from a quartz vein with scheelite assayed 10.97% Wo3. Furthermore, in 2006, Astral Mining Corporation conducted a helicopter-borne geophysical (electromagnetic survey on the area as part of the JJ property) which showed the area is underlain by Paleozoic argillaceous quartzites and argillites which may be part of the Lower Jurassic Rossland Group. These metamorphosed sediments have been intruded by the Middle to late Jurassic Nelson Intrusions, comprised mainly of granite and granodiorite, and then later by Middle Eocene Coryell Intrusion syenite and associated dykes.2

Figure 2 - Maxus Mining Lotto Tungsten Property

Hurley Antimony Project Highlights

The Hurley Antimony Project ("Hurley") is located 7 kilometres south-east of the village of Gold Bridge, and 10 kilometres east of the historic Bralorne-Pioneer Gold Mining Camp which has produced over 4 million ounces of gold. Soil and vegetation sampling indicate there is a strong positive geochemical correlation in the soil samples between gold and associated elements silver (+0.69), As (+0.86) and Sb (+0.84).7

The adjacent Reliance Gold Project reported intervals that include 19.2% Sb and 2.16 g/t Au over 0.5m encountered during 2024 drilling campaign. A total of 199 gold assay composites were re-calculated to include antimony results from the 108 DDH, 84 RC, and 24 roadcut channels completed by the Company which has resulted in a composite average sampled length of 10.1 metres and weighted average grade of 4.55 gpt, 0.20% antimony, and 4.97 gpt AuEQ.8

The eastern area is underlain by undivided sedimentary rocks of the Cayoosh Assemblage which is of Jurassic to Cretaceous Age as well as marine and sedimentary rocks of the Bridge River Complex of Middle Mississippian to Middle Jurassic Age. The Cayoosh Assemblage and the Bridge River Complex are separated by northwest-trending fault-contacts. The western property is underlain by marine and sedimentary rocks of the Bridge River Complex.

Hurley is to the immediate south of a gold-antimony past producer named the Mary Mac Main Zone ("Mary Mac") and a developed gold - antimony advanced prospect. The host rocks are highly similar as those on the Hurley property. Mary Mac produced four (4) tonnes of stibnite/day with the grade being 20% over 2.1 meters and reserves of 13.6 to 18.1 thousand tonnes. Indicated reserves for the Mary Mac Main Zone reported to be 78,500 tonnes at 2.9 grams/tonne gold and the North Zone it was 39,200 tonnes at 2.3 grams/tonne gold.7

Mary Mac South Zone mineralization consists of globular stibnite (antimony host material) and pyrite. Where ore-reserves calculated in 1983 are 27,300 tonnes at 8.18 grams/tonne gold. Gray Rock, a past producer, occurs to immediate west of southern boundary and reportedly contains 70,488 tonnes of proven, probable, and possible reserves grading 3% Sb, 2.1% Pb, and 342.8 grams/tonne Ag. The trend appears to trend onto Hurley, where past work identified rock, soil, and silt samples within the center of the property anomalous in antimony, gold, and silver. Additionally, three (3) antimony veins occur within the western part of Hurley. The southwestern part of Stibnite Prospect appears to occur within the western area and consists of 25-centimeter-wide veins in 60-meter-long shears grading an average 8.9 % antimony.7

Figure 3 - Maxus Mining Hurley Antimony Property

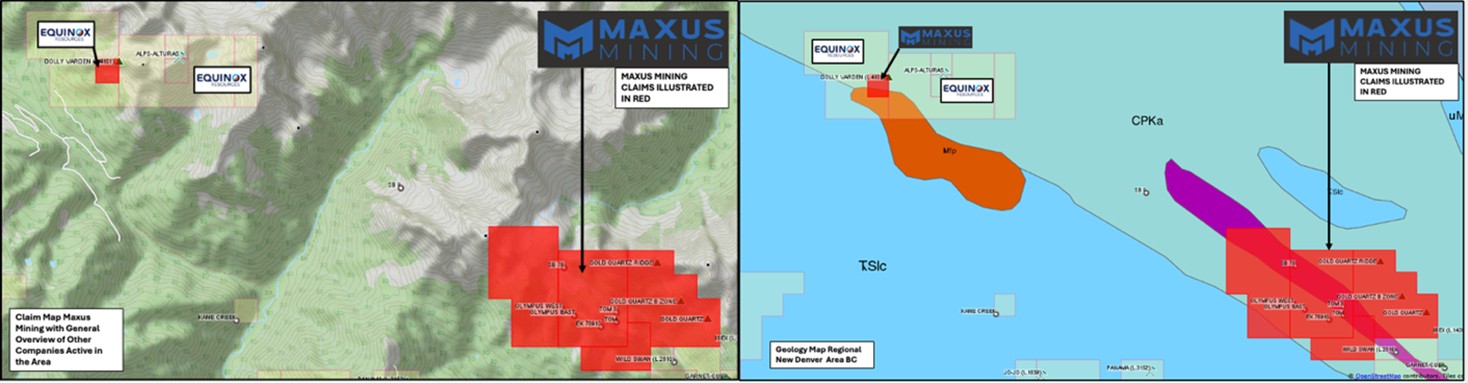

Altura Antimony Project Highlights

The Altura Antimony Project is positioned on the western area of Dolly Varden Mountain, roughly 29 kilometres northeast of New Denver, British Columbia - an area recognized for its strong antimony mineral potential. The property consists of a persistent quartz vein carrying disseminated pyrite and argentiferous tetrahedrite and minor stibnite and chalcopyrite. The vein strikes east, dipping 55 degrees north. It is 0.6 to 3.6 meters thick and has been traced for 600 meters.3

A 4 kg sample of material selected from the dump assayed 1.3 grams per ton gold and 1596 grams per ton silver. There is little geological information on the occurrence, however the 1928 Minister of Mines Annual Report describes a 1.2m quartz vein which carries disseminated to massive stibnite hosted in (or associated with) serpentinite ultramafic rock locally altered to listwanite quartz-carbonate-mariposite.3

The extension claim is on strike from Equinox Resources Inc.'s recent antimony discovery as announced on November 8, 2024, which saw ultra-high grade naturally occurring antimony at their Alturas Project, with assays up to 69.98% Sb.4

Figure 4 - Maxus Mining Altura Antimony Property

Option Agreement Details

On June 4, 2025, the Company entered into the Agreement to acquire an option from the Optionors to earn a hundred percent (100%) interest in the Projects through a combination of cash payments, common share issuances and incurrence of exploration expenditures, as follows:

(1) paying the Optionors an aggregate of $150,000 in cash as follows:

a. $50,000 on or before the date that is thirty (30) business days after June 4, 2025 (the "Effective Date");

b. $50,000 on or before the date that is one (1) year after the Effective Date; and

c. $50,000 on or before the date that is two (2) years after the Effective Date;

(2) issuing to the Optionors an aggregate of $400,000 in common shares ("Shares") as follows:

a. $100,000 in common shares at a deemed price equivalent to the volume-weighted average closing price of the common shares on the Canadian Securities Exchange (the "CSE") in the five (5) trading days immediately prior to issuance on or before the date that is thirty (30) business days after the Effective Date (the "First Tranche Shares");

b. $100,000 in common shares at a deemed price equivalent to the volume-weighted average closing price of the common shares on the CSE in the five (5) trading days immediately prior to issuance on or before the date that is one (1) year after the Effective Date (the "Second Tranche Shares");

c. $100,000 in common shares at a deemed price equivalent to the volume-weighted average closing price of the common shares on the CSE in the five (5) trading days immediately prior to issuance on or before the date that is two (2) years after the Effective Date (the "Third Tranche Shares"); and

d. $100,000 in common shares at a deemed price equivalent to the volume-weighted average closing price of the common shares on the CSE in the five (5) trading days immediately prior to issuance on or before the date that is three (3) years after the Effective Date (the "Fourth Tranche Shares"); and

(3) incurring a minimum of $1,000,000 in exploration expenditures on the Projects as follows:

a. $150,000 on or before the date that is one (1) calendar year after the Effective Date;

b. $250,000 on or before the date that is two (2) calendar years after the Effective Date; and

c. $500,000 on or before the date that is three (3) calendar years after the Effective Date.

Pursuant to the Agreement, the First Tranche Shares, Second Tranche Shares, Third Tranche Shares and Fourth Tranche Shares will all be subject to escrow, with half of the First Tranche Shares released over a 36-month period, the Second Tranche Shares released over a 24-month period, the Third Tranche Shares released over a 18-month period and the Fourth Tranche Shares released over a 12-month period. All securities issued in connection with the Agreement will be subject to a statutory hold period of four months and one day and the Exchange Hold as defined in the policies of the CSE. The Optionors will retain a 2.0% net smelter returns royalty on the Project, of which 1.0% may be purchased back at any time for a one-time cash payment of $1,000,000. No finders' fees were paid on this arm's length Agreement.

References

1 - Geological Survey of Canada Memoir - MINFILE No094C 104 EMPR OF *1992-11; 1993-2 Open File 1992-11, Map Number 10 BCGS

2 - MILFILE No: 082FSW228 - Loto 3, 1980 Grab Sample - https://minfile.gov.bc.ca/report.aspx?f=PDF&r=Inventory_Detail.rpt&minfilno=082FSW228

3 - Dolly Varden Prospect - 11-Oct-1995, Ron McMillan - MINFILE 0.82KSW130 - https://minfile.gov.bc.ca/summary.aspx?minfilno=082KSW130

4 - Equinox Resources - November 8, 2024, 'Ultra High Grade Naturally Occuring Antimony at Alturas Project with Assays up to 69.98% Sb' - https://cdn-api.markitdigital.com/apiman-gateway/ASX/asx-research/1.0/file/2924-02878498-6A1236703

5 - Endurance Gold, Reliance Gold Project, B.C. - Drill and Channel Sample Gold - Antimony Results 2020 to 2024 https://endurancegold.com/projects/reliance-gold-project-b.c/overview/

6 - Endurance Summarizes Antimony Results From The Reliance Gold Project, Bc - Best Intervals Include 19.2% Antimony And 2.16 Gpt Au Over 0.5 M In 2024 Drilling - February 24, 2025 - https://endurancegold.com/news-releases/endurance-summarizes-antimony-results-from-the-reliance-gold-project-bc-best-intervals-include-19.2-antimony-and-2.16-gpt-au/

7 - Mary Mac (Main), Mary Mac (North), Ben Dor, Main, North - 27-Nov-2024, Del Ferguson - MINFILE 092JNE067, https://minfile.gov.bc.ca/Summary.aspx?minfilno=092JNE067

8 - Olympus West, EK, Tom, Chris, Tam, Tim - 24-Oct-1995, Keith J. Mountjoy - MINFILE 0.82KSW175, https://minfile.gov.bc.ca/Summary.aspx?minfilno=082KSW175

Qualified Person

The scientific and technical information contained in this news release has been reviewed and approved by David Mark, P. Geo., a geoscientist consultant to the Company and a Qualified Person as defined in National Instrument 43-101 - Standards of Disclosure for Mineral Projects.

Management cautions that historical results collected and reported by operators unrelated to Maxus have not been verified nor confirmed by its Qualified Person; however, the historical results create a scientific basis work at the Projects. Management further cautions that historical results, discoveries and published resource estimates on adjacent or nearby mineral properties, or other properties located within the area, whether in reference to stated current resource estimates or historical resource estimates, are not necessarily indicative of the results that may be achieved on the Properties.

About Maxus Mining Inc.

Maxus Mining Inc. (CSE:MAXM | FRA:R7V) is a mineral exploration company focused on locating, acquiring, and if warranted, developing economic mineral properties in premier jurisdictions. The Company is working towards progressing its diverse portfolio of exploration properties which includes approximately ~7,244 hectares of prospective terrane comprising ~3,700 hectares of terrane amongst four antimony projects, ~3,120 hectares encompassing the Penny Copper Project & the remaining ~422 hectares coming from the Lotto Tungsten Project.

The Penny Copper Project covers approximately 3,122 hectares and has seen exploration activity throughout the last 100+ years with recent work including rock sampling and minor geological mapping. The Penny Copper Project is located near the major past producing Sullivan Mine at Kimberley, British Columbia, an area that has stimulated both junior and major exploration company activities in the past year. Additionally, the Penny Copper Project saw a 2017 work program return 17 grab samples, which returned copper values up to 1,046 ppm Cu (TK-17-149c), 1,808 ppm Cu (TK17-28) and 2,388 ppm Cu (TK17-12).

At the Quarry Antimony Project, in well-established British Columbia, Canada, one historical sample taken assayed 0.89% g/t Au, 3.8% Cu, 0.34% Zn, 42.5% Pb, and 0.65% g/t Ag and 20% Sb. (Open File 1992-11, Map Number 10). A selected grab sample taken in 1980 at the Lotto Tungsten Project from a quartz vein with scheelite assayed 10.97% Wo3. Additionally, the Altura Antimony Project & the Hurley Antimony project are strategically positioned; Altura is on strike from Equinox Resources recent antimony discovery which saw high-grade naturally occurring antimony with assays up to 69.98% Sb; Hurley neighbours Endurance Gold Corp.'s Reliance Gold Project which saw antimony results from 2024 work programs include 19.2% Sb and 2.16 g/t Au over 0.5m encountered during 2024 drilling.

On Behalf of the Board of Directors

Scott Walters

Chief Executive Officer, Director

+1 (778) 374-9699

info@maxusmining.com

Disclaimer for Forward-Looking Information

Certain statements in this news release are forward-looking statements, including with respect to future plans, and other matters. Forward-looking statements consist of statements that are not purely historical, including any statements regarding beliefs, plans, expectations or intentions regarding the future. Such information can generally be identified by the use of forwarding-looking wording such as "may", "expect", "estimate", "anticipate", "intend", "believe" and "continue" or the negative thereof or similar variations. The reader is cautioned that assumptions used in the preparation of any forward-looking information may prove to be incorrect. Events or circumstances may cause actual results to differ materially from those predicted, as a result of numerous known and unknown risks, uncertainties, and other factors, many of which are beyond the control of the Company, including but not limited to, business, economic and capital market conditions, the ability to manage operating expenses, and dependence on key personnel. Forward looking statements in this news release include, but are not limited to, statements with respect to the Projects and their mineralization potential; the Company's objectives, goals, or future plans with respect to the Projects; completion of the Acquisition; and the Company's anticipated exploration programs at the Projects. Such statements and information are based on numerous assumptions regarding present and future business strategies and the environment in which the Company will operate in the future, anticipated costs, and the ability to achieve goals. Factors that could cause the actual results to differ materially from those in forward-looking statements include, the continued availability of capital and financing, litigation, failure of counterparties to perform their contractual obligations, loss of key employees and consultants, and general economic, market or business conditions. Forward-looking statements contained in this news release are expressly qualified by this cautionary statement. The reader is cautioned not to place undue reliance on any forward-looking information.

The Canadian Securities Exchange (CSE) does not accept responsibility for the adequacy or accuracy of this release.

Photos accompanying this announcement are available at

https://www.globenewswire.com/NewsRoom/AttachmentNg/30e51d90-1356-40bf-9871-f298c00f0ad9

https://www.globenewswire.com/NewsRoom/AttachmentNg/8c8ddc22-9b8e-4dbf-ad36-0b9c72e75dd5

https://www.globenewswire.com/NewsRoom/AttachmentNg/9c9961a6-3ee5-4221-a185-279cce85541e

https://www.globenewswire.com/NewsRoom/AttachmentNg/fe157e6d-5c5f-4d48-b622-7cf44cc392ab