Palm Beach Gardens, Florida--(Newsfile Corp. - June 10, 2025) - Robert G. Brown, hereinafter referred to as "Mr. Brown", holding directly and indirectly 6,469,683 shares of common stock, $0.01 par value per share ("Common Stock"),1 in SPAR Group, Inc., a Delaware corporation (the "Company"), who is a founder of the Company as well as past CEO and Chairman, hereby announces how he plans to vote, and reasons therefor, at the upcoming annual meeting of the shareholders of the Company to be held on June 12, 2025 (the "2025 Annual Meeting").

This is not a solicitation of authority to vote your proxy. Please DO NOT send your proxy card to Mr. Brown who is not able to vote your proxies, nor does this communication contemplate such an event. Mr. Brown urges shareholders to vote in person or by proxy at the 2025 Annual Meeting in accordance with the instructions provided by the Company in the Proxy Statement filed with the SEC on May 23, 2025 (the "Proxy Statement") and the Proxy Card thereof (the "Proxy Card").

The following information should not be construed as investment advice. Please read the important notices at the end of this document.

Reasons for Mr. Brown's votes:

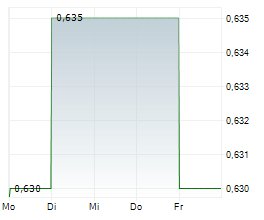

On June 3, 2024, the price of the Company's Common Stock was $2.97. On May 29, 2025, the price of the Company Common Stock was $1.02.

In 2024 and 2025, the Company's management, with approval of the board of directors of the Company (the "Board"), took various actions (including the sale of profitable subsidiaries of the Company) that have resulted in a 25.1% reduction in revenue from 2023 ($262,747) to 2024 ($196,814) (figures in thousands).2

The Board has approved cash compensation for the Board for the fiscal year of 2025 in an aggregate of almost $1,000,000.3

The Company failed to hold an annual shareholder meeting in 2024.4

The Company failed to file an annual report on Form 10-K in a timely manner for the fiscal year of 20245 and was notified by NASDAQ that the Company was at risk of being delisted.6

The Compensation Committee of the Board approved a $2,264,877 summary compensation package for the CEO for the year of 2024, an increase from $1,164,551 for the year of 2023, $612,613 for the year of 2022, and $304,086 for the year of 2021.7

The Company is in violation of various provisions of its bylaws, as amended through the date hereof (the "Bylaws").8

The Company refused to allow other candidates for the Board to be put into the proxy to give shareholders a choice among candidates for directors.9 The current directors voted to allow only those currently serving as directors to be included as candidates for election as directors in the Proxy Statement for the 2025 Annual Meeting, thereby ensuring the shareholders do not have a choice of directors.10

There is a lack of focus on increasing the price of the Company's Common Stock to improve shareholder value.

The Company did not hold an annual shareholders meeting in 2024 and is holding the 2025 Annual Shareholders meeting on June 12, 2025.11

The Company has provided no guidance of expected Earnings Per Share (EPS) in 2025.

In the fiscal year of 2024, the Company had a net loss attributable to SPAR Group, Inc., of $4,412,000 from a profit of $5,742,000 in 2023.12

The Bylaws were changed in 2022 making them shareholder unfriendly and out of compliance with best practices as recommended by Glass-Lewis and Institutional Shareholder Services (ISS).13 These include: (1) requirements that 75% of the shareholders are required to call a meeting of the shareholders14 versus a best practice recommended by Glass-Lewis or ISS, (2) allowing the CEO to have 100% of the voting authority of the Board in certain situations, and (3) prohibiting directors who have prior associations with the Company, such as employees, advisors or former executives, from serving as Committee Chairman or the Chairman.15 Only directors without any prior association with the Company are permitted to serve in these roles.16

The Governance Committee of the Board has ignored past shareholder advisory votes on maintaining the current auditors.17

The Board has failed to publicly disclose various legal disputes with shareholders.18

The Board recommended that shareholders approve a sale of the Company transaction approved by the Board in August 202419 (such transaction, the "Highwire Merger"), without validating if the prospective buyer could finance the transaction. The Highwire Merger agreement precluded the Company from taking any competing sale or merger actions until May 30, 2025.20 The Highwire Merger failed and by May 30, 2025,21 the price of the Company's Common Stock has declined over 60% from just prior to the date of the announcement of the Highwire Merger.22 There has been no accountability for this failure of the Highwire Merger, and the financial advisory firm involved in this transaction has not been terminated and is still under contract with a guaranteed minimum payment for a future transaction.

The CEO of the Company also is the Chairman of Qantm Creative, a supplier to the Company.23 His wife, Jean Matacunas, is the CEO of Qantm Creative.24

Mr. Brown believes that the shareholders' interests would be better served and advanced by the following actions:

- A 6,000,000 share buyback.

- A $.02/per share quarterly dividend.

- A review by the Board of the A&R Bylaws and the best practices recommended by Glass Lewis and ISS to determine if the current A&R Bylaws are in the best interest of the shareholders.

- A review of Board compensation to determine if making the compensation partly dependent (e.g. 50% of compensation) on the share price would be in the best interest of the shareholders.

- A review by the Compensation Committee to determine if the shareholders would be more effectively served by having a high proportion of management's compensation based on delivering shareholder value (as evidenced by the stock price) and positive net earnings.

The current Board has had ample opportunity to correct many of the Company's problems and to take many other actions beneficial to shareholders, but has failed to do so.

Mr. Brown will vote at the 2025 Annual Meeting in person or by proxy as follows:

- PROPOSAL 1 - ELECTION OF DIRECTORS:

- AGAINST the election of Ms. Linda Houston (Chairperson of the Compensation Committee), Mr. John Bode (Chairman of the Audit Committee) and Mr. Michael R. Matacunas to the Board;

- FOR the election of Mr. James R. Brown and Mr. Panagiotis Lazaretos to the Board.

- AGAINST the election of Ms. Linda Houston (Chairperson of the Compensation Committee), Mr. John Bode (Chairman of the Audit Committee) and Mr. Michael R. Matacunas to the Board;

- PROPOSAL 2 - AGAINST the ratification, on an advisory basis, of the use of BDO USA, P.C. as the independent registered accounting firm for the corporation and its subsidiaries for the year ending December 31, 2025.

- PROPOSAL 3 - AGAINST the advisory vote on the compensation of the named executive officers.

- PROPOSAL 4 - FOR A ONE (1) YEAR REVIEW PERIOD in respect of the advisory vote on whether the corporation should request an advisory vote from its stockholders respecting compensation of the named executive officers every one (1), two (2) or three (3) years (i.e., "Say on Frequency").

- PROPOSAL 5 - AGAINST the authorization of the 2025 Stock Compensation Plan.

IMPORTANT NOTICES:

THIS IS NOT A PROXY SOLICITATION AND NO PROXY CARDS WILL BE ACCEPTED. PLEASE DO NOT SEND YOUR PROXY TO MR BROWN. TO VOTE YOUR PROXY, PLEASE FOLLOW THE INSTRUCTIONS ON YOUR PROXY CARD.

THE FOREGOING INFORMATION MAY BE DISSEMINATED TO COMPANY SHAREHOLDERS VIA TELEPHONE, U.S. MAIL, E-MAIL, CERTAIN WEBSITES AND CERTAIN SOCIAL MEDIA VENUES, IN ADDITION TO PRESS RELEASE. THIS DOCUMENT SHOULD NOT BE CONSTRUED AS INVESTMENT ADVICE, OR AS A SOLICITATION OF AUTHORITY TO VOTE YOUR PROXY, OR A RECOMMENDATION OF HOW TO VOTE.

THE COST OF DISSEMINATING THE FOREGOING INFORMATION TO SHAREHOLDERS IS BEING BORNE ENTIRELY BY MR. BROWN.

THE INFORMATION CONTAINED HEREIN HAS BEEN PREPARED FROM SOURCES BELIEVED RELIABLE BUT IS NOT GUARANTEED BY MR. BROWN AS TO ITS TIMELINESS OR ACCURACY, AND IS NOT A COMPLETE SUMMARY OR STATEMENT OF ALL AVAILABLE DATA. THIS DOCUMENT IS FOR INFORMATIONAL PURPOSES ONLY AND SHOULD NOT BE CONSTRUED AS A RESEARCH REPORT.

Disclaimers

The views expressed herein are those of Mr. Brown as of the date referenced and are subject to change at any time based on market or other conditions. These views are not intended to be a forecast of future events or a guarantee of future results. These views may not be relied upon as investment advice. The information provided in this material should not be considered a recommendation to buy or sell any of the securities mentioned. It should not be assumed that investments in such securities have been or will be profitable. This document is rendered solely for informational purposes.

This filing is in connection with the planned vote by Mr. Brown (which he reserves the right to modify without notice) at the June 12, 2025, meeting of the Company's shareholders called by the Board. It is not a recommendation for how any shareholder's shares should be voted (for, against or abstain) in connection with any of the directors or proposals set forth in the Company's proxy statement. It is not an attempt to either appoint or remove any director.

Press inquiries: please contact Robert Brown via email at rbrown6@msn.com.

# # #

1 Robert G. Brown, Statement of Changes in Beneficial Ownership (Form 4/A) (May 12, 2025).

2 SPAR Grp., Inc. Annual Report 33 (Form 10-K) (May 16, 2025), see sections Consolidated Statements of Operations and Comprehensive (Loss) Income.

3 SPAR Grp., Inc., Schedule 14A 25 (Form DEF14A) (May 23, 2025).

4 SPAR Grp., Inc., Current Report Exh. 99.1, (Form 8-K) (Jan. 3, 2025).

5 SPAR Grp., Inc., Current Report (Form 8-K) (Apr. 23, 2025).

6 SPAR Grp., Inc., Current Report Exh. 99.1 (Form 8-K) (Apr. 23, 2025).

7 SPAR Grp., Inc., Schedule 14A 23 (Form DEF14A) (May 23, 2025).

8 Amended and Restated Bylaws, adopted effective as of January 18, 2022, attached as Exhibit 3.3 to the Company's Current Report (Form 8-K) (Jan. 25, 2022) (hereinafter referred to as the "A&R Bylaws") (Mr. Brown alleges (x) that the Company's failure to have a Board of 7 members for the calendar year of 2024 was a violation of Section 3.01 of the A&R Bylaws; (y) the terms of the written letter of resignations for directors was changed to terms other than as specified in Section 3.11 of the Bylaws; and (z) Section 3.09 provides that the shareholders may remove a director, but the Board requires each director to execute a resignation letter that permits other members of the Board to remove such director).

9 SPAR Grp., Inc., Schedule 14A (Form DEF14A) (May 23, 2025).

10 SPAR Grp., Inc., Schedule 14A (Form DEF14A) (May 23, 2025).

11 SPAR Grp., Inc., Current Report, Exh. 99.1, (Form 8-K) (Jan. 3, 2025); SPAR Grp., Inc., (Form 8-K) (Mar. 11, 2025).

12 SPAR Grp., Inc., Annual Report. 33 (Form 10-K) (May 16, 2025), see Consolidated Statements of Operations and Comprehensive (Loss) Income.

13 2022 Policy Guidelines, Glass Lewis, 27 (last visited May 30, 2025) https://resources.glasslewis.com/hubfs/2022%20Guidelines/2022%20United%20States%20Benchmark%20Policy%20Guidelines.pdf; United States Proxy Voting Guidelines, Glass Lewis, 33 (Jan. 9, 2025) https://www.issgovernance.com/file/policy/active/americas/US-Voting-Guidelines.pdf

14 A&R Bylaws Sections 2.02 and 2.11(a).

15 A&R Bylaws Sections 3.04, 4.04 and 5.05.

16 Id.

17 SPAR Grp., Inc., Current Report (Form 8-K) (July 12, 2022) (Proposal (ii), the ratification of the appointment of BDO USA, LLP, as the independent registered accounting firm received 7,613,862 votes against, and only 6,925,283 votes "for").

18 Mr. Brown currently is in a dispute with the Company over certain provisions of the Change of Control, Voting and Restricted Stock Agreement, dated as of January 28, 2022 (Exhibit 10.1 of the Company's Current Report Form 8-K filed Jan. 28, 2022), having alleged that the Company is in breach of various terms therein.

19 SPAR Grp., Inc., Current Report (Form 8-K) (Aug. 30, 2024).

20 SPAR Grp., Inc., Current Report (Form 8-K) (Aug. 30, 2024), (Exh. 2.1: Agreement and Plan of Merger, by and among Highwire Capital LLC, Highwire Merger Co 1, Inc., and SPAR Group Inc. (the "Merger Agreement"), Section 7.02 and Covenants in Section 5.01).

21 SPAR Grp., Inc., Current Report (Form 8-K) (May 23, 2025).

22 SPAR Grp., Inc., Current Report (Form 8-K) (June 5, 2024) (announcing Letter of Intent with Highwire); SPAR Group, Inc. (SGRP) Stock Declines While Market Improves: Some Information for Investors, Zacks, https://www.zacks.com/stock/news/2479236/spar-group-inc-sgrp-stock-declines-while-market-improves-some-information-for-investors?cid=CS-MSN-FT-tale_of_the_tape|yseop_template_6v1-2479236 (last visited May 30, 2025) (year-to-year decline of approximately 60%).

23 Mike Matacunas, LinkedIn, https://www.linkedin.com/in/mike-matacunas (last visited June 2, 2025); see also About Us, Qantm Creative https://qantmcreative.com/about/ (last visited June 2, 2025).

24 About Us, Qantm Creative https://qantmcreative.com/about/ (last visited June 2, 2025).

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/254525

SOURCE: Robert G. Brown