Palm Beach Gardens, Florida--(Newsfile Corp. - June 12, 2025) - Robert G. Brown, hereinafter referred to as "Mr. Brown", holding directly and indirectly 6,469,683 shares of common stock, $0.01 par value per share ("Common Stock"),[1] in SPAR Group, Inc., a Delaware corporation (the "Company"), who is a founder of the Company as well as past CEO and Chairman, hereby responds to the Company's press release of June 11, 2025 (the "SPAR June 11 Release").[2] The SPAR June 11 Release was issued by the Company in response to Mr. Brown's June 10, 2025 press release and related Form PX14A6G, filed with the U.S. Securities & Exchange Commission on June 10, 2025.

This is not a solicitation of authority to vote your proxy. Please DO NOT send your proxy card to Mr. Brown who is not able to vote your proxies, nor does this communication contemplate such an event. Mr. Brown urges shareholders to vote in person or by proxy at the 2025 Annual Meeting in accordance with the instructions provided by the Company in the Proxy Statement filed with the SEC on May 23, 2025 (the "Proxy Statement") and the Proxy Card thereof (the "Proxy Card").

The following information should not be construed as investment advice. Please read the important notices at the end of this document.

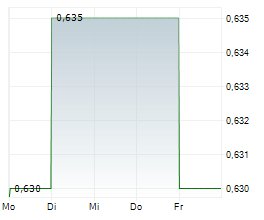

Mr. Brown notes that the SPAR June 11 Release does not address the reason(s) for the drop in stock price from $2.97 on June 3, 2024, to $1.02 on May 29, 2025, or how the Board plans to increase the stock price.

Mr. Brown recommended 5 items to the Company's Board of Directors (the "Board") for consideration and implementation. They are:

- A 6,000,000 share buyback.

- A $.02/per share quarterly dividend.

- A review by the Board of the Company's Amended and Restated Bylaws, adopted effective as of January 18, 2022 (the "A&R Bylaws"), and the best practices recommended by Glass Lewis and ISS to determine if the current A&R Bylaws are in the best interest of the shareholders.

- A review of Board compensation to determine if making the compensation partly dependent (e.g. 50% of compensation) on the share price would be in the best interest of the shareholders.

- A review by the Compensation Committee to determine if the shareholders would be more effectively served by having a high proportion of management's compensation based on delivering shareholder value (as evidenced by the stock price) and positive net earnings.

In the SPAR June 11 Release, the Company did not address Mr. Brown's recommendations and he still recommends that the Board consider all 5 actions.

Mr. Brown is a large shareholder, and his interests are aligned with the shareholders. Mr. Brown believes that his recommendations should be considered and implemented by the Board for the benefit of all shareholders.

While the SPAR June 11 Release does not address the substantive issues of Mr. Brown's recommendations, it does spend a lot of time attacking him personally. In politics it is said if you cannot win on the substance, attack the person. Much of what is in the SPAR response is unverifiable, out of context, irrelevant or consists only of selected extracts of settlements and other discussions.

Mr. Brown believes that his recommendations are in the best interests of the shareholders. He encourages the Board to be transparent and explicitly advise the shareholders what the Board's position is on all five of his recommendations.

IMPORTANT NOTICES:

THIS IS NOT A PROXY SOLICITATION AND NO PROXY CARDS WILL BE ACCEPTED. PLEASE DO NOT SEND YOUR PROXY TO MR BROWN. TO VOTE YOUR PROXY, PLEASE FOLLOW THE INSTRUCTIONS ON YOUR PROXY CARD.

THE FOREGOING INFORMATION MAY BE DISSEMINATED TO COMPANY SHAREHOLDERS VIA TELEPHONE, U.S. MAIL, E-MAIL, CERTAIN WEBSITES AND CERTAIN SOCIAL MEDIA VENUES, IN ADDITION TO PRESS RELEASE. THIS DOCUMENT SHOULD NOT BE CONSTRUED AS INVESTMENT ADVICE, OR AS A SOLICITATION OF AUTHORITY TO VOTE YOUR PROXY, OR A RECOMMENDATION OF HOW TO VOTE.

THE COST OF DISSEMINATING THE FOREGOING INFORMATION TO SHAREHOLDERS IS BEING BORNE ENTIRELY BY MR. BROWN.

THE INFORMATION CONTAINED HEREIN HAS BEEN PREPARED FROM SOURCES BELIEVED RELIABLE BUT IS NOT GUARANTEED BY MR. BROWN AS TO ITS TIMELINESS OR ACCURACY, AND IS NOT A COMPLETE SUMMARY OR STATEMENT OF ALL AVAILABLE DATA. THIS DOCUMENT IS FOR INFORMATIONAL PURPOSES ONLY AND SHOULD NOT BE CONSTRUED AS A RESEARCH REPORT.

Disclaimers

The views expressed herein are those of Mr. Brown as of the date referenced and are subject to change at any time based on market or other conditions. These views are not intended to be a forecast of future events or a guarantee of future results. These views may not be relied upon as investment advice. The information provided in this material should not be considered a recommendation to buy or sell any of the securities mentioned. It should not be assumed that investments in such securities have been or will be profitable. This document is rendered solely for informational purposes.

Press inquiries: please contact Robert Brown via email at rbrown6@msn.com.

# # #

[1] Robert G. Brown, Statement of Changes in Beneficial Ownership (Form 4/A) (May 12, 2025).

[2] SPAR Group, Inc. Responds to False and Disparaging Comments from Former Board Member, Robert G. Brown, Regarding the Company and Its Board, SPAR Group, Inc. (last viewed June 12, 2025) https://investors.sparinc.com/news-releases/news-release-details/spar-group-inc-responds-false-and-disparaging-comments-former.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/255385

SOURCE: Robert G. Brown