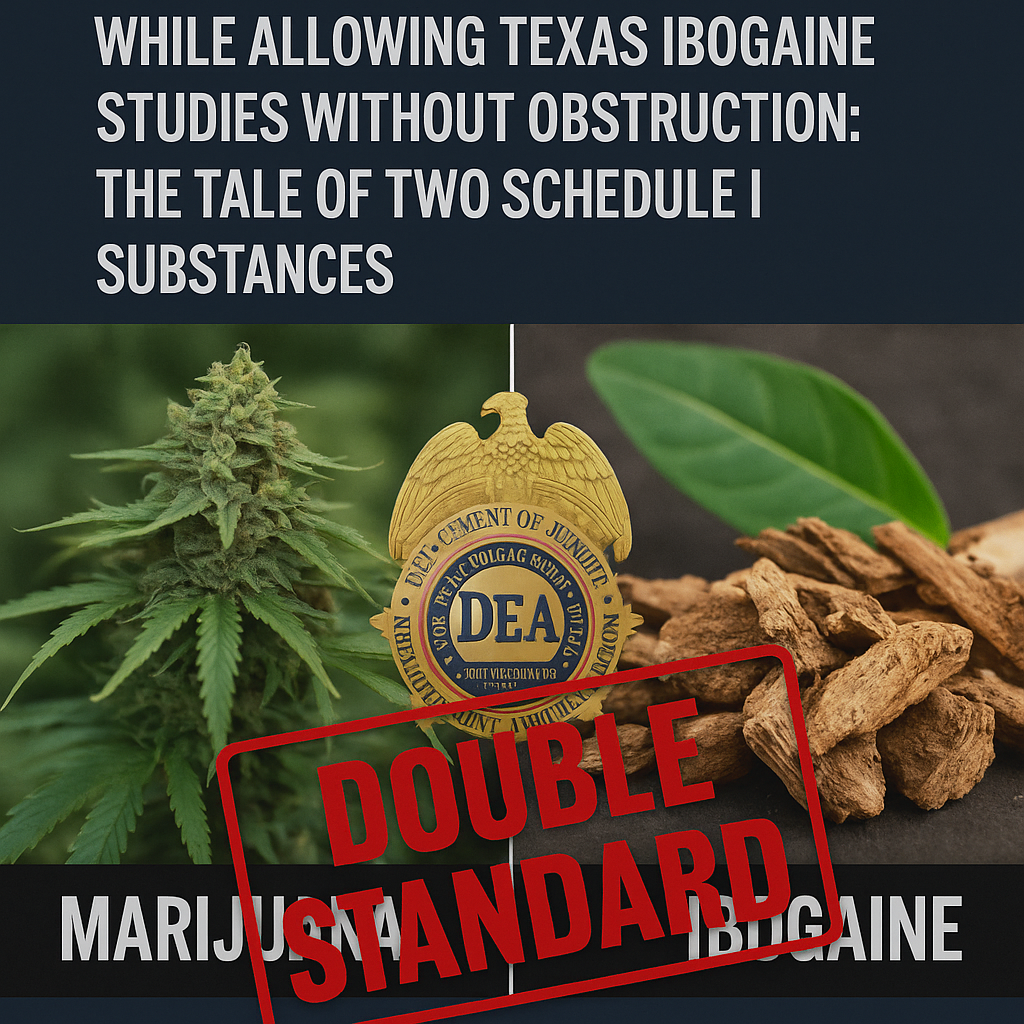

Two Schedule I drugs. Two research tracks. One DEA double standard.

MMJ BioPharma Cultivation's FDA sanctioned cannabis research has been stonewalled for seven years. Meanwhile, Texas launches state-funded ibogaine trials with full political support and zero DEA obstruction.

Is federal drug policy about science or selective enforcement?

WASHINGTON, DC / ACCESS Newswire / June 15, 2025 / The Drug Enforcement Administration (DEA) has spent the last seven years obstructing MMJ BioPharma Cultivation's federally lawful efforts to research cannabis derived medicine for devastating neurological diseases. Yet this week, the same Drug Enforcement Administration sits idly by as Texas Governor Greg Abbott signs SB 2308, a bold new law investing $50 million into clinical research of ibogaine, a Schedule I psychedelic with no FDA approval and known cardiotoxicity risks.

The DEA hypocrisy is staggering.

Two Schedule I Drugs, Two Opposite Realities

Ibogaine and marijuana are both Schedule I substances - the most restrictive classification under the Controlled Substances Act. This means the DEA claims they have:

No currently accepted medical use, and

A high potential for abuse.

And yet, while Texas is encouraged to pursue ibogaine trials through gifts, grants, and state matching funds, MMJ BioPharma has been trapped in a Kafkaesque limbo for attempting the same with cannabis-despite MMJ's direct alignment with the FDA's Investigational New Drug (IND) process, orphan drug designation, and a DEA-compliant manufacturing facility.

"Why is Texas allowed to bypass federal enforcement for psychedelic research while MMJ BioPharma Cultivation is targeted and delayed for developing cannabis-based therapies through the FDA?"

stated Duane Boise CEO MMJ.

The Texas Psychedelic Loophole: DEA Selective Enforcement?

Under SB 2308, Texas will now:

Fund clinical ibogaine trials despite its Schedule I status

Rely on state institutions with cardiac-monitoring capabilities

Pursue FDA registration, even though ibogaine has never passed federal safety review

There has been no indication that the DEA intends to interfere with this psychedelic research initiative. In fact, Texas officials cite DEA coordination as merely a procedural formality.

Compare that to MMJ BioPharma:

Filed for DEA Schedule I Bulk Manufacturing Registration in 2018

Passed multiple DEA facility inspections

Obtained FDA Orphan Drug Designation for Huntington's Disease

Submitted INDs for MS and Huntington's

Was forced to sue the DEA in federal court after years of delay and inaction

Despite this, DEA attorneys - including those under internal ethics investigation - have argued to dismiss MMJ's claims and to keep the company locked out of cannabis-based drug development.

So let's ask the obvious: Will the DEA block Texas next? Or are Schedule I drugs only "dangerous" when researched by companies the DEA doesn't control?

Veterans Deserve Science, Not Bureaucracy

Both ibogaine and cannabis have shown promise in treating PTSD, opioid dependency, and neurodegenerative diseases, especially among U.S. veterans. But only one path is being respected by federal regulators: the one funded by politics, not science.

"Patients deserve real medicine, not political footballs," said Duane Boise, CEO of MMJ International Holdings.

The Inconvenient Truth: MMJ Followed the Law - And Paid the Price

The contrast could not be more striking:

Texas bypasses federal law, gets funded

MMJ follows federal law, gets punished

If the DEA allows Texas to move forward unimpeded while continuing to obstruct MMJ's FDA-approved research, it will be a glaring admission of regulatory bias, abuse of discretion, and political favoritism.

Congress, the courts, and the public must now ask:

Is the DEA enforcing the law-or weaponizing it?

If the DEA cannot respect the law, then the law must be used to dismantle the DEA.

MMJ is represented by attorney Megan Sheehan.

CONTACT:

Madison Hisey

MHisey@mmjih.com

203-231-8583

SOURCE: MMJ International Holdings

View the original press release on ACCESS Newswire:

https://www.accessnewswire.com/newsroom/en/healthcare-and-pharmaceutical/dea-delays-mmj-cannabis-research-while-allowing-texas-ibogaine-studie-1039130