NOT FOR DISTRIBUTION TO U.S. NEWSWIRE SERVICES OR DISSEMINATION IN THE UNITED STATES

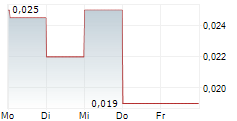

TORONTO, June 18, 2025 (GLOBE NEWSWIRE) -- Water Ways Technologies Inc. (TSXV: WWT) (FRA: WWT) ("Water Ways" or the "Company"), a global provider of Israeli-based agriculture technology, providing water irrigation solutions to agricultural producers, announces that at the special meeting of shareholders of the Company (the "Meeting") scheduled for July 14, 2025, shareholders will be asked to pass, with or without variation, an ordinary resolution to approve a consolidation (the "Consolidation") of the common shares in the capital of the Company (the "Common Shares") on the basis of up to ten (10) pre-Consolidation Common Shares for one (1) post-Consolidation Common Share, as and when determined by the board of directors of the Company (the "Board") in its sole discretion.

The Board is seeking authority to implement the Consolidation if and when it believes such action shall be appropriate and beneficial to the capital structure of the Company. The Company believes that the Consolidation could also broaden the pool of investors that would consider investing in Water Ways, thereby resulting in a more efficient market for the Common Shares.

Currently, the Company has 148,785,346 Common Shares issued and outstanding on a pre-Consolidation basis. If the Consolidation is completed, the Company would have approximately 14,878,537 Common Shares issued and outstanding, assuming the Consolidation ratio is completed on the basis of ten (10) pre-Consolidation Common Shares for one (1) post-Consolidation Common Share. No fractional Common Shares would be issued as a result of the Consolidation and no cash consideration would be paid in respect of fractional shares.

The Common Shares would continue to trade on the TSX Venture Exchange (the "Exchange") under the symbol "WWT" and the Company's name would remain the same.

As a result of the Consolidation, the exercise or conversion price and the number of Common Shares issuable under any of the Company's outstanding warrants and stock options would be proportionately adjusted to reflect the Consolidation in accordance with the respective terms thereof.

Notwithstanding the foregoing, the Board may determine not to implement the Consolidation at any time after the Meeting and after receipt of necessary regulatory approvals, but prior to effecting the required amendment to the Company's articles, without further action on the part of the shareholders. The Consolidation is subject to the prior approval of the Exchange and shareholders of the Company.

The Company previously announced a proposed share consolidation in its news releases dated December 11, 2024, and December 23, 2024. Although shareholder approval for the proposed consolidation was obtained at a special meeting held on December 29, 2023, the consolidation was not implemented, and the shareholder approval lapsed on December 29, 2024.

Further information on the Consolidation can be found in the Company's management information circular dated June 9, 2025 available on SEDAR+ at www.sedarplus.ca.

About Water Ways Technologies Inc.

Water Ways through its subsidiary, is a Canadian provider of Israeli-based agriculture technology, providing water irrigation solutions to agricultural producers in Canada and the USA. Water Ways is capitalizing on the opportunities presented by micro and smart irrigation to the Canadian market. Water Ways' irrigation projects include vineyards, blueberries, fresh produce cooling rooms and more.

For more information, please contact

Ronnie Jaegermann

Director

T: +972-54-4202054

E: Ronnie@exit-team.com

https://www.water-ways-technologies.com/

https://www.hg-wwt.com/

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Forward-Looking Statements

Certain statements contained in this press release constitute "forward-looking information" as such term is defined in applicable Canadian securities legislation. The words "may", "would", "could", "should", "potential", "will", "seek", "intend", "plan", "anticipate", "believe", "estimate", "expect" and similar expressions as they relate to Water Ways. Forward looking statements in this press release include statements regarding the Meeting, the proposed Consolidation, including the timing and completion thereof, and TSXV and shareholder approval of the Consolidation All statements other than statements of historical fact may be forward-looking information. Such statements reflect Water Ways' current views and intentions with respect to future events, and current information available to Water Ways, and are subject to certain risks, uncertainties and assumptions. Material factors or assumptions were applied in providing forward-looking information. Many factors could cause the actual results, performance or achievements that may be expressed or implied by such forward-looking information to vary from those described herein should one or more of these risks or uncertainties materialize. Should any factor affect Water Ways in an unexpected manner, or should assumptions underlying the forward-looking information prove incorrect, the actual results or events may differ materially from the results or events predicted. Any such forward-looking information is expressly qualified in its entirety by this cautionary statement. Moreover, Water Ways does not assume responsibility for the accuracy or completeness of such forward-looking information. The forward-looking information included in this press release is made as of the date of this press release and Water Ways undertakes no obligation to publicly update or revise any forward-looking information, other than as required by applicable law. Water Ways' results and forward-looking information and calculations may be affected by fluctuations in exchange rates and its own share prices. All figures are in Canadian dollars unless otherwise indicated.