PRESS RELEASE

PRESS RELEASE

With the US data center pipeline surging regulated utilities are proving advantaged in meeting demand, says Wood Mackenzie

- Wood Mackenzie is tracking 134 GW of proposed data centres across the US, up from 50 GW a year ago

- Vertically integrated regulated utilities emerging as leaders in capturing the growth opportunity

- Deregulated markets are struggling to accommodate large loads

- Off grid solutions present challenges, with few projects moving forward

LONDON / HOUSTON / SINGAPORE, 19 June 2025 - With data center demand booming in the US, vertically integrated regulated utilities are proving to be advantaged compared to deregulated markets in getting large loads connected to the grid, according to the new Horizons report from Wood Mackenzie.

According to the report, "US power struggle: How data centre demand is challenging the electricity market model", Wood Mackenzie is now tracking 134 GW of proposed data centres and 63 GW of utility commitments to large loads, the latter equal to a 12% increase in US electricity demand.

"Substantial hurdles make meeting this demand growth challenging," said Chris Seiple, vice chairman, Energy Transition and Power & Renewables for Wood Mackenzie. "There are bottlenecks for critical pieces of equipment needed to enable new supply, substantial amounts of coal fired generation is set to retire, and new projects have long lead times due to bottlenecked interconnection queues, the need for transmission upgrades and permitting challenges.

"The large load demand being met by regulated utilities are raising a host of new issues for regulators and could ultimately expose existing customers to picking up the tab for investments to serve data centres if this demand does not materialise as anticipated. In a competitive power market, if data centres are added at a pace faster than new power plants can be brought online, it could threaten grid reliability and lead to power outages."

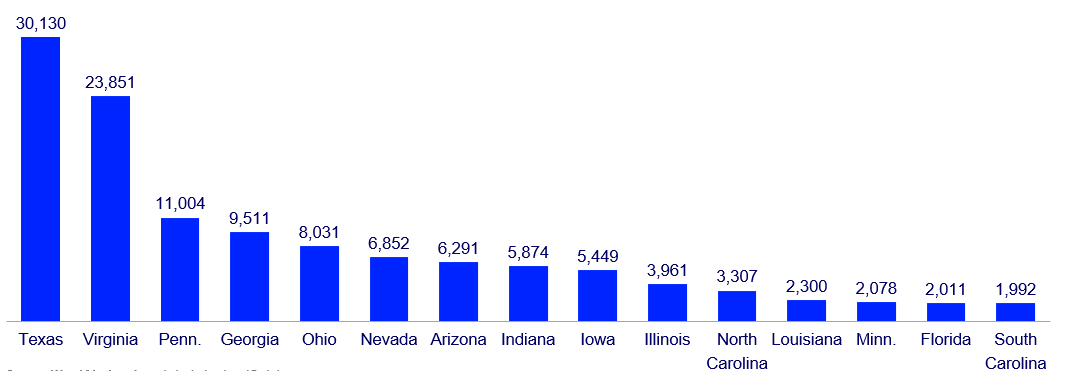

Figure 1: MW of announced data centres since 1 January 2023 in top 15 US states

Source: Wood Mackenzie

Regulated utilities advantaged in meeting this new demand

With utilities citing longer and longer lead times to get data centers connected to the grid, many are seeking off-grid solutions, or those self-sufficient power systems independent of the grid. However, success in such projects is rare.

"Relying on resources with no grid connection while achieving the reliability data centers desire introduces enormous engineering complexity, risk, and cost.," said Seiple. "With off-grid not a viable scalable solution, it is becoming increasingly clear that vertically integrated regulated utilities that embrace data centres are emerging as the leaders in capturing the growth opportunity."

According to the report, Utilities are capitalising on the following strengths:

- Integrated load and generation planning processes. Integrated load and generation planning processes enable them to plan for new demand growth best and most efficiently.

- Foster flexibility and creativity in accelerating project timelines. Utilities are not known for innovation, but because of their integrated planning processes, they are best placed to advise a data centre developer on how to configure their project to minimize interconnection costs and get connected most quickly.

- Building community support. Given their local political relationships, utilities can sometimes be supportive in gaining local community support for data centre development and helping to pave the path for zoning or other regulatory changes.

- Land ownership at attractive sites. Multiple utilities have retired coal-fired power plants or other land with significant transmission and fibre infrastructure.

The report notes that just because utilities are proving advantaged in meeting data center demand growth, there are still disadvantages. Utilities may not offer the clean energy solutions often desired. Not all utilities are innovative, and they may not offer the same commercial flexibility a large load can achieve in a deregulated market where it has choices. Utilities have varying track records in delivering infrastructure projects on time and on budget. Most important, existing utility customers could potentially be at risk of paying for the investments meant to meet these new loads if the new demand does not materialize as forecast.

"Deregulated markets, in contrast to regulated utilities, are struggling to accommodate large loads," said Ben Hertz-Shargel, global head of Grid Edge for Wood Mackenzie. "Energy and capacity prices remain below the level necessary to incentivize new entry, and by their nature markets do not allow costs to be confined to large load customers."

The report notes that electricity markets are more local than most commodity markets, and so politicians can be blamed for high prices and scarcity, in the form of grid outages.

"Something will have to give," said Hertz-Shargel. "If markets allow rates to rise for all customers, states are likely to intervene, which could have long-term impacts on power prices and asset valuations. This presents an unprecedented test for deregulated markets."

The report concludes that utilities, like markets, are exposed to significant risk.

"Utilities are at a crossroads, seeking to balance state economic development objectives and an unprecedented revenue opportunity against the risk to reliability and a radically new credit profile," said Seiple. "As one utility executive put it, they are building the plane while flying it. Their business model and financial condition are certain to look very different when they are done."

Read the entire report here.

ENDS

For further information please contact Wood Mackenzie's media relations team:

Mark Thomton

+1 630 881 6885

Mark.thomton@woodmac.com

Hla Myat Mon

+65 8533 8860

hla.myatmon@woodmac.com

Chris Boba

+44

Angelica Juarez

angelica.juarez@woodmac.com

The Big Partnership

You have received this news release from Wood Mackenzie because of the details we hold about you. If the information we have is incorrect you can either provide your updated preferences by contacting our media relations team. If you do not wish to receive this type of email in the future, please reply with 'unsubscribe' in the subject header. -

About Wood Mackenzie

Wood Mackenzie is the global insight business for renewables, energy and natural resources. Driven by data. Powered by people. In the middle of an energy revolution, businesses and governments need reliable and actionable insight to lead the transition to a sustainable future. That's why we cover the entire supply chain with unparalleled breadth and depth, backed by over 50 years' experience in natural resources. Today, our team of over 2,000 experts operate across 30 global locations, inspiring customers' decisions through real-time analytics, consultancy, events and thought leadership. Together, we deliver the insight they need to separate risk from opportunity and make bold decisions when it matters most. For more information, visit woodmac.com.