Judge Mulrooney's decision may have handed MMJ BioPharma Cultivation a defeat inside the DEA's walls, but in doing so, he may have handed MMJ a powerful victory in federal court. The record of constitutional violations and DEA violations is now preserved - the "Axon-Jarkesy defense"is primed - and the very administrative law judge system the DEA clings to may not survive scrutiny.

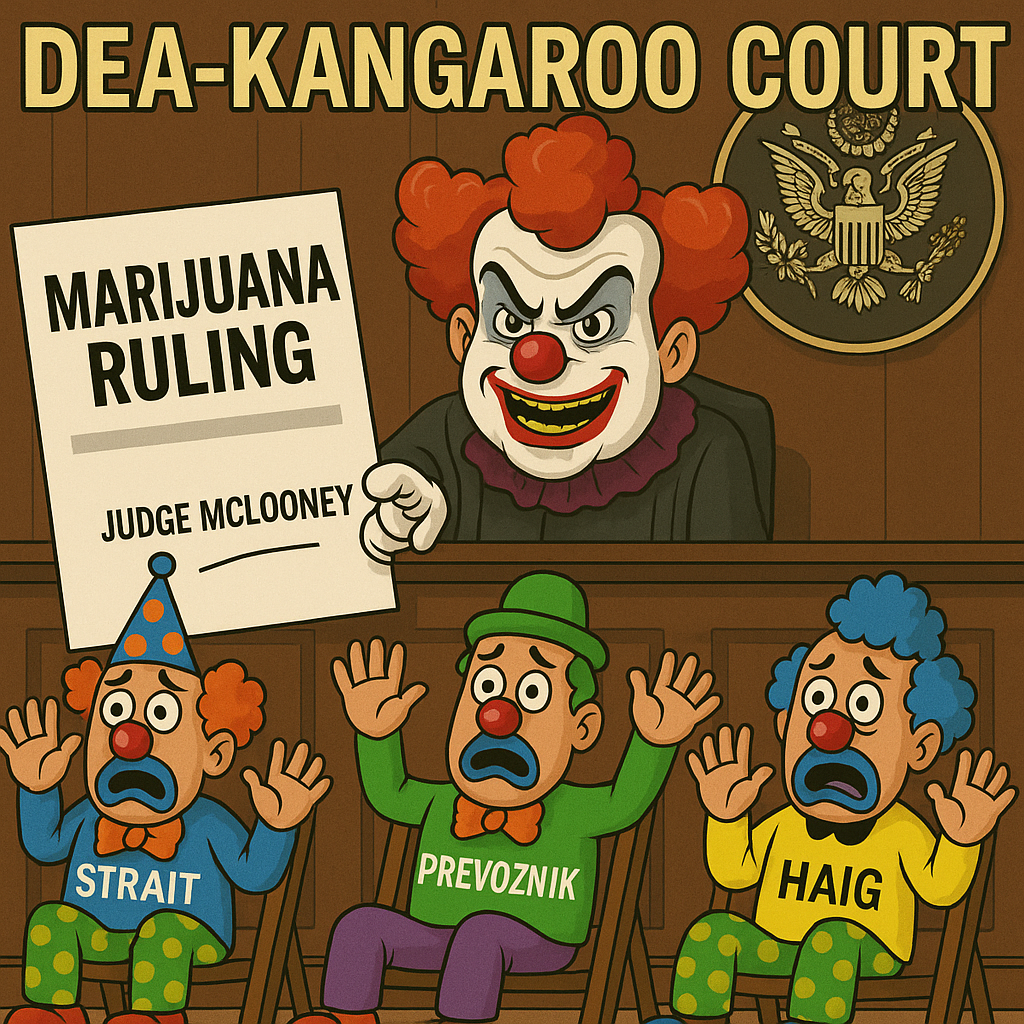

WASHINGTON, D.C. / ACCESS Newswire / June 22, 2025 / In a move that now appears both unconstitutional and strategically reckless, the Drug Enforcement Administration's (DEA) Chief Administrative Law Judge John J. Mulrooney II has ruled against MMJ BioPharma Cultivation - not by adjudicating evidence, but by canceling the hearing altogether, shutting the courtroom door before any facts could be presented.

This denial of due process is not just procedural misconduct. It stands in direct violation of recent Supreme Court precedent - namely, Axon Enterprise, Inc. v. FTC (2023) and Jarkesy v. SEC (2024) - which fundamentally altered the authority of federal agencies to conduct internal administrative hearings shielded from constitutional scrutiny.

Why DEA's ALJ System is Constitutionally Cracked

In Axon v. FTC, the Supreme Court held that constitutional challenges to federal administrative adjudication systems need not wait until after the agency's internal process is complete. The ruling opened the door for early judicial review - precisely to prevent agencies like the DEA from causing irreparable harm to regulated parties before a federal court can weigh in.

Justice Gorsuch put it plainly: "A proceeding that has already happened cannot be undone."

But that is exactly what happened to MMJ BioPharma Cultivation. Despite spending seven years pursuing a legally sound registration to grow marijuana for FDA-sanctioned clinical trials, MMJ was denied the chance to be heard. Judge Mulrooney ruled - without trial - that the case could be decided on the papers, ignoring contested facts, ignoring ex parte communications concerns, and ignoring the constitutional structure of justice itself.

Jarkesy and the Death Knell for DEA's Shadow Court

The Supreme Court's decision in Jarkesy v. SEC went even further. The Court ruled that administrative adjudications violate the Constitution on multiple fronts:

By depriving parties of their Seventh Amendment right to a jury trial,

By violating the nondelegation doctrine, and

By insulating ALJs with unconstitutional job protections that defy Article II's Take Care Clause.

The DEA's administrative system which allowed Judge Mulrooney to operate unchecked, issue rulings without testimony, and sabotage a life sciences company without judicial oversight - now sits squarely in the crosshairs of both Axon and Jarkesy.

MMJ BioPharma Cultivation: The Victim of an Unconstitutional Machine

MMJ BioPharma Cultivation is not a fringe operation. It is the only DEA applicant actively pursuing pharmaceutical-grade cannabinoid therapies under FDA Investigational New Drug (IND) protocols, including a manufactured softgel formulation for Huntington's Disease and Multiple Sclerosis.

Despite this, Judge Mulrooney's June 2025 ruling canceled a long-scheduled hearing without any opportunity for MMJ to introduce its DEA-compliant facility documentation, binding supply agreements, or evidence of DEA ex parte interference. Even worse, the company was never formally noticed of the pretrial decision - a basic requirement of any fair proceeding.

Instead of adjudicating facts, Mulrooney rubber-stamped DEA's bureaucratic inertia.

What's Next? The Courts Must Clean Up the DEA's Mess

The Supreme Court has been crystal clear: agencies like the DEA do not have unreviewable authority over people's rights, livelihoods, or innovations. Congress did not create "mini-courts" within executive agencies to bypass the Constitution.

Judge Mulrooney's decision may have handed MMJ a defeat inside the DEA's walls, but in doing so, he may have handed MMJ a powerful victory in federal court. The record of constitutional violations is now preserved - the "Axon Side-Step" is primed - and the very administrative law judge system the DEA clings to may not survive scrutiny.

If MMJ's case advances to the D.C. Circuit or even the Supreme Court, it may well be the case that dismantles the DEA's internal adjudication regime once and for all.

In the end, the question is no longer whether MMJ BioPharma has been mistreated. The question is whether the DEA's system can survive the Constitution.

MMJ is represented by attorney Megan Sheehan.

CONTACT:

Madison Hisey

MHisey@mmjih.com

203-231-8583

SOURCE: MMJ International Holdings

View the original press release on ACCESS Newswire:

https://www.accessnewswire.com/newsroom/en/healthcare-and-pharmaceutical/dea-judge-mulrooney%e2%80%99s-mmj-marijuana-ruling-may-be-dea%e2%80%99s-last-stand-be-1041353