Phase Three Drilling About to Commence

VANCOUVER, BC / ACCESS Newswire / June 24, 2025 / Quartz Mountain Resources Ltd. (TSXV:QZM)(OTC PINK:QZMRF) ("Quartz" or the "Company") is pleased to announce assay results from four core holes that comprise the Phase Two drill program completed at the Prodigy gold-silver discovery on its Maestro Property in Central British Columbia. All four holes, PR25-03 through PR25-06, returned broad intervals of precious and base metals mineralization, starting from a shallow depth. The results represent a successful follow-up to previously announced discovery drilling and the initial start to delineation of a substantial new epithermal Au-Ag system at Maestro. Drill intersections indicate strong potential for both bulk tonnage and high-grade mineralization. The Prodigy Au-Ag system remains open in all directions promising signi?cant upside and expansion potential. Phase Three drilling is now mobilizing to site to continue the systematic delineation of Prodigy.

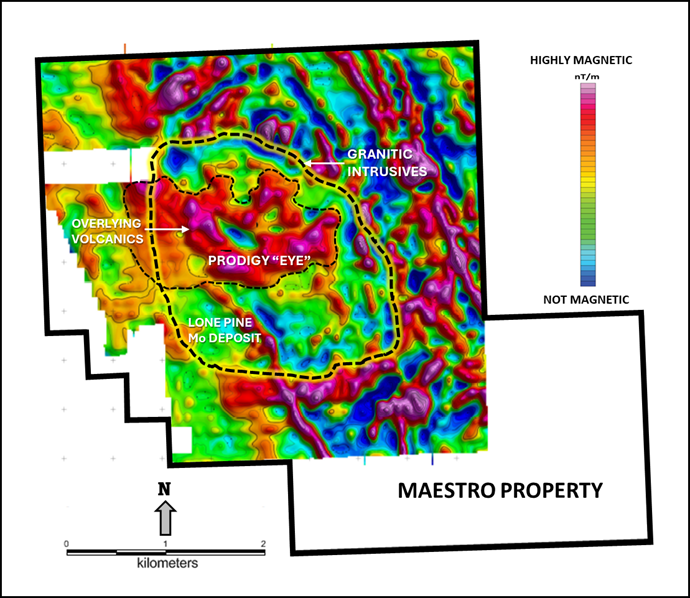

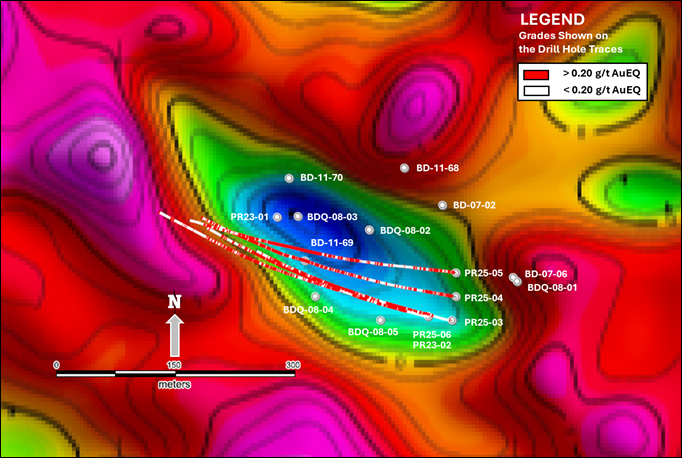

Assay results from Quartz's four, Phase Two core holes and the earlier completed two, Phase One core holes (PR23-01 and PR23-02) are listed in Table 1 below. For completeness, results from six historical core holes drilled in the period 2007-2011 by a past operator in the Prodigy area are listed in Table 2. All these holes have intersected Au-Ag veins occurring within a bulk tonnage-epithermal-style, disseminated Au-Ag system hosted within Mo-Cu porphyry mineralization (see Figure 1 and Figure 2, Prodigy "Eye" Drill Hole Plan Map). Table 3 lists results from four historical holes located east of Prodigy which clearly intersected a major molybdenum-copper porphyry system which is separate and distinct from the adjacent Prodigy epithermal Au-Ag discovery.

Bob Dickinson, Chairman of Quartz said "One of the things that excites us most is Maestro shares a promising geological environment with the Blackwater Gold Mine which Artemis Gold Inc., recently placed into production. This geological connection strengthens our belief in Maestro's signi?cant potential and inspires our ongoing 2025, multi-stage delineation drill programs. At Prodigy, large volumes of multiple styles of brecciation have undergone extensive rock alteration and quartz-ankerite veining. Rock alteration, predominantly green sericite, which is associated with Au-Ag mineralization, has created a significant magnetic low due to the destruction of magnetite within the altered and mineralized area. This prominent magnetic low has an "Eye" shaped geometry measuring 525 m long by 225 m wide and indicates a substantial mineral system to be drill delineated. With $3,600,000 of funds on hand, Phase Three drilling at Prodigy is about to commence and is designed to support Quartz's strategy of developing high value, high demand projects with significant transaction potential."

The Maestro property completely covers the large Lone Pine molybdenum deposit and Quartz's targeted, and potentially related, epithermal precious metal systems that occur up to several kilometres outboard of Lone Pine. Currently, the Company's phased drill programs are focused on delineation drilling of the Prodigy Au-Ag discovery, one of several exciting precious metal deposit targets on the Maestro Property. The four, Phase Two holes, totalling totally 3,255 meters, were drilled westerly at angles of 60° to 73° across the southern end of the "Eye". Au-Ag mineralization in multiple zones was cut by these holes from near surface, laterally for approximately 325 meters and to vertical depths of over 650 meters.

Quartz Phase One and Phase Two Prodigy "Eye" Assay ResultsA

TABLE 1 | |||||||||

Drill Hole | Incl. | From | To | Int.1,2,3 | AuEQ4 | Au | Ag | Mo | Cu |

PR23-01 |

| 51.0 | 252.0 | 201.0 | 0.53 | 0.18 | 18 | 0.010 | 0.05 |

| incl | 51.0 | 96.0 | 45.0 | 0.74 | 0.24 | 28 | 0.015 | 0.05 |

| incl | 153.0 | 240.0 | 87.0 | 0.62 | 0.25 | 19 | 0.007 | 0.07 |

|

| 279.0 | 282.0 | 3.0 | 3.95 | 0.65 | 215 | 0.002 | 0.46 |

|

| 375.0 | 393.0 | 18.0 | 0.54 | 0.09 | 1 | 0.065 | 0.03 |

PR23-02 |

| 81.0 | 279.0 | 198.0 | 0.47 | 0.20 | 10 | 0.014 | 0.04 |

| incl | 225.0 | 279.0 | 54.0 | 0.94 | 0.59 | 16 | 0.016 | 0.04 |

|

| 324.0 | 759.0 | 435.0 | 1.22 | 0.65 | 30 | 0.025 | 0.04 |

| incl | 324.0 | 675.0 | 351.0 | 1.47 | 0.78 | 36 | 0.029 | 0.05 |

| and | 537.0 | 639.0 | 102.0 | 3.80 | 2.22 | 104 | 0.029 | 0.09 |

| and | 537.0 | 549.0 | 12.0 | 9.63 | 1.23 | 586 | 0.060 | 0.61 |

| and | 603.0 | 639.0 | 36.0 | 6.93 | 5.73 | 87 | 0.013 | 0.05 |

PR25-03 |

| 87.5 | 690.9 | 603.4 | 0.56 | 0.25 | 12 | 0.020 | 0.03 |

| incl | 87.5 | 258.7 | 171.1 | 0.70 | 0.22 | 24 | 0.017 | 0.06 |

| and | 87.5 | 123.0 | 35.5 | 0.93 | 0.18 | 41 | 0.013 | 0.12 |

| and | 157.0 | 258.7 | 101.7 | 0.77 | 0.29 | 23 | 0.020 | 0.05 |

| and | 200.0 | 258.7 | 58.7 | 0.93 | 0.41 | 25 | 0.025 | 0.04 |

| incl | 365.6 | 541.0 | 175.4 | 0.66 | 0.30 | 9 | 0.035 | 0.03 |

| and | 390.0 | 528.0 | 138.0 | 0.71 | 0.33 | 10 | 0.034 | 0.03 |

| and | 456.0 | 484.5 | 28.5 | 1.02 | 0.51 | 11 | 0.055 | 0.04 |

| and | 504.3 | 528.0 | 23.7 | 0.93 | 0.47 | 22 | 0.024 | 0.04 |

| incl | 567.0 | 612.0 | 45.0 | 0.72 | 0.45 | 17 | 0.004 | 0.03 |

| incl | 660.3 | 690.9 | 30.7 | 0.72 | 0.43 | 8 | 0.030 | 0.01 |

PR25-04 |

| 16.6 | 99.0 | 82.4 | 0.56 | 0.08 | 15 | 0.032 | 0.07 |

| incl | 63.0 | 99.0 | 36.0 | 0.79 | 0.12 | 26 | 0.031 | 0.12 |

|

| 138.0 | 172.0 | 34.0 | 0.44 | 0.07 | 11 | 0.012 | 0.11 |

|

| 259.0 | 663.9 | 404.9 | 0.52 | 0.16 | 9 | 0.032 | 0.03 |

| incl | 270.0 | 311.7 | 41.7 | 0.60 | 0.16 | 24 | 0.014 | 0.04 |

| incl | 341.7 | 663.9 | 322.2 | 0.55 | 0.18 | 8 | 0.036 | 0.03 |

| and | 341.7 | 378.0 | 36.3 | 0.64 | 0.21 | 21 | 0.017 | 0.05 |

| and | 341.7 | 347.6 | 5.9 | 2.21 | 0.51 | 104 | 0.015 | 0.23 |

| and | 393.0 | 480.0 | 87.0 | 0.70 | 0.26 | 13 | 0.033 | 0.06 |

| and | 534.0 | 546.0 | 12.0 | 1.75 | 0.29 | 44 | 0.119 | 0.14 |

PR25-05 |

| 225.0 | 671.1 | 446.1 | 0.51 | 0.18 | 5 | 0.037 | 0.03 |

| incl | 323.0 | 660.0 | 337.0 | 0.60 | 0.23 | 6 | 0.042 | 0.03 |

| and | 414.0 | 671.1 | 257.1 | 0.69 | 0.29 | 8 | 0.044 | 0.02 |

| and | 414.0 | 561.0 | 147.0 | 0.85 | 0.33 | 8 | 0.062 | 0.03 |

| and | 609.0 | 660.0 | 51.0 | 0.71 | 0.43 | 14 | 0.016 | 0.02 |

PR25-06B |

| 240.0 | 420.0 | 180.0 | 0.42 | 0.17 | 8 | 0.016 | 0.04 |

| incl | 240.0 | 279.0 | 39.0 | 0.89 | 0.34 | 26 | 0.014 | 0.10 |

|

| 480.0 | 643.0 | 163.0 | 0.37 | 0.06 | 2 | 0.045 | 0.01 |

A. See Figure 1 and Figure 2 for drill hole location plan. See footnotes to Table 1, 2 and 3 below.

B. PR25-06 was wedged from PR23-02 and commenced coring at 240 meters downhole.

Selected Historical Prodigy "Eye" Assay ResultsA

TABLE 2 | |||||||||

Drill Hole | Incl. | From | To | Int.1,2,3 | AuEQ4 | Au | Ag | Mo | Cu |

BD-11-69 |

| 35.0 | 54.2 | 19.2 | 1.32 | 0.25 | 72 | 0.012 | 0.08 |

| incl | 49.3 | 51.0 | 1.7 | 11.11 | 1.35 | 711 | 0.003 | 0.73 |

|

| 134.1 | 205.2 | 71.1 | 3.07 | 0.35 | 185 | 0.025 | 0.22 |

| incl | 136.1 | 185.3 | 49.2 | 4.20 | 0.48 | 264 | 0.011 | 0.30 |

| and | 142.5 | 148.8 | 6.3 | 22.06 | 1.94 | 1484 | 0.011 | 1.34 |

| and | 180.0 | 183.3 | 3.3 | 13.56 | 0.60 | 921 | 0.007 | 1.17 |

|

| 329.1 | 404.5 | 75.4 | 0.97 | 0.10 | 1 | 0.136 | 0.02 |

|

| 445.8 | 450.8 | 5.0 | 1.24 | 0.75 | 16 | 0.041 | 0.03 |

BD-11-70 |

| 47.4 | 55.2 | 7.8 | 0.59 | 0.03 | 9 | 0.016 | 0.25 |

|

| 114.5 | 399.7 | 285.2 | 0.51 | 0.02 | 4 | 0.053 | 0.09 |

| incl | 173.8 | 338.5 | 164.7 | 0.49 | 0.02 | 4 | 0.043 | 0.11 |

| and | 195.5 | 196.1 | 0.6 | 5.25 | 0.48 | 202 | 0.012 | 1.57 |

BDQ-08-02 |

| 21.0 | 81.0 | 60.0 | 0.42 | 0.07 | 9 | 0.024 | 0.07 |

|

| 197.0 | 403.0 | 206.0 | 0.96 | 0.10 | 46 | 0.035 | 0.07 |

| incl | 197.0 | 213.0 | 16.0 | 8.48 | 1.09 | 551 | 0.023 | 0.37 |

| and | 203.0 | 209.0 | 6.0 | 20.46 | 2.62 | 1350 | 0.018 | 0.86 |

BDQ-08-03 |

| 9.0 | 352.7 | 343.7 | 0.54 | 0.13 | 13 | 0.030 | 0.06 |

| incl | 9.0 | 167.0 | 158.0 | 0.67 | 0.11 | 25 | 0.022 | 0.08 |

| and | 67.0 | 167.0 | 100.0 | 0.80 | 0.16 | 35 | 0.021 | 0.07 |

| and | 67.0 | 117.0 | 50.0 | 1.09 | 0.22 | 50 | 0.019 | 0.10 |

| and | 79.0 | 101.0 | 22.0 | 1.86 | 0.34 | 95 | 0.016 | 0.19 |

BDQ-08-04 |

| 293.0 | 551.3 | 258.3 | 0.81 | 0.43 | 13 | 0.026 | 0.04 |

| incl | 373.0 | 497.0 | 124.0 | 1.16 | 0.64 | 19 | 0.038 | 0.05 |

| and | 373.0 | 463.0 | 90.0 | 1.30 | 0.71 | 23 | 0.037 | 0.06 |

BDQ-08-05 |

| 119.0 | 223.0 | 104.0 | 0.47 | 0.17 | 13 | 0.014 | 0.04 |

| incl | 141.0 | 223.0 | 82.0 | 0.52 | 0.20 | 15 | 0.015 | 0.03 |

|

| 275.0 | 325.0 | 50.0 | 0.59 | 0.30 | 15 | 0.012 | 0.04 |

Historical drill hole assay results at Prodigy drilled by a previous operator between 2007 and 2011. See Figure 1 and Figure 2 for drill hole location plan. See footnotes to Table 1, 2 and 3 below.

Historical Porphyry Drill Hole ResultsA

TABLE 3 | ||||||||

Drill Hole Number | Incl. | From (m) | To (m) | Int.1,2,3 (m) | Au (g/t) | Ag (g/t) | Mo (%) | Cu (%) |

BD-07-02 |

| 158.0 | 300.8 | 142.8 | 0.01 | 2 | 0.057 | 0.05 |

BD-07-06 |

| 158.5 | 275.2 | 116.7 | 0.01 | 1 | 0.040 | 0.04 |

BD-11-68 |

| 41.2 | 353.1 | 311.9 | N/A | 2 | 0.067 | 0.07 |

BD-11-68 | incl. | 100.1 | 317.4 | 217.3 | N/A | 2 | 0.072 | 0.08 |

BDQ-08-01 |

| 6.1 | 425.0 | 418.9 | 0.01 | 1 | 0.046 | 0.04 |

BDQ-08-01 | incl. | 287.0 | 353.0 | 66.0 | 0.01 | 3 | 0.090 | 0.07 |

Historical drill hole assay results from four holes drilled east and distinct from the Prodigy precious metals system. See footnotes to Tables 1, 2 and 3 below. N/A means not assayed for Au.

Footnotes to Tables 1, 2 and 3.

Width reported are drill widths, such that true thicknesses are unknown.

All assay intervals represent length-weighted averages.

Some figures may not sum exactly due to rounding.

Gold equivalent (AuEQ) calculations use metal prices of: Au US$1,800.00/oz, Ag US$22.00/oz, Mo US$17.00/lb and Cu US$4.00/lb. and conceptual recoveries of: Au 80%, Ag 80%, Mo 75%, and Cu 75%. Conversion of metals to an equivalent gold grade based on these metal prices is relative to the gold price per unit mass factored by conceptual recoveries for those metals normalized to the conceptualized gold recovery. The metal equivalencies for each metal are added to the gold grade. The general formula is: AuEQ g/t NMV = (Au g/t) + (Ag recovery / Au recovery) * (Ag $ per oz. / Au $ per oz. * Ag g/t)) + ((Mo recovery / Au recovery) * (Mo % * Mo $ per lb. * 22.0462) / (Au $ per oz. / 31.10348)) + (Cu recovery / Au recovery) * (Cu % * Cu $ per lb. * 22.0462) / (Au $ per oz. / 31.10348)).

Figure 1: Magnetic Plan Map of Portion of Maestro Property Showing Magnetic Low Prodigy "Eye"

Figure 2: Prodigy "Eye" Drill Hole Plan Map

The combined Prodigy drill hole intercepts show characteristics of a polymetallic gold silver-epithermal deposit consistent with intermediate-sulphidation epithermal deposit models.

An example of this kind of deposit is the Blackwater Gold Mine owned by third party Artemis Gold Inc., which that company recently permitted and put into production. At Blackwater Mine, the base case cut-off grade within the reasonable prospects of an eventual economic extraction conceptual pit is 0.20 g/t Au EQ. The Blackwater Base Case Mineral Resource Estimate on May 5, 2020 was:

Measured and Indicated ResourcesA,B | |||||||

Cut-off | Tonnage | In-Situ Grades | In-Situ Contained Metal | ||||

(g/t AuEQ) | (Mt) | AuEQ g/t | Au g/t | Ag g/t | AuEQ (koz) | Au (koz) | Ag (koz) |

0.20 | 597 | 0.65 | 0.61 | 6.4 | 12,406 | 11,672 | 122,381 |

Bird, S, et al (2024) Blackwater Gold Mine, British Columbia, NI 43-101 Technical Report on 2024 Expansion Study prepared for: Artemis Gold Inc., effective date: 21 February, 2024 available at https://www.artemisgoldinc.com/blackwater-project/blackwater-gold-project/technical-reports/ . The Mineral Resource has been confined by a conceptual pit shell to meet "reasonable prospects of eventual economic extraction" using the following assumptions: the 143% price case with a Base Case of US$1,400/oz Au and US$15/oz Ag at a currency exchange rate of 0.75 US$ per C$; 99.9% payable Au; 95.0% payable Ag; US$8.50/oz Au and US$0.25/oz Ag offsite costs (refining, transport, and insurance); a 1.5% NSR royalty; and uses a 93% metallurgical recovery for gold and 55% recovery for silver. The AuEq values were calculated using US$1,400/oz Au, US$15/oz Ag, a gold metallurgical recovery of 93%, silver metallurgical recovery of 55%, and mining smelter terms for the following equation: AuEq = Au g/t + (Ag g/t x 0.006).

The Qualified Person has been unable to verify this Resource Estimate, and this information is not necessarily indicative of mineralization on the Maestro Property.

Characteristics of BC Epithermal Au-Ag Deposits

These deposits are characterized by large tonnages that host gold and silver mineralization with grades conducive to bulk-tonnage mining, internal grade continuity ranges from strong to erratic.

Many of these deposits have a definite spatial, temporal and, plausibly, genetic link to large, nearby porphyry style deposits.

Variations in the primary permeability of host rocks, commonly augmented by fracture-induced secondary permeability, strongly influence the distribution and grade of gold and silver mineralization.

Most deposits contain zones of higher-grade gold mineralization which are commonly related to structures active during the time of mineralization.

Gold and silver mineralization can be found within completely pervasive alteration in rock types with high primary permeability and/or in structural zones.

Base metal enrichment, particularly of copper but commonly accompanied by other base and trace metals, is spatially associated with gold and silver mineralization.

Gold and silver mineralization is precipitated mostly during strong quartz sericite ± carbonate alteration and is associated with disseminated and vein hosted pyrite. Carbonate minerals are commonly ferruginous and/or manganiferous.

Most contain an early stage of potassium-silicate alteration which is largely to completely replaced by quartz-sericite alteration and associated gold, silver and base metal mineralization.

Mineralization is spatially, and commonly temporally, related to shallow emplacement of felsic intrusions.

Gold and silver mineralization occurs in diverse host rocks which include intrusive, volcanic and sedimentary rock types.

About Quartz

Headquartered in Vancouver, Canada, Quartz Mountain Resources (TSXV:QZM, OTC Pink: QZMRF) is a well- funded public company whose successful mine-finding management team is focused on discovering and transacting important-scale gold, silver and copper projects in British Columbia. The Company owns 100% of the Maestro high grade gold-silver project and 100% of the Jake porphyry copper-gold-silver project. Both projects are permitted by the British Columbia government for drilling activities with access to infrastructure and high potential for the development of substantial resources for significant future transactions.

Quartz is associated with Hunter Dickinson Inc. (HDI), a company with over 35 years of successfully discovering, developing and transacting mineral projects in Canada and internationally. Former HDI projects in British Columbia included Mount Milligan, Kemess South and Gibraltar -- all of which are porphyry-copper±gold deposits with current-producing or former-producing mines. Recently, Amarc Resources, an HDI associate, with funding from Freeport, announced the exciting discovery of the exceptionally high grade, AuRORA gold-copper-porphyry deposit also in British Columbia. Other well-known projects with HDI involvement include Sisson, Duke and Prosperity in Canada, Pebble and Florence in the United States, and Xietongmen in China.

Quartz is committed to the advancement of important-scale, critical and essential mining assets while following responsible mineral development principles, including a mandate to employ best-practice approaches in the engagement and involvement of local communities and meeting rigorous environmental standards.

About Maestro

The Maestro Project, located in central British Columbia, lies adjacent to Highway 16, 15 km north of Houston and 45 km

south of Smithers, providing year-round road access to the project and nearby infrastructure including, rail, hydroelectricity, and natural gas. This logistical advantage, near resource supporting centres, positions the Maestro Project favourably for potential development. Covering 2,309 hectares, it has a rich exploration history dating back to 1914, primarily focusing on the Lone Pine Mo-Cu porphyry deposit and not the precious metals potential of the surrounding area (see Quartz news release March 19th, 2024, and NI 43-101 Technical Report and Preliminary Economic Assessment, P&E Mining Consultants Inc., January 21st, 2011).

Since acquiring the property, Quartz has conducted comprehensive geochemical and geophysical surveys, including soil/silt sampling, induced polarization geophysics, airborne magnetic surveys, hyperspectral studies, detailed relogging of historical drill core and assaying for gold only, 976 pulp samples derived from historical assaying of numerous core holes located across the Maestro Property. Quartz's first ever drill test, on its Maestro Property, a maiden Phase One, two-hole drill program at the Prodigy Zone, discovered exciting high-grade Au-Ag lodes and Ag-Au veins which are both hosted within an extensive epithermal Au-Ag system. The Au lodes and Ag veins along with the more disseminated precious metals intersected by the drill holes are all hosted within a large and earlier deposited, Mo-Cu porphyry system. Quartz's second core hole, PR-23-02 intersected 102 m grading 2.22 g/t Au and 104 g/t Ag, including 12 m grading 1.23 g/t Au and 586 g/t Ag and also 36 m of 5.73 g/t Au and 87 g/t Ag. These results indicate high potential for both bulk tonnage and underground high-grade gold and silver mineralization. Phase Two, delineation type drilling of the new Prodigy discovery at Maestro, commenced in March 2025. It is expected that drilling at Prodigy will be consistently advanced with multiple drill program stages during 2025. Mineralization remains open, promising significant further potential.

About Jake

The 100% owned Jake Property is located 160 km north of Smithers in north central BC. It is accessible by helicopter and close to the Minaret airstrip and historical logging roads which lead to mining support towns of Smithers, Fort St. James and Hazelton.

Mineralization at Jake is situated within a prominent rusty coloured gossan measuring 3.5 km long by 1.5 km wide. The combination of extensive historical and recent exploration work has outlined a very expansive altered area at Jake hosting epithermal and porphyry-style sulphide disseminations and veinlets containing Cu-Au-Ag-Zn-Mo and Re. A series of modern surface exploration programs were first completed by Quartz to build on very compelling historical data on the Property developed by legendary porphyry copper explorers, including Kennco, Canadian Superior, Cities Service, Placer Development and Teck Corp. Taken together this comprehensive technical database defined a significant-scale porphyry copper-gold deposit target which Quartz tested with 3,418 meters of drilling in seven 7 holes during 2024. This maiden drill program successfully discovered a new porphyry copper-gold-silver system, wide open to expansion. Upon discovery, Quartz acquired a 100% interest in mineral tenures over an entire new BC porphyry copper-gold district surrounding the Jake Property. The next milestone towards a transaction will be delineation drilling of the new Jake discovery, currently being planned to commence after delineation drilling at Maestro.

Quality Assurance/Quality Control Program

Quartz drilled NQ size core in the 2023 and 2025 drilling programs. All drill core was logged, photographed, and cut in half with a diamond saw. Half core samples from the 2023 Prodigy drilling were sent to ALS Canada Ltd., Langley, B.C., for preparation and for 2025, half core samples were sent to ALS Canada Ltd., Kamloops, B.C. All samples were analyzed at ALS Canada Ltd., North Vancouver, B.C. All are ISO/IEC 17025:2017 accredited facilities. At the laboratory, samples were dried, crushed to 70% passing -2mm, and a 250 g split pulverized to better than 85% passing 75 microns. Samples were analyzed for Au by fire assay fusion of a 30 g sub-sample with an ICP-AES finish. In 2023, samples were analyzed for 48 elements, and in 2025, for 60 elements. Both multi-element analyses included Ag, Mo, and Cu, and were conducted using

a four-acid digestion followed by ICP-MS. Overlimits for Ag, Cu, Pb and Zn were analyzed by four-acid digestion and ICP-AES finish. For Au overlimits and additional Ag overlimits, a fire assay fusion and gravimetric finish were completed. As part of a comprehensive Quality Assurance/Quality Control ("QAQC") program, Quartz Mountain control samples were inserted in each analytical batch at the following rates in 2023: standards one in 40 regular samples and in-line replicates one in 40 regular samples. In 2025 standards were inserted at one in 20 regular samples and in-line replicates at one in 20 regular samples. In both 2023 and 2025, at least one coarse blank was inserted per analytical batch. The control sample results were then checked to ensure proper QAQC procedures.

Qualified Person

Farshad Shirmohammad, M.Sc., P. Geo., a "Qualified Person" within the meaning of National Instrument 43-101 - Standards of Disclosure for Minerals Projects, who is not independent of Quartz Mountain Resources Ltd., has reviewed and approved the scientific and technical information contained in this news release.

On behalf of the Board of Directors

Robert Dickinson

Chairman

For further information, please contact:

Bob Dickinson

Email: robertdickinson@hdimining.com Ph: +1 604-684-6365

or:

Roger Blair

Email: rblair@acuityadvisorycorp.com Ph: +1 604-351-0025

or

16.32%

Jeff Wilson

E Mail: jwilson@acuityadvisorycorp.com Ph: +1 604-837-5440

Prodigy Drill Hole Spatial Data

TABLE 4 | ||||||

Drill Hole | Easting | Northing | Elevation (m) | Azimuth (°) | Dip (°) | Length (m) |

PR23-01 | 646200 | 6044300 | 842 | 180 | -73 | 633.0 |

PR23-02 | 646390 | 6044175 | 839 | 280 | -70 | 812.5 |

PR25-03 | 646420 | 6044170 | 846 | 280 | -70 | 759.0 |

PR25-04 | 646425 | 6044200 | 847 | 280 | -65 | 753.0 |

PR25-05 | 646425 | 6044230 | 849 | 280 | -65 | 821.5 |

PR25-06 | 646390 | 6044175 | 839 | 280 | -70 | 921.0 |

BDQ-08-01 | 646502 | 6044219 | 863 | 315 | -60 | 425.8 |

BDQ-08-02 | 646316 | 6044284 | 853 | 0 | -90 | 531.6 |

BDQ-08-03 | 646226 | 6044301 | 849 | 0 | -90 | 481.6 |

BDQ-08-04 | 646248 | 6044200 | 840 | 0 | -90 | 551.3 |

BDQ-08-05 | 646330 | 6044170 | 841 | 0 | -90 | 486.5 |

BD-11-68 | 646360 | 6044362 | 858 | 0 | -90 | 590.4 |

BD-11-69 | 646235 | 6044245 | 836 | 0 | -90 | 602.6 |

BD-11-70 | 646215 | 6044349 | 852 | 0 | -90 | 470.6 |

BD-07-02 | 646408 | 6044315 | 853 | 0 | -90 | 506.4 |

BD-07-06 | 646497 | 6044224 | 863 | 0 | -90 | 473.2 |

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Cautionary Statement Regarding Forward-Looking Information.

This release includes certain statements that may be deemed "forward-looking-statements". All statements in this release, other than statements of historical facts are forward-looking-statements. Although the Company believes the expectations expressed in such forward-looking statements are based on reasonable assumptions, such statements are not guarantees of future performance and actual results or developments may differ materially from those in the forward-looking statements. Assumptions used by the Company to develop forward-looking statements include the following: the Company's projects will obtain all r16.32%equired environmental and other permits, and all land use and other licenses, studies and explo9.14%ration of the Company's projects will continue to be positive, and no geological or technical problems will occur. Though the Company believes the expectations expressed in its forward-looking-statements are based on reasonable assumptions, such statements are subject to future events and third party discretion such as regulatory personnel. Factors that could cause actual results to differ materially from those in forward-looking statements include variations in market prices, continuity of mineralization and exploration success, and potential environmental issues or liabilities associated with exploration, development and mining activities, uncertainties related to the ability to obtain necessary permits, licenses and tenure and delays due to third party opposition, changes in and the effect of government policies regarding mining and natural resource exploration and exploitation, and exploration and development of properties located within Aboriginal groups asserted territories that may affect or be perceived to affect asserted aboriginal rights and title, and which may cause permitting delays or opposition by Aboriginal groups, continued availability of capital and financing, and general economic, market or business conditions. Investors are cautioned that any such statements are not guarantees of future performance and actual results or developments may differ materially from those projected in the forward-looking statements. For more information on the Company, and the risks and uncertainties connected with its business, investors should review the Company's home jurisdiction filings as www.sedarplus.ca and its 20F filings with the United States Securities and Exchange Commission

SOURCE: Quartz Mountain Resources Ltd.

View the original press release on ACCESS Newswire:

https://www.accessnewswire.com/newsroom/en/metals-and-mining/quartz-intersects-long-gold-silver-intervals-from-phase-two-drilling-at-maestro-p-1042303